Mike Davis, director of oil market development at Intercontinental Exchange, discusses current trends shaping the global oil markets. He discusses how supply and demand, the return of inflation, and the expansion of product breadth have contributed to the increase in global oil trading volumes and especially in ICE Brent Crude futures.

Q: What are the volume trends in global oil trading right now and what does that mean for the market?

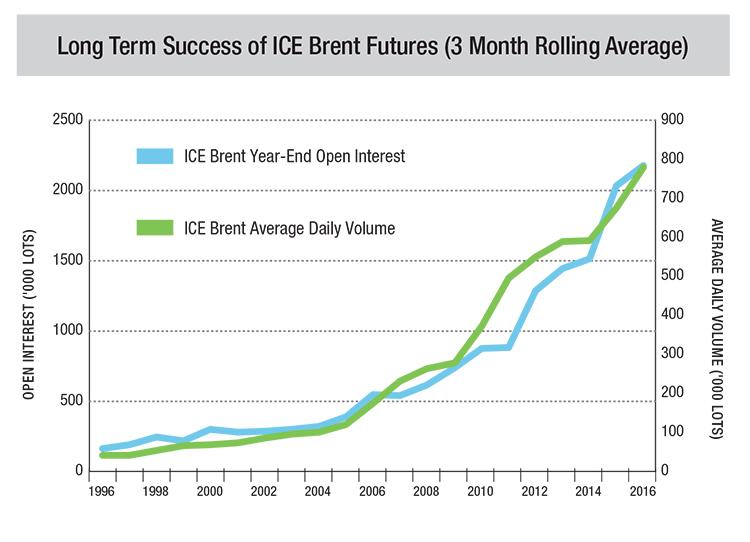

Volume in global oil trading is increasing, and it’s important to note that open interest is increasing with it. When you look at a 20-year chart of ICE Brent Crude futures, the global benchmark for oil prices, you can see it’s hit a run of 20 consecutive years of volume records, and it’s also continuously set open interest records during that period to bring it up to over 2.4 million open lots today. Similarly, WTI, the benchmark for U.S. crude oil, has seen steadily increasing volumes and open interest for the last several years. It makes sense that we’re seeing both numbers rise simultaneously since they go hand-in-hand.

Together, higher volumes and open interest correlate to increased liquidity, greater confidence in the market and tighter spreads.

Q: What’s driving the increase in oil trading in fundamental terms?

There are considerable engines of uncertainty around oil prices in the market right now. First, there’s a supply and demand balancing act that’s playing out. As past markets responded to a supply surplus, we started to see an increase in the number of drilled-but-uncompleted (DUC) wells across U.S. shale fields, a decrease in rig counts as oil rigs were decommissioned, some curtailing of production levels and a spiral of cost-cutting and project cancellations that fuelled uncertainty and volatility as oil producers looked for a fresh equilibrium at lower crude prices. However, now that some of the surplus has been used and supply levels are nearer to residual demand levels, producer optimism is returning to the markets.

Second, there’s a strong financial interest in oil matters in relation to current interest rates and a potentially inflationary global environment. There’s concern in the market over the return of inflation, and there’s been a move toward using commodities as inflation protection. With index-protected or linked bonds forming a major part of sovereign issuance, one might think there was plenty of protection available to asset-liability institutions like insurance and pension funds, but the fall in real interest rates has dragged down yields for those index-linked sovereign bonds and pushed up prices to the extent that they are also somewhat tied to the overall yield curve. That makes oil instruments relatively attractive as an alternative hedge against inflation, as oil prices typically pick up rapidly and early in inflationary cycles.

Finally, the breadth of tradable oil products has expanded to better meet the trading and risk management needs of market participants. There’s now a product to reflect every possible basis option across risk, geography and time. For example, in addition to our global benchmark futures contract on Brent, we now offer more than 400 related products that trade through ICE’s markets, including options, cracks, spreads and differentials. We’ve engineered that product breadth in response to the increase in sophisticated trading strategies that require more product flexibility, a growing focus on cost efficiencies associated with clearing which has prompted us to expand the range of products we can clear in response to the needs of market participants, and the need for greater access to the global oil markets.

Those factors are culminating in increased oil trading.

