The foreign exchange markets are among the largest in the world, with an estimated $7.5 trillion in turnover per day. Yet the vast majority of the trading is handled on a bilateral basis, with no use of the central clearing mechanism that predominates in many other financial markets.

That is slowly beginning to change. LCH, the UK clearinghouse that processes more than 80% of the global market for interest rate swaps, offers a clearing service called ForexClear to participants in the over-the-counter FX markets. This year LCH has seen a steady increase in the number of firms using this service and a large increase in the volume of transactions processed through that service.

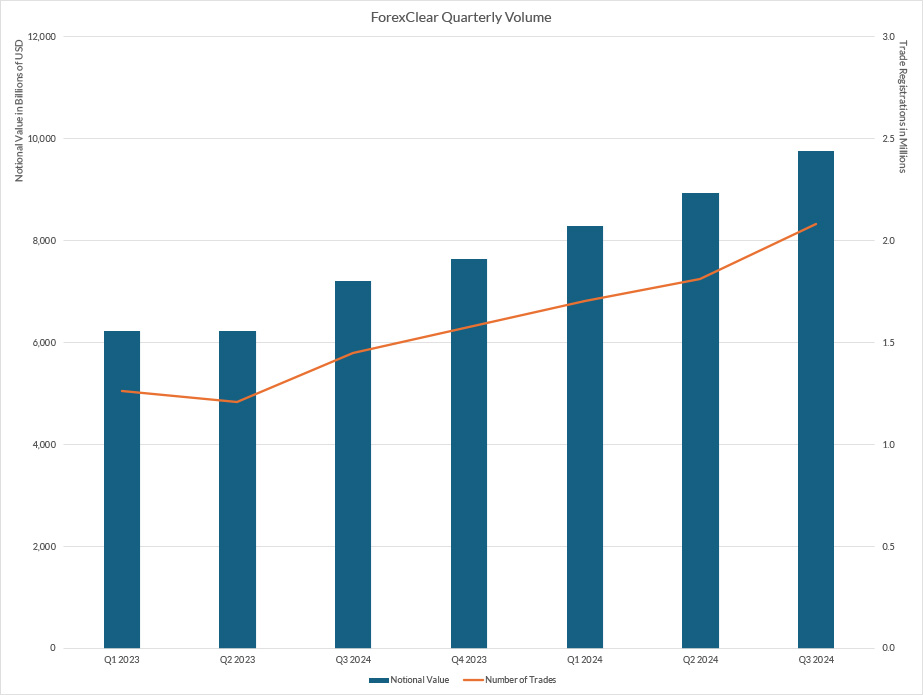

In the second quarter of 2024, LCH’s ForexClear cleared $8.9 trillion in notional value, a record amount and up 44% from the second quarter of 2023. Three months later, LCH reported $9.6 trillion in volume for the third quarter, another quarterly record, and up 35% from the third quarter of 2023.

The number of transactions processed through the service also is on the rise. In the third quarter, more than two million trades were registered with ForexClear, up 43% from the third quarter of 2023.

While the growth is impressive, the volume of cleared transactions is still a drop in the bucket compared to the overall size of the FX markets. According to the most recent survey published by the Bank for International Settlements, trading in OTC FX markets reached $7.5 trillion per day in April 2022. In practical terms, that means ForexClear is handling less than 1% of the OTC FX markets.

But the signs of growth are encouraging. Mariam Rafi, global head of financial resource management for Citi’s futures, clearing and FX prime broker division, has been watching the trend. She works with clients that clear their interest rate swaps at LCH and she is looking forward to seeing similar adoption in the FX market, but she says it would be “premature” to say that the turning point has arrived.

“There are definitely some increases – there are green shoots – but I would say that’s about it,” Rafi told MarketVoice.

One crucial difference: participants in the global interest rate swaps market had no choice but to adopt central clearing. After the financial crisis of 2008, policymakers in the Group of 10 countries agreed on a package of reforms that included requirements on the industry to move most of the IRS market to central clearing. That mandate was not extended to the FX markets, so if and when the FX markets adopt central clearing, the transition will be voluntary.

