As exchange floors have shut down and markets have become more electronic, avenues of entry to that world have changed, and opportunities to find jobs through relationships and networking have diminished. At the same time, skills in STEM (science, technology, engineering and math) are becoming more important for job seekers in finance, but the educational system in the U.S. does not always put a high priority on these skills.

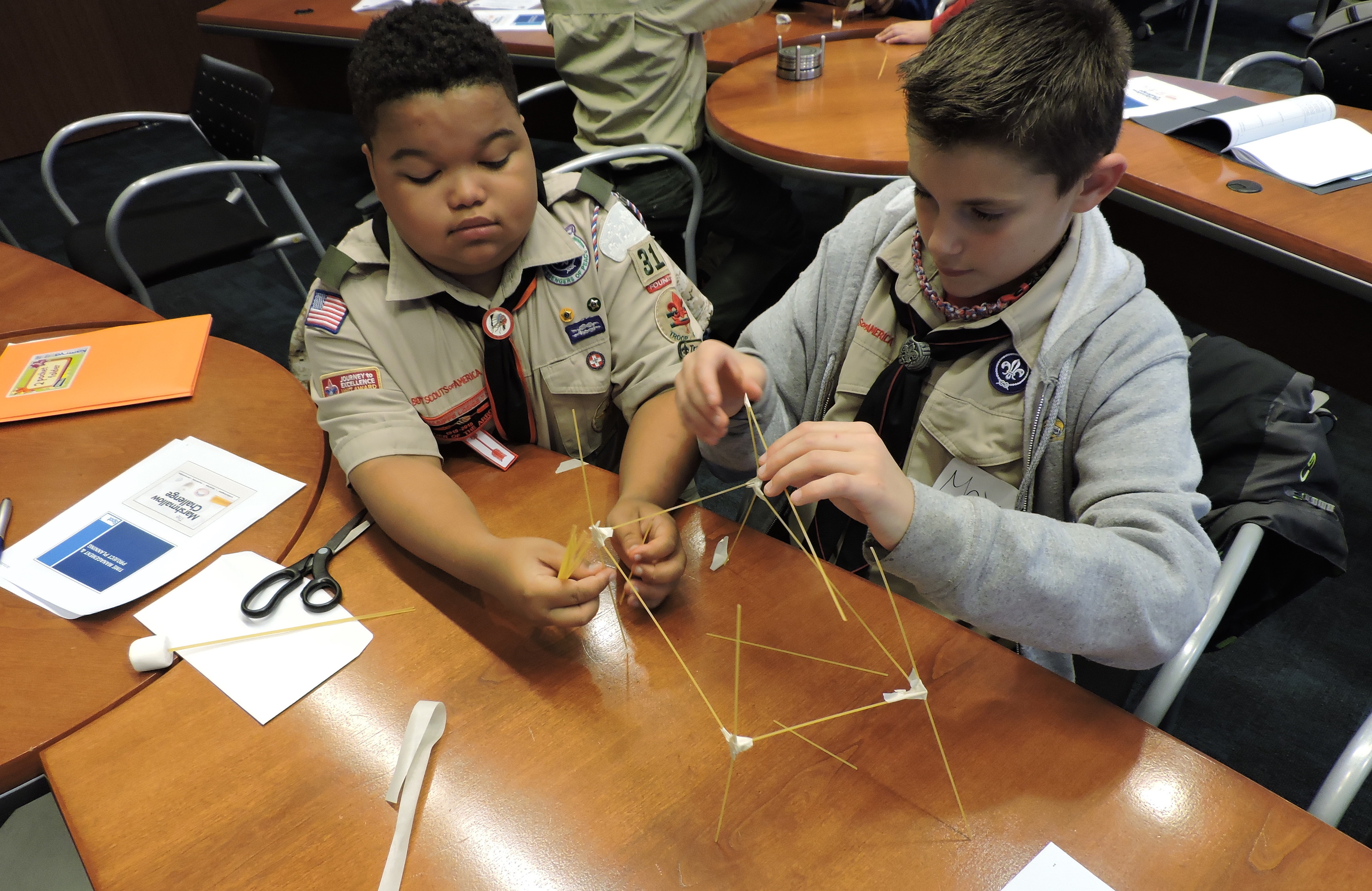

To help address these challenges, a group of firms in the Chicago futures industry have joined forces with the Boy Scouts of America to promote STEM and introduce scouts to the world of trading and finance. So far, more than 120 Scouts have participated in the program.