Q: Who is trading in ICE’s oil markets?

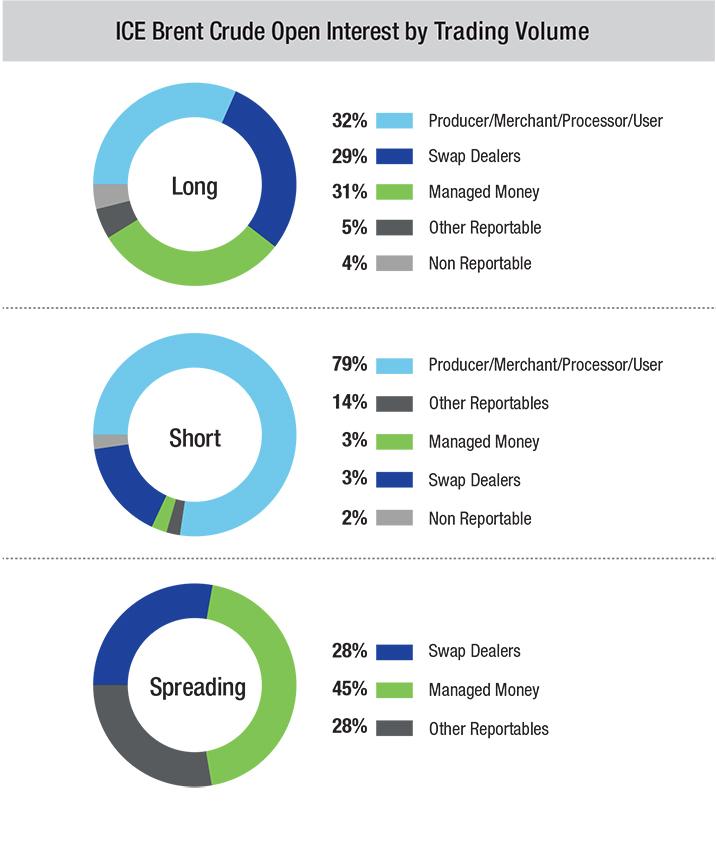

We see a variety of participants in our markets, but our core is made up of physically-oriented traders. You see that reflected in the Commitment of Traders reports for ICE Brent Crude. On the long side, 32% of the January open interest in ICE Brent was held by commercials, and that number went up to 75% on the short side. This reflects the fact that producers are using our markets to lock in the price of the oil they expect to sell into the global oil marketplace.

Producer / Merchant / Processor / User

Entities with exposure to the underlying physical market for the commodity that use the futures market to hedge the risks associated with such exposure. “Commercial” participants. Examples would include oil exploration and drilling firms, specialist commodity trading firms with physical exposures, producers, exporters/importers, coffee roasters, cocoa processers, sugar refiners, food and confectionary.

Swap Dealer

Entities dealing primarily in “swap” or other over the counter (OTC) transactions in the commodity in question and that use the futures market to hedge this exposure. Examples would include investment banks and other complex financial institutions.

Managed Money

Entities managing futures trading on behalf of clients. Investment firms. Examples include hedge funds, pension funds, registered U.S. commodity trading advisors or commodity pool operators.

Other Reportables

Every other reportable trader. Examples include proprietary (multi-asset) trading houses, algorithmic traders and local traders.

Nonreportable Positions

This is a balancing figure and consists of the total reportable long, short and spreading positions subtracted from the overall open interest figure for the commodity.

Q: What is ICE watching now?

Right now, we’re watching policy very closely, especially in the U.S. The energy industry is laser-focused on how U.S. President Trump’s vision to make America “energy independent” will play out over the next several years. So far, the plans set forth include: creating U.S. jobs through increased shale production, increasing the U.S. energy output through ramping up production of oil, natural gas and other energy resources, and decreasing the economy’s reliance on OPEC for oil price setting. How these plans evolve under the new administration will have a big impact on market confidence when it comes to oil trading.

Global interest rates are another dynamic story that we’re keeping an eye on. The U.S. Fed has recently begun to raise interest rates, while the U.K. most recently decreased rates. Other central banks in Europe, or Japan, have pursued negative interest rates. With monetary policy around the world moving in different directions, the price of oil is uncertain.