France has not defaulted on its debts since 1797, but bond traders are a nervous bunch.

Since 9 June, when French President Emmanuel Macron stunned political observers by calling a snap election, the price of France's government bonds has fallen sharply.

Uncertainty about the outcome of the election and the future direction of economic and fiscal policy has weighed heavily on the minds of bond traders

One measure is the spread over German debt, the benchmark for the eurozone. Before the snap election announcement, the spread between 10-year French and German debt was around 45 basis points. After the announcement, the spread rose as much as 75 basis points, a level not seen since the European sovereign debt crisis in 2011.

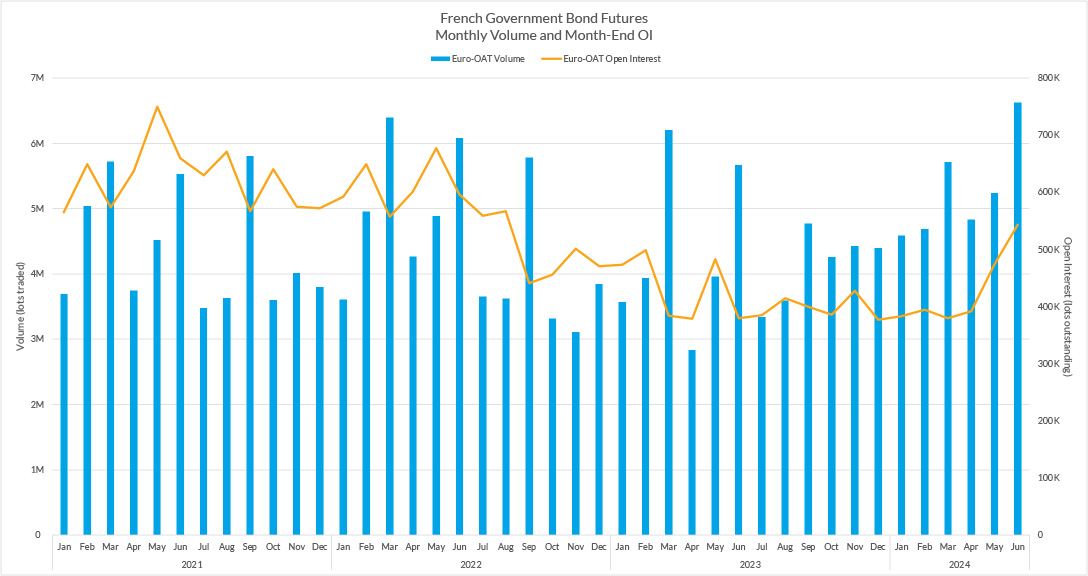

That uncertainty has translated into a big surge in the trading of futures on French debt, known as Obligations Assimilables du Trésor or OATs. According to Eurex, the leading exchange for bond futures in Europe, the notional value of OAT futures trading topped 824 billion euros in June. That was up 25% from the previous month and the highest level since June 2022.

Europe's bond futures market is smaller than the US Treasury futures market in terms of trading volume, but it has one dimension that the US market lacks – credit spreads. Each government issues its own debt, which means that bond prices reflect the specific economic and fiscal conditions in each country.

Eurex has offered futures on Italian government debt since 2009 and French debt since 2012. Although trading activity in these futures is far smaller than futures on German debt, they provide investment managers and other market participants a way to hedge changes in relative value.

That certainly came into play in June, when the yields on French bonds fell below the yield on comparable bonds issued by the Portuguese government, even though the latter have a lower credit rating from S&P, Moody's and other rating agencies. As a Bloomberg article pointed out on 12 June, the flareup in French political risk "upended" the hierarchy of European sovereign debt markets and pushed the price of French debt far out of line with historical relationships.

Crushing Defeat

What triggered the turmoil in the bond market? The answer starts with the European parliamentary elections in early June. Rassemblement National, the right-wing party led by Marine Le Pen, won far more votes than the centrist coalition led by Macron's Renaissance party. That prompted Macron to announce on 9 June the dissolution of the National Assembly, the lower house of France's Parliament, and hold new elections in two rounds, the first on 30 June and the second on 7 July.

