In this commentary written for MarketVoice, an expert in clearinghouse margin describes four examples of spikes in margin requirements in the commodity futures markets and outlines some of the reasons for the increases.

Energy markets have been subject to a series of shocks in the past few years, all of which have had a significant impact on prices of the derivatives traded on these products and as a consequence the margin requirements demanded from traders in the derivatives market.

One of the most heavily impacted has been Dutch TTF gas futures. As prices reached record levels, firms were hit with extremely high margin calls - a combination of variation margin losses and increased initial margin requirements. Businesses were forced to make decisions between closing out hedges to reduce margin or resorting to high-cost borrowing to meet the calls. Some firms were brought to the brink of collapse by the rapid increase in margin levels required to cover potential future losses.

These extreme changes in requirements not only focused the mind, they also highlighted the difficulty in forecasting margin requirements. In cleared derivatives markets, central counterparties collect initial margin to protect themselves against price risk in a situation of default. They also collect variation margin as price changes affect the value of outstanding positions. Each CCP has its own margin calculation methodology, and although there are similarities in these methodologies, how they respond to market conditions can vary significantly.

In this article we consider the impact of recent price volatility on four examples of commodity futures traded on different markets. As the examples show, the CCP margin models react differently to market conditions, which means that forecasting margin requirements requires a deep understanding of the methodologies involved.

It is not just forecasting that is important. Firms need to be aware of the margin they are paying and how it could be impacting their bottom line. Initial margin algorithms tend to be considered as “black box”, with most being portfolio-based and therefore not attributed back to individual trades or strategies. But as our analysis shows, there are moments in time, particularly when prices are falling rapidly from previous highs, when margin requirements can be greater than the value of the individual position.

Analysis

Below we look in more detail at how requirements have changed for a range of commodity futures across multiple exchanges and CCPs and we discuss the reasons behind some of the levels of increases that have been seen. The selected products are:

- Dutch TTF gas at ICE Endex

- High open interest - it is generally seen as the benchmark contract for European gas

- The contract saw extreme volatility in 2022 following the Russian invasion of Ukraine

- German power at European Energy Exchange

- Liquidity in the contract has seen financial speculators becoming more involved

- The contract is inherently volatile, with prices impacted by both supply and demand

- Ercot power at Nodal Exchange

- Ercot, which stands for the Electric Reliability Council of Texas, is one of the seven regional grid operators in the US.

- The contract can be subject to extreme volatility, as was seen during the 2023 heatwave in Texas

- Soybean oil at CME

- The contract is highly liquid with significant open interest

- Although it is based on an agricultural commodity, there is growing use of soybean oil as a feedstock to produce biodiesel as part of the move towards renewable energy.

The majority of this analysis concentrates on the margin requirements for the front month contract, therefore taking both volatility and seasonality into account. In some cases we have considered other data, for example how the margin for a given expiry changes over time as well as comparisons of equivalent products at different CCPs.

ICE TTF Dutch Gas

The ICE TTF base future contracts are for physical delivery through the transfer of rights in respect of natural gas at the Title Transfer Facility (TTF) Virtual Trading Point, operated by Gasunie Transport Services. Delivery is made equally each hour on every day of the expiry month.

Open interest is shared between ICE and EEX and both contracts are considered under MiFID II as critical or significant commodity derivatives and therefore subject to position limits. Deliverable supply is estimated at over 150 million MWh, with trading limits set at around 15%, or 20 MWh. Overall open interest at ICE is over 1 million lots going out in time for more than a decade.

The contract has seen significant volatility over the past four years, particularly following the Russian invasion of Ukraine. Europe's decision to forego Russian gas supplies was met with fears of gas shortages during winter 2022. However, a warmer-than-expected winter dramatically changed the situation. leading to lower demand for, and higher inventories of, gas in European countries. The mild winter alleviated fears of gas shortages and reduced the need to refill storage in the summer of 2023.

With less demand, and more gas available, there was downward pressure on gas prices, with lower prices encouraging more consumption during the summer, as it was cheaper to use gas than other forms of energy. After breaking the €140 per megawatt hour mark in December 2022, July 2023 futures prices trended downward to just above €40. Since then there has been a slight decrease in prices, but they are still at around €30 per MWh, an increase of around 50% on pre-invasion levels.

