Dialogue is key to making the derivatives industry thrive

The summer is usually a quiet time here in Washington, D.C. but this year proved to be an exception.

Right at the end of August, the Senate confirmed Dawn DeBerry Stump and Dan M. Berkovitz to fill the remaining two open spots on the Commodity Futures Trading Commission. This is very good news for the CFTC and for our industry.

Dawn Stump brings decades of experience in public policy matters to the CFTC having held senior roles at the House and Senate Agriculture Committees as well as NYSE Euronext and FIA itself. Dan Berkovitz is equally qualified, having served as general counsel at the CFTC, a partner at the law firm of Wilmer Hale, and a senior staff lawyer for the Senate Permanent Subcommittee on Investigations.

Both bring a terrific blend of experience and expertise to this agency at a critical time and I expect they will approach the issues facing this industry with fairness, balance and a willingness to listen. It has been a pleasure to work closely with both of these thoughtful individuals over the years, and we look forward to the benefits of having a full complement of commissioners under the leadership of Chairman Giancarlo.

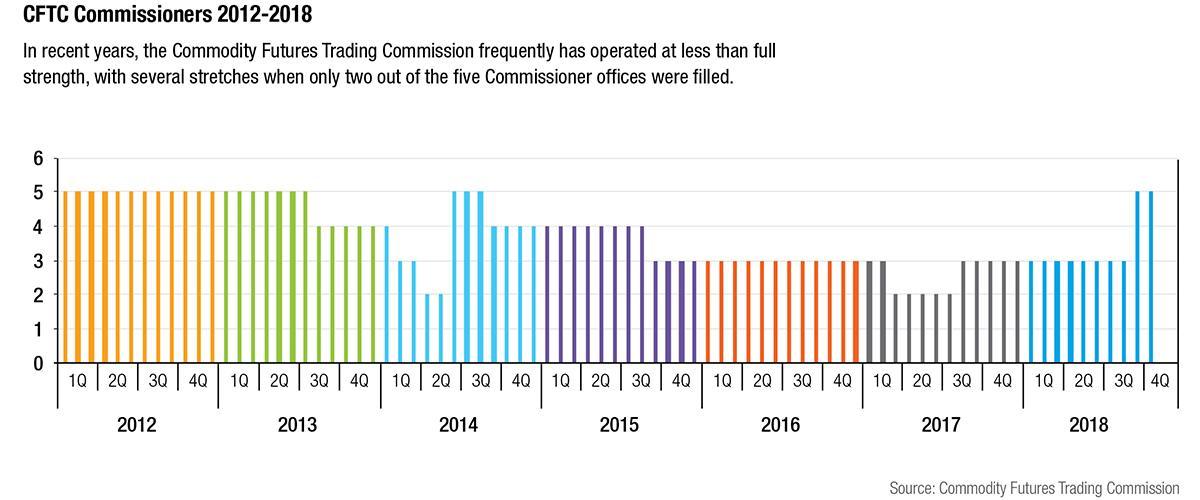

What many of you may not realize is that it is quite rare for the CFTC to have all five of its Commissioners. As you can see from the attached chart, the agency has been at full strength for only three months out of the last five years.

You may be wondering why this matters since the CFTC can operate and function with less than a full five-person commission. Let me explain.

Yes, rules can be passed or repealed and staff can still issue letters and no-action letters. But not having a full complement of commissioners deprives the CFTC of the wide range of perspectives it was designed to have. Chairman Giancarlo even stated publicly that he wouldn’t move major rulemakings without a full commission.

Another reason is that when there is a less than a full complement of commissioners, the commissioners themselves are prevented from talking to each other. You read that right, they can’t discuss and debate major issues. What I am referring to is an obscure federal law called the Government in the Sunshine Act. This law prevents certain federal officials, such as CFTC commissioners, from meeting behind closed doors without public notice.

Now I am a strong believer in transparency, but the side effect of this law is quite severe. So long as there are five commissioners, any two commissioners can get together and talk about agency issues. But things get complicated when the CFTC falls below full strength. For example, when there are only three commissioners, then any time two commissioners are in the same room, they form a de facto majority, and the law states a majority of the commission cannot have a meeting without the conversation being held in public.

This effectively means that commissioners can’t talk to each other, deliberate points of view, develop relationships and compromise on important issues. Instead they have to exchange views through their staff, or wait for the next public meeting. That is not smart regulation.

I can tell you from personal experience that this restriction seriously impairs the ability of the CFTC to do its job. Commissioners need to have relationships with fellow commissioners, just as they do with members of Congress and their staffs, industry advocates and other interested parties. Not being able to discuss and deliberate prevents the implementation of effective public policy and leads us farther away from smart regulation. These relationships pave the way for a respectful debate and a thoughtful exchange of ideas, both of which are critical to creating good policy towards our industry.

A final reason is that it fosters bipartisan cooperation. Even though the commissioners come from different parties, the CFTC has a long history of working together to strike the right balance in its rules and regulations. Having a full commission means that the CFTC is in a better position to weigh arguments from both sides of the political spectrum as it deals with the policy issues on its agenda in the months ahead.

In our role as the industry’s advocate, we look forward to working with all five commissioners. We have always made it a priority to meet with the CFTC and provide our views on both market trends and pending regulation. Earlier this year, we arranged for FIA’s board of directors to come to Washington for a series of meetings, not only with the CFTC but also with several other important policy-making bodies including the Federal Reserve and the Securities and Exchange Commission. We continued to make the case that banking regulators should give fair treatment of clearing in the capital rules. And to make sure that our arguments are heard, we met with several members of Congress to urge them to support our advocacy through legislative measures.

Of course Washington is not our only focus. In June I travelled to Shanghai for a conference cosponsored by the Federal Reserve Bank of Chicago and the Shanghai Clearing House. The conference brought together clearing experts from all over the world to discuss best practices for clearing risk management. It also gave me an opportunity to renew FIA’s relationships with important stakeholders in the Chinese futures markets, which I expect will become more and more important to our work in the years ahead.

As you all know, Europe is currently in the process of making some extremely important changes to its regulatory framework for financial markets in general and clearing in particular. In line with our global mandate, I will be travelling to Europe twice during the month of September, first for the Eurofi conference in Vienna and then for the ceremonial opening of our new office in Brussels.

In Vienna I will be joined by several members of our European policy team, and I expect we will have a busy schedule of meetings with EU policy makers involved with the regulation of derivatives. During my Brussels visit, I will lead a delegation of FIA board members to visit members of the European Parliament and share our views on the importance of international cooperation and regulatory harmonization.

As you can see, the common theme here is dialogue. We believe dialogue is the best way to resolve our differences and balance public and private interests. And we are committed to making that dialogue happen, not only in the meetings I have described above, but also at our conferences in London, Chicago, Singapore and beyond. That’s how we can achieve our goal of helping our industry grow and expand.

Before closing, I should mention an important development that took place in mid-September, just as we were going to press with this issue of MarketVoice. A trader active in European power markets defaulted on his obligations at Nasdaq Clearing. Although the clearinghouse was able to manage the default in line with its procedures, the losses incurred on the trader’s positions resulted in a large drawdown on the default fund, which had to be replenished by clearinghouse members. As the head of FIA, I am deeply concerned by this incident. We are engaged with Nasdaq and the clearing firm community to find out how this default happened and what steps should have been taken to prevent such a large impact on the default fund. We haven’t reached any conclusions yet, but I expect this incident will be an important topic of conversation at our upcoming FIA Expo in Chicago.