A message from Walt Lukken, President and CEO, FIA

Ten years ago, I found myself right at the heart of one of the worst financial crises our generation has ever seen. In March 2008, I was serving as the acting head of the Commodity Futures Trading Commission, and the warning lights on our market risk monitors were flashing red.

You all know what happened next. First Bear Stearns had to be rescued, then Fannie and Freddie collapsed, then Lehman declared bankruptcy, then two days later AIG had to be rescued. And on the other side of the Atlantic, RBS and Barclays faced major losses, Lloyds took over HBOS, Fortis had to be rescued…that was the year when our financial system teetered on the brink of collapse.

For the better part of the last 10 years, policymakers around the world have established a new regulatory framework for the global financial system in response to the crisis of 2008. Some key elements are still in progress, but most of the major pillars are now in place: Dodd Frank, EMIR, Basel III, MiFID II and their equivalents around the G20. And we can see the results. We have more clearing of derivatives, more transparency into trading, more capital in the banking system, and better benchmarks in both financial and commodity markets.

With this experience in mind, we should take stock of the progress we have made, ensure that the regulations are working as intended, and consider how they might be improved. In particular, it has become increasingly clear that several unintended consequences are harming the quality of the derivatives markets and eroding their value to end-users. Three examples at the top of my mind:

- The cost of clearing has increased due to the unforeseen impact of the Basel III capital requirements.

- As the details of the rules diverge from one jurisdiction to the next, regulators are finding it increasingly difficult to agree on a common approach to crossborder trading and clearing.

- The diversion of resources into compliance, while necessary, has drained resources away from growth opportunities and stifled investments in new technologies.

I am glad to see that efforts are now under way in Washington, Brussels and beyond to assess the impact of the reforms and consider how they may need to be recalibrated. That is an important and welcome project. But it is even more imperative to turn our sights to the challenges and opportunities of the future. During all those years of rulemaking, the world did not stand still. The time is ripe for regulators to shift their attention to the trends that are shaping the future of this industry.

From my seat here at FIA, I see at least three megatrends that have the potential to transform this industry over the next 10 years.

1. Technology as Both an Enabler and a Disrupter

We are seeing digitization and automation at all levels of our industry and indeed our economy as a whole. Big data, cloud computing, artificial intelligence—all of these trends are converging in a way that will revolutionize how we conduct our businesses. I know it's not easy to change the culture inside the large organizations that dominate our industry. But it has to happen, and it's already underway at many of the large firms among FIA's membership. I am particularly impressed by the progress being made with distributed ledgers, and I anticipate that we will soon see practical applications of enterprise blockchain technologies in payments, settlements and derivatives processing.

2. The Rise of China

On March 26, the Shanghai International Futures Exchange will open for business. For the first time the international community will have the ability to participate directly in a Chinese futures market. Later this year MSCI will add more than 200 China A-shares to its emerging markets index, which will spur new flows of international investment into China's onshore stock markets. These two developments are real harbingers for the future and as a member of the advisory council working with the chairman of the China Securities Regulatory Commission, I can tell you that more cross-border opportunities are in the pipeline. Just as powerful will be Chinese institutions participating in Western markets. China is turning from a savings nation to an investing nation, and Chinese brokers are already knocking on the doors of exchanges in Europe and the U.S. As Pimco observed in a recent analysis, it's time to shift our perspective from “made in China” to “trade in China.”

3. Transformation of Energy Markets

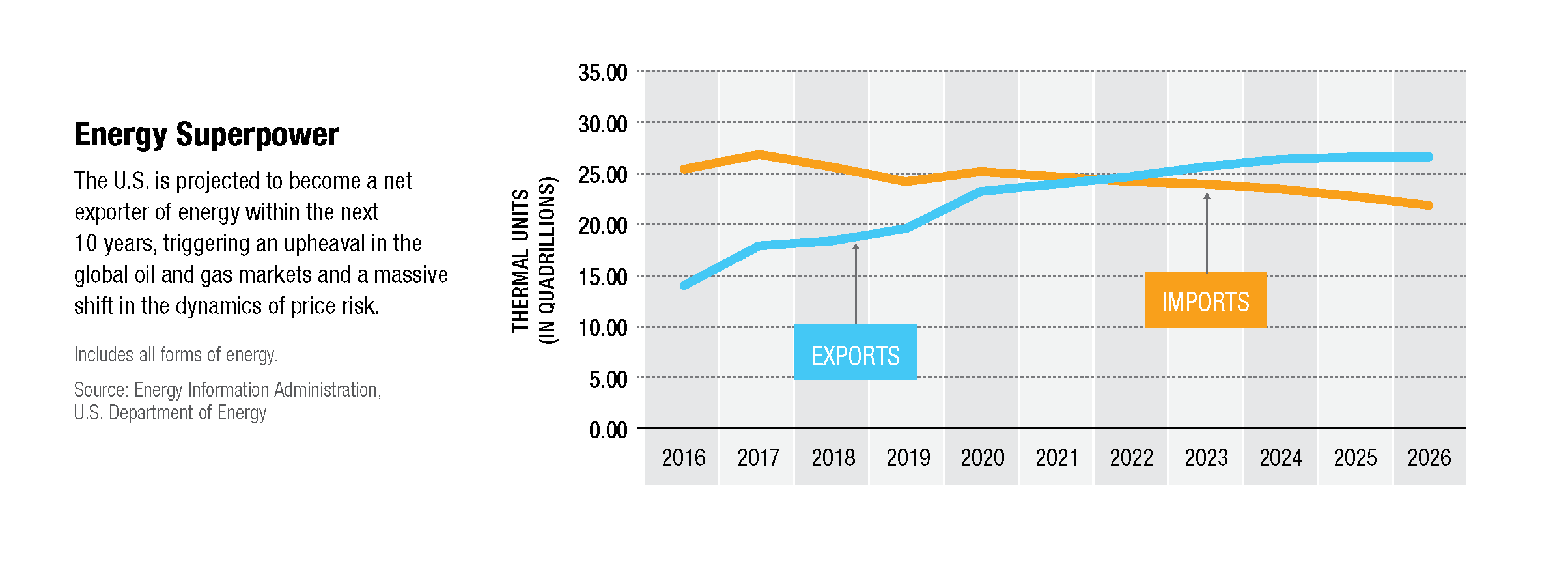

The advances that have allowed the extraction of oil and gas from shale formations are upending the global energy industry and reshaping the geopolitics that have defined the last century. The International Energy Agency estimates that U.S. oil production is growing at a rate unparalleled by any country in history and forecasts that the U.S. will become a net exporter of oil within the next 10 years. That is truly an extraordinary development. Think back to where we were 10 years ago, when oil prices peaked at $145 per barrel. It was those very prices that led to the capital investments that are bearing fruit today. As economists like to say, the cure for high prices is high prices. That's why it's important that markets, not politicians, set the price of goods and services in our economy.

Looking ahead, there is no question that this surge in production is reordering the global network of energy trading and driving higher trading volumes in energy derivatives markets. The shale revolution is also transforming the U.S. into a net exporter of natural gas. BP projects that expanded LNG production will lead to a globally integrated gas market in the coming years that will be anchored by U.S. gas prices. In short, the world is changing, and the derivatives markets have a historic opportunity to provide end-users with the mechanisms they need to hedge their risks.

There are many other megatrends in our world today, but I highlight these three to illustrate the need for policymakers to pivot towards the future. I am optimistic about the changes on the horizon, but I am also cognizant of the risks that they may bring. We have learned the lessons of the 2008 crisis. Now it's time to focus on sustainable growth and innovation.