Green Shoots

What is driving the increase in the volumes flowing through ForexClear? The first thing to note is that ForexClear is not designed to cover all types of OTC FX transactions. The main focus is non-deliverable forwards, and in that corner of the market LCH is gaining traction.

According to the BIS survey in 2022, average daily volume in these contracts was $266 billion*, equivalent to 3.5% of the total OTC FX market. Andrew Batchelor, head of ForexClear, estimates that LCH’s clearing service captures about 25% of the global NDF market.

The service covers 25 NDF currency pairs, of which 15 are based on emerging market currencies and 10 on G-10 currencies. The four most popular contracts are based on emerging market currencies – the Taiwan dollar, the Indian rupee, the Korea won, and the Brazilian real.

In part that reflects the challenges of access to those currencies. An NDF allows two counterparties to exchange cash flows in dollars or euros based on the prevailing spot rate for one of these currencies. NDFs therefore are a convenient way to hedge currency risk in currencies that are not freely exchanged or have low liquidity.

A few years ago, LCH added FX options, forwards and spot transactions to the ForexClear offering. Batchelor says NDFs still account for most of the flows, with 85% of the service’s volume in NDFs, and the remaining share split between FX options (14%), and spot and forwards (1%).

The second factor driving the uptick in clearing is that the economics of FX trading are changing. Over the last decade global regulators have gradually implemented the so-called “UMR” rules, which impose margin requirements on uncleared trades. Applying these requirements to bilateral trades in the FX markets changes the cost of those trades, and that is causing many banks to reconsider the tradeoffs between cleared and uncleared trades.

That reconsideration is showing up in two ways. First, in bank-to-bank trading, where both sides are looking for ways to reduce the cost of trading, and second, in the prime brokerage business. The UMR requirements were implemented first for banks, but now that it covers clients as well, some prime brokers are encouraging clients to clear their trades because that reduces the cost for the bank.

In addition, the capital requirements for large global banks are much higher than they used to be, another outcome from the post-crisis reforms. NDFs are on the list of assets that must be included in capital requirement calculations, so submitting them for clearing both reduces the overall amount through netting and reduces the risk weighting relative to bilateral trades.

“There are some clients who are motivated now more to clear their NDFs because of UMR pressures,” said Citi’s Rafi. “It’s getting even more expensive for FX prime brokers to support client activity on a bilateral basis, so there is definitely a push to clear client trades.”

Next Wave

LCH’s strategy began by selling forex clearing to the top of the financial food chain: the large global banks that dominate the OTC FX markets. “Our strategy was to go after the big banks first, because they have the largest FX portfolios and they’re the ones subject to UMR and the capital rules. And then you go down that long curve of top-tier, second-tier, third-tier banks, and regional banks given the liquidity now present in the service,” said LCH’s Batchelor.

Step one seems to have worked. Batchelor said the world’s 25 biggest banks are now convinced that FX clearing is an important tool for minimizing their financial resource optimization requirements. “If you speak the global head of FX, or the global markets COO, or the head of markets at a large markets, they fundamentally get that clearing is attractive and that they should be clearing as much as possible,” he said.

LCH is now “moving down that size curve,” Batchelor added. “More recently, we’ve welcomed banks like BBVA, UOB and Wells Fargo as members to the service.” He said the clearinghouse is also in conversation with regional banks in Scandinavia, Korea, Singapore, Netherlands, Canada and others.

Standard Chartered was one of the early converts. The bank specializes in emerging markets and actively trades NDFs in emerging market currencies. Andy Ross, the bank’s global head of prime brokerage, said adopting clearing is a win-win for the large banks because it nets out risk by matching up offsetting trades.

Standard Chartered also was one of the first to participate in the expansion of ForexClear beyond the dealer community. Initially the service was only available for trades between members of the service, but in 2022 LCH opened it to market participants that want to clear their trades through their brokers. In March 2023, Standard Chartered cleared its first client NDF trade with IndusBank, a commercial bank headquartered in Mumbai. Standard Chartered said clients using the service would benefit from “reduced operational complexity, robust risk management and increased liquidity.”

