If India’s Ministry of Tourism hadn’t already trademarked Incredible India, its Ministry of Finance might well be using the old slogan to lure more foreign investors to what is now the world’s largest and fastest-growing equity derivatives market.

These days, 84% of all equity options traded on the planet are bought or sold on exchanges in India, according to FIA data, when ten years ago it was only 15%.

In the first quarter of 2024, more than 34.8 million equity index options traded on the two main financial derivatives exchanges—the National Stock Exchange of India, and BSE India, formerly known as the Bombay Stock Exchange. That was double the volume traded in Q1 2023, and it represented 73% of all futures and options traded on every exchange, everywhere.

Of course, volume alone is not the sole measure of a market's size, as experienced derivatives traders know. The value of the equity index options traded on NSE and BSE are very small compared to the comparable contracts in North America and Europe.

Even so, small numbers add up. An alternative measure is to look at the premiums that options traders pay for the contracts they buy. An option premium is essentially the market price of an option contract, and therefore the total premiums paid are a good yardstick for the value of a market.

Premium Turnover

So how large is the Indian options market in value terms? Fortunately, NSE, the larger of the two Indian exchanges, publishes detailed data every month on the total amount of premiums paid on the options listed on its exchange. In March, the most recent data available, buyers of options listed on NSE paid premiums worth 12.5 trillion rupees, equivalent to $150 billion in US dollars.

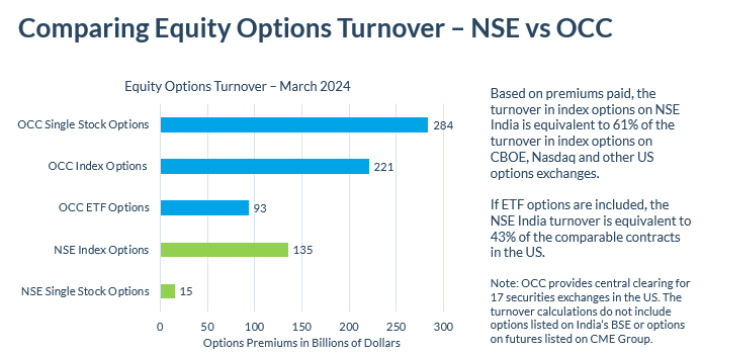

Comparing that to the US shows that the Indian market is nowhere near as large as the contract volume might suggest, but very large all the same. Using data published by the Options Clearing Corporation, FIA estimates that total premiums paid by options buyers across all 17 US options exchanges added up to $598 billion in March. In other words, NSE's options market is about one quarter of the size of the US market in value terms.

That comparison includes single stock options, which has long been a strength of the US market, especially since the post-pandemic explosion in the trading volume in options on popular stocks such as Apple, Tesla, Amazon and Facebook. In contrast, India's derivatives market has evolved towards single stock futures, which trade in much higher volumes than single stock options.

Focusing on just the index side of the market therefore gives a more accurate comparison. And what those numbers show is that the equity index options market on NSE is between 40% and 60% of the US market in value terms, depending on which types of options are included.

OCC data shows that $221 billion in premiums paid in March for index options listed on Cboe, Nasdaq and other US options exchanges. Options on shares in ETFs, which are in effect options on indices, add another $93 billion, bringing the total premium turnover to $314 billion in March.

Going back to the NSE data, premium turnover for just index options was 11.28 billion rupees in March, equivalent to $135 billion in US dollars. In other words, the turnover in index options on NSE India was equivalent to 61% of the turnover in index options on CBOE, Nasdaq and other US options exchanges. When ETF options are included, the NSE India turnover was equivalent to 43% of the comparable contracts in the US.

Retail Driven

Currently, one-third of the turnover in index options on the NSE is driven by retail investors, one half by proprietary traders playing a market-maker role, and less than one-tenth by foreign investors, according to NSE data.

The fast and furious trading involves mostly zero-day-to-expiration options that expire on the day of purchase. A recent Bloomberg report said the average time a trader holds an option is under 30 minutes.

“If you want to gamble, if you need diabetes and high blood pressure, then go into this market,” said Ashwani Bhatia, a member of the Securities and Exchange Board of India (SEBI), according to the report.