Macron's decision stunned veteran observers of French politics and even members of his own party, with French newspaper Le Monde reporting that the announcement sent "shockwaves" through all levels of the government. The move was widely viewed as a gamble, given the popularity of the right and the risk that RN would win a majority of seats in the National Assembly and take control of the government.

That led to a selloff among French assets, according to analysts at Deutsche Bank. The spread between French and German 10-year bonds widened by 29 basis points in the week after the election announcement, which according to the analysts was "the biggest weekly widening in the spread since the sovereign debt crisis in 2011."

Another Shock

The actual election results turned out to be even more unpredictable and confusing. RN did win a majority in the first round, but not as much as predicted. That led to a brief "relief rally" in the price of French bonds. But sentiment reversed after the second round. Le Pen's RN did worse than expected, and the Nouveau Front Populaire, an alliance that includes socialist and communist parties, won more seats than any other group.

Deutsche Bank's analysts called this "yet another electoral shock", but the markets quickly realized that political gridlock would be the most likely result. No party had achieved a working majority, making it unlikely that either left or right would be able to implement any extreme changes in economic or fiscal policy.

S&P, the ratings agency, summed up the situation by commenting that the split vote "will likely complicate policymaking." S&P predicted that the government "will struggle to implement meaningful policy measures," but made no change to its rating on French debt.

The outlook now is for an extended period of uncertainty about French politics and a persistent discount in the pricing of French debt. The fixed income strategy team at JP Morgan commented in early July, shortly after the second-round results, that the election outcome was "messy but not disruptive". The JP Morgan team predicted that bond spreads would stay in a 60-70 basis point range, up from 45 basis points before the snap election announcement, until there is "clarity on the path ahead."

Contrast with Italy

Meanwhile, on the other side of the Alps, the Italian debt market is following a very different trajectory. For years the demand for Italian bonds has been vulnerable to fears about the government's stability and the state of Italy's public finances. When Giorgia Meloni, the leader of Italy's right wing Fratelli d'Italia party, took office as prime minister in October 2022, Italy's debt was on the edge of junk status, and fears of populist excess pushed the spread over German debt to roughly 250 basis points.

Those fears have faded, however. Meloni's government showed more fiscal restraint than many expected, and equally important, Italy's economy grew faster than expected. Investors started piling into Italian debt, prices rose, and by mid-May 2024, the spread between Italian and German bonds had fallen as low as 114 basis points, according to data published by Borsa Italiana.