Clearing also creates a backdoor for price discovery between markets that don’t normally have access to each other, according to Ross. “There are pools of liquidity in Asian markets that are often segregated…Indian banks are trading with Indian banks, the Korean banks are trading with the Korean banks, and so on and so forth, with some international brokers stepping in,” Ross said. “The minute you have a clearing provider and a platform, you give the ability for those people to find price discovery.”

Member-to-member trades continue to account for the majority of the cleared volume, but client cleared volume has been picking up. Client NDF trades broke above $100 billion for the first time in August 2024. Although that is a relatively small amount compared to the overall volume of cleared flows, it was up 58% from the previous year. The total number of clients connected to ForexClear now stands at 84, of which seven were onboarded in the first half of this year.

Société Générale is another example of a bank that is offering this clearing service to its clients. Jamie Gavin, managing director and head of prime brokerage clearing for EMEA for the French bank, said he sees regional banks as a likely group of users. “We think that there are some more regional bank players coming onto the LCH service through intermediary client clearers,” Gavin said.

There are also signs that hedge funds and market makers are beginning to use the service. In July, Société Générale acted as the clearing broker for an NDF trade by Virtu Financial, a non-bank market maker headquartered in New York. This marked the first time that Virtu had used the service. Gavin commented that the transaction was “another important milestone” in the provision of FX clearing services for the bank’s clients.

Better Analytics

LCH is also investing in a set of tools to help members and clients optimize capital and margin usage in their FX positions and better assess the benefits from clearing. One set of tools came through the acquisition of Quantile, a provider of optimization services, by the London Stock Exchange Group, the parent company of LCH. That deal was completed in late 2022, and LCH and Quantile have been working together to apply Quantile’s portfolio optimization analytics to the FX market.

A second initiative came in 2023, when LCH rolled out what it called “smart clearing” in partnership with Quantile. This set of tools allows member banks to submit a portfolio of trades or positions for analysis, and Quantile will identify which trades or positions should be cleared to achieve the optimal level of capital and margin usage. A bank can use that information to decide what option makes the most sense – submit it for clearing or offset the risk with other bilateral trades.

LCH says it developed its FX Smart Clearing service in response to the implementation of new requirements on the banking industry that require them to use SA-CCR as the methodology for calculating counterparty credit risk. SA-CCR, which stands for the standardized approach to counterparty credit risk, has significantly increased capital requirements for banks trading FX derivatives. According to LCH, uncleared FX has a capital requirement for risk-weighted assets of 20-100%, but that falls to just 2% if the trades are cleared.

In terms of additional products that can be brought into clearing, LCH is working with the Hong Kong Monetary Authority and market participants to expand to offshore renminbi (CNH) option clearing next year. “We think this would be a material addition to our offering, given the huge growth in CNH trading and the counterparty, capital and settlement risks present in this part of the market” Batchelor said.

Société Générale’s Gavin is also positive about the prospects of a CNH contract. “We think that will be important for the Asian client base,” he said.

Gavin sees demand ahead as well for deliverable FX options. ForexClear currently supports the clearing of FX options trades where both sides are members of the clearing service, but not yet for client trades. “For us, the next big hurdle will be deliverable FX options for clients. Especially because of the pressure from UMR, we think that’s going to be material for the market,” he explained. But he says he doesn’t expect to see that product on the market before 2027.

Batchelor is optimistic that the pace of adoption is poised to accelerate. “We think in two, three years’ time, our offering will have expanded significantly from a product point of view and will be much bigger from a participant point of view. The question is, is there a tipping point at which everyone goes, ‘Okay, this makes sense’. We're some way off with that, but the signs are there that the trajectory is strong.”

* Average daily volume of non-deliverable forwards in 2022 was $266 billion, not $266 million as this article incorrectly stated.