Japan, the land of the rising sun, is home to one of the first global financial centers to open each day. But trading does not end when the sun goes down. During the Asian evening, most activity settles down, but the market remains open almost all night, giving local and international investors more opportunity to take advantage of trading opportunities.

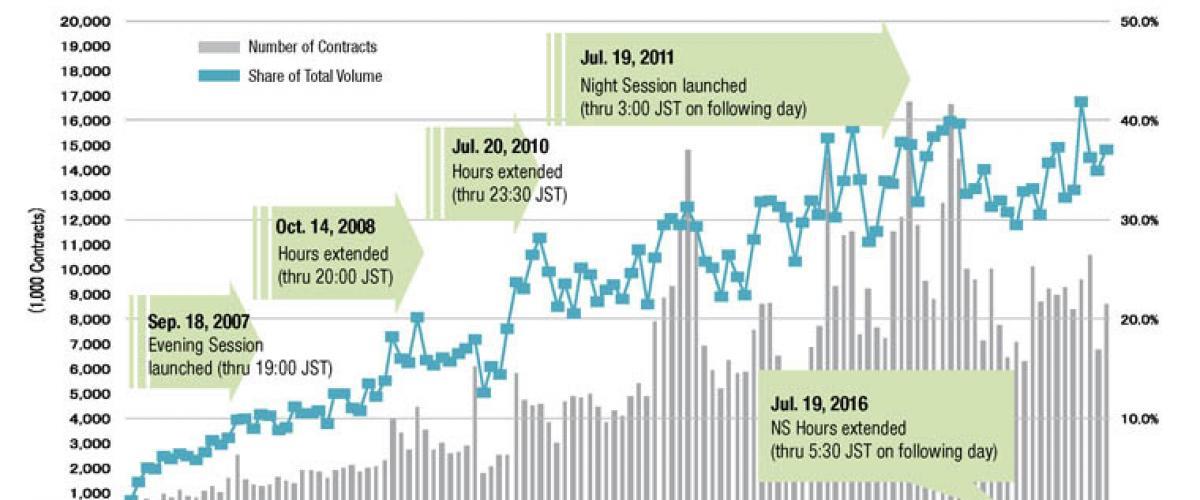

Looking back even a decade ago, Japan’s market closed in the early afternoon, well before the trading day began in London or Chicago. In September 2007, in response to globalization, Osaka Securities Exchange, now Osaka Exchange, the derivatives arm of Japan Exchange Group, launched an evening session from 4:30 p.m. to 7:00 p.m. (JST). Since then, the session has been continuously expanded to meet trading participants’ demand for longer trading hours and to cater to the ever increasing domestic demand stemming from the rise of the online brokerages.

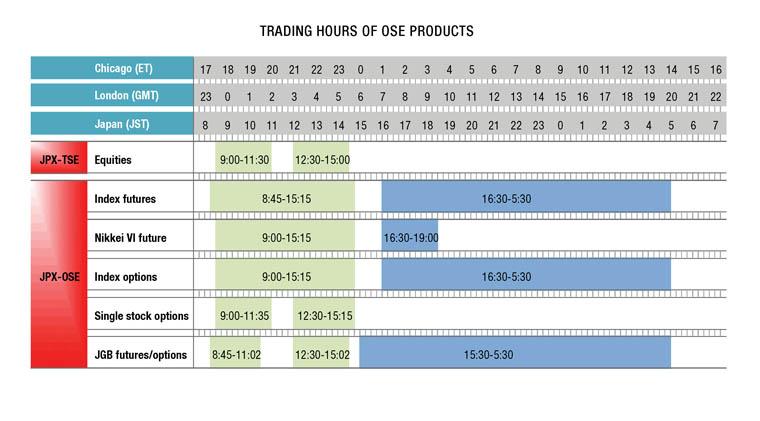

In 2011, when the session was extended to 3:00 a.m. (JST), its name was changed to the Night Session. Then in July 2016, the trading hours were extended by another two and a half hours to 5:30 a.m. (JST), which translates to 8:30 p.m. in London and 2:30 p.m. in Chicago. This effectively means the market is open almost all night, giving traders and investors the opportunity to adjust their positions in response to market moves, economic data and other news coming out of Europe and the U.S.

How Much Trading Takes Place During the Night Session?

One might assume that trading activity would be relatively low during the overnight hours. To the contrary, trading volume during the night session currently accounts for about 40% of the exchange’s total trading of futures and options. In the case of macro global events, when Japan’s cash markets are closed, OSE continues to provide opportunities to take a position on Japanese equities in the form of derivatives products. For example, during May 2017, headlines about Donald Trump’s connections to Russia sparked so much trading that the night session was more active than during daytime hours. As economic integration increases globally, OSE experiences elevated levels of volatility and trading activity during Asian nighttime.

Who trades during the night session? The evening session was introduced to meet demand from non-Japanese foreign traders and they continue to be the major players during the night session. On the other hand, with the rise of the online brokerages, participation by Japanese retail investors is also growing, bringing a different approach to trading strategies. This diverse mix of investor types is the strength of the OSE’s market, and it allows all types of investors to enjoy liquid markets even during the Asian nighttime.

OSE is proud to say that in only ten years’ time, the Nikkei 225 mini has evolved into the third most actively traded index futures globally. This success is due to a large degree to the popularity of the night session, which has helped this contract to become a major benchmark for equity markets worldwide.

Although Japan is in the Far East, the OSE market is not hard to access. It is the convenient and liquid market not only for Asian people but also for everyone who lives outside of the Asian time zone.

To learn more, visit: www.jpx.co.jp/english