We're gearing up for another great FIA Asia conference later this month, and I'm excited to mark what will be my 13th year at this important gathering for the cleared derivatives industry.

Headlines from Europe and the US sometimes squeeze APAC issues out of the spotlight, but it's increasingly clear that this region is where the action is. Every time I attend our Asia conference, I am struck by just how much growth and innovation is happening in this region – and I expect this year will be no exception.

APAC derivatives markets are dynamic and complex. Heck, even the acronym itself is an oversimplification as issues differ greatly from China to Korea to India to Australia.

Each of these regions has its own interesting story to tell. That's why we have an annual three-day conference, after all, and even that sometimes doesn't seem enough!

It's impossible to sum up everything that’s going on across Asia, but if I had to pick a short list of trends that are most important in the region right now, here’s my list:

More Global Benchmarks in the East: It wasn't that long ago that many considered Asian derivatives markets either too small or too insular to be a reference for global economic activity. That's simply no longer the case. Some China-listed futures contracts like wood pulp and petrochemicals have no peers internationally and serve as the primary global benchmarks for hedgers. While Singapore and Malaysia have relatively smaller markets, they also have emerged as key price discovery centers for iron ore and palm oil, respectively. In fact, Bursa Malaysia recently announced a first-of-its-kind agreement with the Dalian Exchange to license its settlement price for DCE's heavily traded soy oil futures. It’s clear that more global economic activity is being priced using Asian benchmarks than ever.

China's Commodity Exchanges Dominate: Of the top 10 agricultural commodity contracts worldwide, 9 trade on a Chinese futures exchange. Of energy commodity contracts, 4 of the top 10 are listed in either China or India. And in metals, you have to get to #12 on the list before you find any futures or options that are not listed on Chinese exchanges! That's not surprising when you consider the people purchasing power of APAC and its supersized industrial sector. With commodities at the forefront of our attention during the green revolution and global unrest, these statistics show why we must be paying close attention to APAC’s dominance in this area.

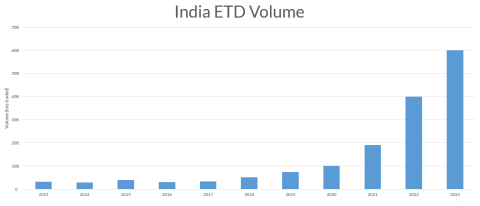

India's exponential growth: India’s ETD volumes have grown more than 10-fold since 2017 to roughly 60 billion contracts already traded in 2023. This is a remarkable feat in both its scale as well as consistency each consecutive year. India has become a major marketplace that is an increasingly important part of the global derivatives community, with the potential to stand shoulder to shoulder with China and even mature markets like the US and Europe. We've heard from several FIA members that are investing in the region to take advantage of this impressive trend. You should expect to see more attention on India in 2024, too.

APAC internationalization: Speaking of India, the GIFT Connect that launched in July to bring global trading of Nifty Index derivatives went off without a hitch, proving that India's markets are steadily getting more international and more institutional. This builds on other products with global appeal like Korea Exchange's Kospi Index futures and options, which are now traded widely by market participants worldwide. Finally, the passage of the landmark Futures and Derivatives Law in China last year marks yet another important milestone in the internationalization of the Asian market. All this is proof that APAC derivatives markets are getting more connected and more influential on the world stage.

Leadership in sustainability: Carbon markets and ESG issues have been a priority across APAC in the last few years. China's national emissions trading scheme celebrated its second year of operation in July, by some measures is the largest such market in the world – bigger even than covered emissions in Europe. Elsewhere, mandatory ESG reporting will come into effect next year in Hong Kong. Asia is emerging as a global leader on this topic, which will fuel new contracts and innovations that drive our green transition.

As you can see, there’s a lot of exciting things happening across the APAC region. All this and more will be on display at our FIA Asia conference on 28-30 November – but even if you can’t join us in person, the growth in ETD markets across this region is a trend that everyone in our markets should see as a top priority.

Top 10 Agricultural Futures and Options Contracts

| Rank | Contract | Jurisdiction | 2023 Vol | 2022 Vol | Change |

| 1 | Soybean Meal Futures, Dalian Commodity Exchange | China | 266,856,677 | 246,514,865 | 8.3% |

| 2 | RBD Palm Olein Futures, Dalian Commodity Exchange | China | 168,295,450 | 179,031,389 | -6.0% |

| 3 | Rapeseed Meal (RM) Futures, Zhengzhou Commodity Exchange | China | 168,087,528 | 100,481,538 | 67.3% |

| 4 | Soybean Oil Futures, Dalian Commodity Exchange | China | 157,298,975 | 139,691,266 | 12.6% |

| 5 | White Sugar (SR) Futures, Zhengzhou Commodity Exchange | China | 147,614,871 | 67,998,704 | 117.1% |

| 6 | Rapeseed Oil (OI) Futures, Zhengzhou Commodity Exchange | China | 141,848,882 | 63,405,924 | 123.7% |

| 7 | Cotton No. 1 (CF) Futures, Zhengzhou Commodity Exchange | China | 129,902,631 | 82,297,125 | 57.8% |

| 8 | Corn Futures, Dalian Commodity Exchange | China | 125,384,299 | 102,391,682 | 22.5% |

| 9 | Woodpulp Futures, Shanghai Futures Exchange | China | 87,689,158 | 65,238,856 | 34.4% |

| 10 | Corn Futures, Chicago Board of Trade | U.S. | 64,689,256 | 61,530,213 | 5.1% |

Top 10 Metals Futures and Options Contracts

| Rank | Contract | Jurisdiction | 2023 Vol | 2022 Vol | Change |

| 1 | Steel Rebar Futures, Shanghai Futures Exchange | China | 398,243,144 | 377,920,197 | 5.4% |

| 2 | Silver Futures, Shanghai Futures Exchange | China | 179,749,339 | 122,059,581 | 47.3% |

| 3 | Iron Ore Futures, Dalian Commodity Exchange | China | 162,417,275 | 159,332,816 | 1.9% |

| 4 | Hot Rolled Coil Futures, Shanghai Futures Exchange | China | 115,427,398 | 109,472,441 | 5.4% |

| 5 | Iron Ore Options, Dalian Commodity Exchange | China | 70,705,485 | 27,546,747 | 156.7% |

| 6 | Aluminum Futures, Shanghai Futures Exchange | China | 60,062,370 | 80,564,757 | -25.4% |

| 7 | Ferrosilicon (SF) Futures, Zhengzhou Commodity Exchange | China | 52,653,427 | 51,197,091 | 2.8% |

| 8 | Silicon Manganese (SM) Futures, Zhengzhou Commodity Exchange | China | 44,506,923 | 31,755,553 | 40.2% |

| 9 | Nickel Futures, Shanghai Futures Exchange | China | 44,439,307 | 41,814,913 | 6.3% |

| 10 | Steel Rebar Options, Shanghai Futures Exchange | China | 42,781,995 | N/A | N/A |

Note: Volume is for Jan. 1 through Sept. 30 of each respective year. Source: FIA Data. Steel Rebar Options began trading in December 2022.