The initiative started with Trading Tech 300, a plan to recruit 10 people from 30 different firms in the financial industry to train Scouts in STEM-focused merit badges. The first program ran last summer with participants including Advantage Futures, the NFA, Glenstar Properties, CBOE and Spot Trading, providing experts in their various fields to help the scouts earn their badges. The merit badge requirements are rigorous and follow the Boy Scouts of America's official guidelines.

Attracting a diverse group of Chicago kids to STEM and to the Scouts "has the potential to make a positive impact on Chicago’s crime problem," says John Lothian.

One of the leaders of this initiative is John Lothian, a former Chicago futures broker who is the founder and owner of MarketsWiki, MarketsWiki Education and MarketsReformWiki and the publisher of John Lothian News. Lothian is also a Scout leader and has organized several events to encourage young people to seek careers in the futures industry.

Part of the impetus for the program was also to remake the LaSalle Street Dinner, an annual event for people in the derivatives industry to support the Boy Scouts of America. Myriam Herrera, development director for BSA's Pathway to Adventure Council, asked Lothian to reinvent the dinner, and he came up with the idea to turn it into an awards presentation for the Trading Tech 300 participants. The TT 300 program now culminates in an awards event recognizing the achievements of those who took part.

Advantage Futures was the first firm to sign on to the project and chose to administer the chess and public speaking merit badges. Advantage Futures' involvement was inspired in part by its CEO, Joe Guinan, who was among the youngest Scouts in Connecticut to earn the rank of Eagle Scout. Terry Duffy, senior vice president, business development at Advantage Futures, was inspired by his two sons who are Eagle Scouts. Advantage had an employee who was "just short of a chess master," Duffy said, and he and some members of his chess group came to teach the boys about the history of chess and how to keep score. One of them played six games with the scouts simultaneously, winning all of them, and then explained why the boys lost.

At Spot Trading, scouts worked on the merit badges for programming and personal management by writing code using the programming language Python, and by investing a theoretical $1,000, allocating it among stocks, mutual funds and savings bonds, among other tasks. "We gave them an overview of programming languages and an understanding of intellectual property, and they had to write a sample program," said DeBorah Lenchard, the director of education and talent development at Spot. "The kids had a great time because they had the chance to meet people who actually did this for a living, and talked about what their typical day was like and the types of thing they worked on," Lenchard said.

At the National Futures Association, Scouts learned the history behind fingerprinting and how the NFA uses fingerprinting in the derivatives industry. The scouts earned their merit badges in part by acting as detectives and using what they had learned to solve the Mystery of the Stolen Lunch. "The scouts were so engaged and interested," said Kristen Scaletta, communications manager at the NFA. "It was good to be a role model in the financial industry for them."

The Chicago Board Options Exchange also offered the fingerprinting merit badge and had their EMT staff teach the first aid merit badge. Glenstar Properties, which owns the Chicago Board of Trade Building, administered the badges for electricity, engineering and search and rescue, using the building as a teaching tool, with some of its engineers volunteering to help out.

Lothian and others are hoping to expand the program further, opening it up to girls as well as boys. "There aren't enough women in STEM, so anything we can do to encourage more to take part we'd love to do," said Spot Trading's Lenchard.

The program is looking for companies to participate in 2016 and all of the firms that have participated are eager to continue participating in Trading Tech 300.

Herrera was instrumental in helping to coordinate the merit badge sessions. "Everyone it touches has walked away with excitement," said Herrera.