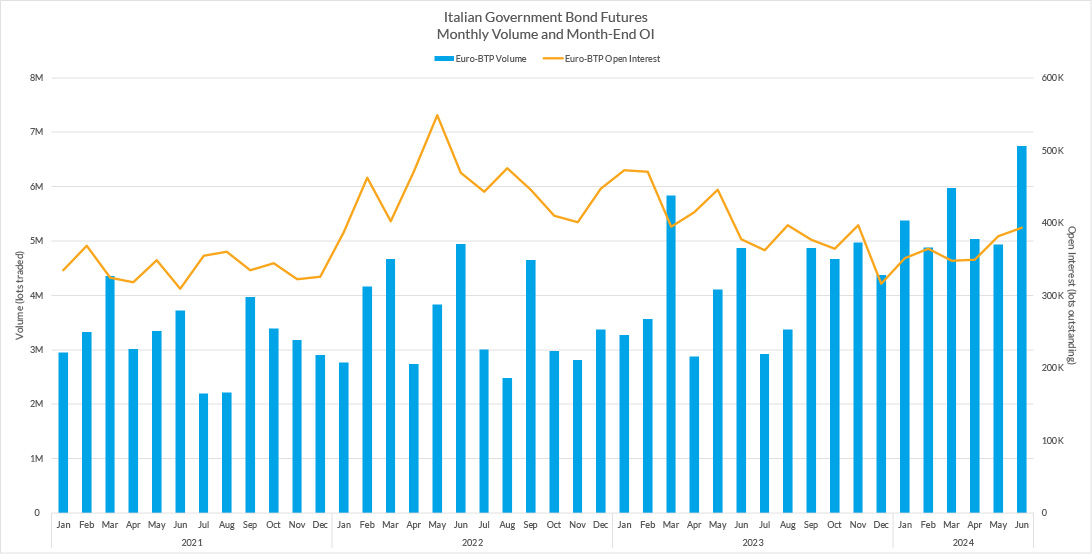

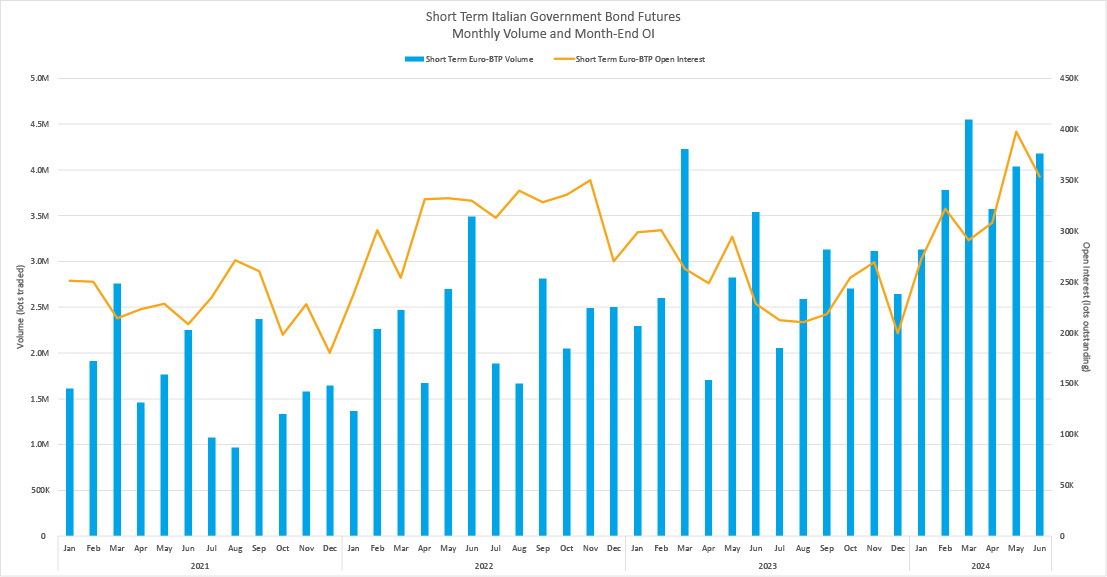

The futures markets have provided a convenient way to trade this spread. Eurex offers two contracts based on Italian debt, known as Buoni del Tesoro Poliennale or BTPs. One covers the 10-year point on the interest rate curve, the other the 2-year point on the curve.

Over the last several years, the level of trading volume in these contracts has been rising steadily as institutional investors have increased their exposure to Italian debt. According to the futures execution team at UBS, the size available at the top of book has increased substantially, and the market is now deep enough to support automated trading via algos.

The flareup in political risk in France did spill over into the Italian market. 10-year BTP volume hit a record level of 6.75 million contracts in June, equivalent to 785 billion euros in notional value, compared to below five million contracts the month before.

Jump in Open Interest

Amid the surge in trading activity, open interest in the French bond futures has risen as traders have looked for ways to hedge the uncertain outlook for French politics. Open interest in OAT futures started rising in May and surged to 542,842 contracts at the end of June, up more than 40% over two months. Even so, open interest remains well below the levels seen in 2021 and 2022, and it is not clear if the increase will be sustained.

Open interest in the 10-year BTP futures has followed a similar trajectory, with a steady decline since the middle of 2022 and then an upswing over May and June.

Open interest in the 2-year, on the other hand, hit a record 397,602 contracts at the end of May and remained above 350,000 at the end of June. Quite apart from all the political uncertainty, the short-term BTP futures have grown in popularity as a way to manage interest rate risk at the short end of the curve.