Cross-border interaction is a defining characteristic of the industry

As I write this in early November, I am preparing for a trip to Beijing and Singapore, and I only just returned from a trip to Chicago. I can’t help but think about the connections that link our global markets together.

I start with Scandinavia. As I am sure many of you know, a large default took place in September in the power derivatives market operated by Nasdaq. Nasdaq has published several FAQs regarding the default and is conducting an in-depth analysis of that incident, so it would be premature to jump to conclusions. However, this incident has caused ripples far beyond that marketplace.

The good news is that the clearing system worked. The losses were contained, the markets continued to function, and taxpayers were not asked to intervene. However, the default raised questions about margin methodologies, membership criteria, the process for managing defaults, and the “waterfall” of financial resources that backstop the clearing system. These issues are relevant to every clearinghouse globally.

In a sense, this was a real-life stress test of the clearing system, and like any test, the results should inform our thinking going forward. That was one of the major themes of discussion at our recent conference in Chicago, and in December's issue of MarketVoice we will report on the main points made by speakers at that event.

A far larger event is looming on the horizon — Brexit. We are now only a few months away from the formal departure of the U.K. from the EU, and there remain serious questions about the new state of play. FIA’s overriding concern is to make sure that market participants continue to have access to exchanges, clearinghouses and other essential market infrastructures. As of mid-November, U.K. and EU negotiators had reached a provisional agreement on the terms of a Brexit withdrawal agreement. If approved by political leaders on both side — and that is a big if — this agreement would provide a transition period to the end of 2020 and undoubtedly would pave the way for a smoother departure from the EU than the so-called “hard Brexit.” However, if the agreement is not approved, and we end up with a hard Brexit, the European Commission has proposed a “contingency action plan” to address several important financial services issues, including maintaining access to U.K. clearinghouses.

These are important steps toward ensuring a smooth transition, but there are many areas where clarification is urgently needed. In particular, clearinghouses, intermediaries and their customers will need legal certainty around the scope, timing and duration of any proposal put forward by regulators and policymakers before they have full comfort that Brexit — whether hard or soft — will not have a negative impact on the ability of markets to continue functioning across borders. Until that certainty is granted, FIA will continue to work with the industry to guide it through the unsettled period that lies ahead.

FIA has a long history of supporting cross-border trading and clearing as a means for improving competition and customer choice. Since the very beginning of the commodity futures markets centuries ago, customers have relied on this industry to provide access to the best price discovery and risk management tools available anywhere on the planet.

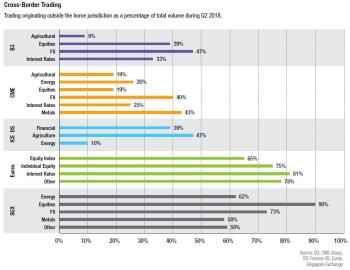

I recently presented data showing the importance of cross-border trading to some of the world’s largest exchanges. This foreign participation improves and deepens liquidity while reducing the costs of trading. This is essential to a healthy market and I remain concerned that political conflicts are eroding the spirit of cooperation among regulators and making it increasingly difficult to maintain open, competitive and globally integrated financial markets.

One exciting opportunity remains the opening of China’s futures markets to foreign investors. In late November, I will be in Beijing participating as a member of the CSRC’s International Advisory Council that seeks input on ways to develop China’s markets. I will advocate several ideas on how to build liquidity in China’s derivatives markets by attracting outside participants, which is similar to the demographics of other major exchanges globally. Only through foreign participation can these markets reach their full potential.

Lastly, I want to turn to two recent developments in the area of capital requirements. In mid-October, the Basel Committee published a consultation regarding the recognition of client margin in the treatment of cleared derivatives in the leverage ratio and asked for feedback on whether a “targeted and limited revision” is warranted. Additionally, in late October, the U.S. banking regulators issued a proposal to permit banks to use an alternative approach to calculating capital requirements for derivatives. The regulators said this alternative approach, which is called the “standardized approach for measuring counterparty credit risk” or SA-CCR, would provide important improvements to risk sensitivity, resulting in more appropriate capital requirements for derivative contracts exposure.

These two developments demonstrate a growing recognition in the regulatory community that the Basel II capital reforms have created economic disincentives for banks to provide clearing services to clients. That certainly was not the intention, but it is the consequence of a flawed treatment of client clearing in the capital standards.

As many of you know, FIA has consistently and strongly advocated for changes in capital requirements for cleared derivatives. FIA officials and member representatives have met with officials from central banks, market regulators and finance ministries in multiple countries to explain how the current treatment works against the G20 mandate for central clearing and discourages end users from using cleared derivatives to hedge risks. We are far from the finish line in this effort, but these are positive steps, and I assure you that we will continue our advocacy to ensure the health of the clearing ecosystem.

Walt Lukken is president and CEO of FIA.