Mutual funds have dramatically increased their holdings of US Treasury futures over the last three years as they have adjusted to a higher interest rate environment and used the leverage embedded in futures to boost their returns, according to research by staffers at the Federal Reserve Board of Governors.

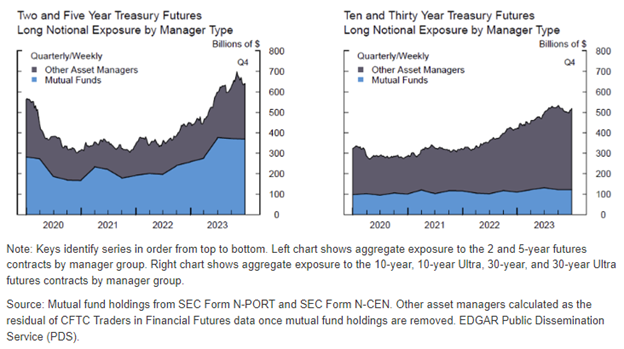

The staffers used data reported by mutual funds to the Securities and Exchange Commission to estimate that mutual funds held roughly $500 billion in Treasury futures as of the fourth quarter of 2023, up by $220 billion or 67% from the fourth quarter of 2020. The majority of that increase came in shorter tenor Treasury futures, primarily two-year and five-year Treasury futures.

"The recent rise in mutual funds' futures holdings reflects both their increased demand for Treasury exposures and an increased preference for sourcing these exposures through futures," the staffers said in the research note.

Mutual Funds Share of Asset Manager Treasury Futures Exposure

The growth in mutual fund holdings of Treasury futures was one of several factors that drove the overall level of open interest in Treasury futures to record levels in 2023. In November, CME Group reported that the notional value of open interest in its Treasury futures market grew to $2.57 trillion, an increase of 50% over the previous year.

The Fed staffers offered several reasons for the increased preference for futures among mutual funds.

First, the leverage embedded in Treasury futures allows funds to reduce the amount of capital required to maintain a position. Although they could achieve that leverage through borrowing in the repo market, there are regulatory limitations on the size of their repo borrowing, and in addition the associated interest expense affects their reported expense ratios.

Second, futures may be preferred for interest rate risk management because of their greater liquidity relative to cash Treasury securities. "Some mutual funds, such as those with volatile investor flows that require frequent adjustments to interest rate exposures may prefer to allocate a greater share of their Treasury exposures in futures since adjustments to futures exposures tend to be easier to implement and less costly," they said.

Third, mutual funds can use Treasury futures as an asset allocation tool. Funds that obtain their exposure to interest rates in the Treasury market through the use of futures can allocate more of their portfolios to corporate bonds and other securities that offer higher yields. The staffers confirmed this trend by using data from the SEC filings to analyze the characteristics of funds that invest predominantly Treasury futures and compare them with those of funds that predominantly hold Treasury securities.

"Funds that obtain most of their Treasury exposures through futures invest in more non-Treasury debt and take on more credit spread risk exposure," the staffers found. "This is consistent with mutual funds' reaching for yield as it indicates futures users' propensity to buy riskier credit to achieve higher yields in the corporate bond market."

"Overall, this comparative analysis shows that futures usage in mutual funds is associated with greater risk taking, greater flow volatility, and higher expense ratios," they concluded. "These findings suggest that although mutual funds have various uses for Treasury futures, many funds use the embedded leverage in futures to increase portfolio risk and reach for yield."

The research note – "Why Do Mutual Funds Invest in Treasury Futures?" – was written by three Fed analysts, Benjamin Iorio, Dan Li and Lubomir Petrasek, and published on May 10. The note reflects the views of the authors and not necessarily those of the Federal Reserve Board or the Federal Reserve System.