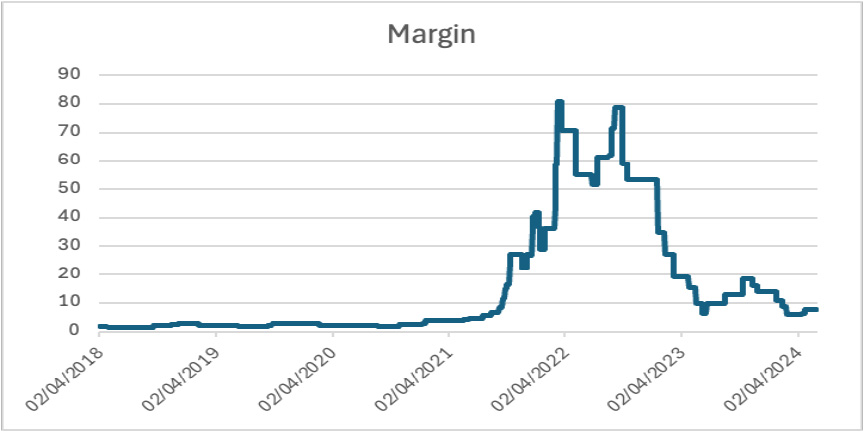

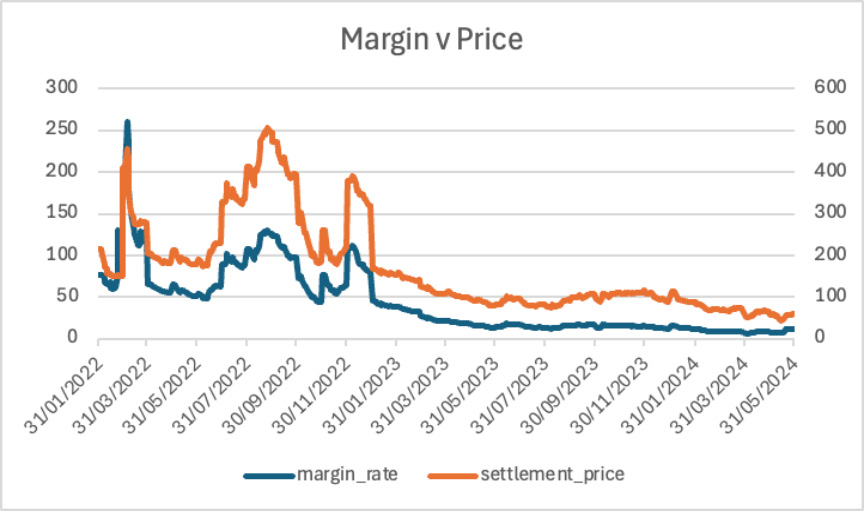

This volatility followed by an overall increase in average prices has had an impact on initial margin requirements as can be seen in the chart below:

The initial margin for the ICE TTF contract is calculated using IRM 1, ICE’s SPAN-based methodology. From 2018 until the Russian invasion of Ukraine, there was very little change in initial margin levels, even during the stress caused by Covid. However, immediately following the events of March 2022, there was a significant spike in requirements. In fact, between the lows of 2018 and the highs of 2022, there was a 60-fold difference in margin levels.

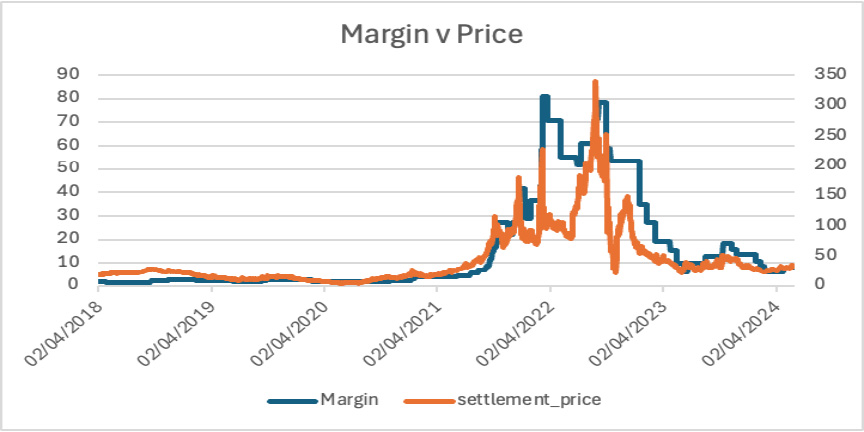

It is interesting to compare initial margin with prices to see how the latter impact the former:

As can be seen, although the prices and margin requirements generally move in line with each other, there is not a direct correlation. Large rises or falls in prices do not necessarily correspond with similar changes in initial margin. In fact, when comparing margin requirements as a percentage of contract value there is huge variation, from a minimum of 4.5% to a maximum of 240%.

With increases in volatility, margin rates usually tend to go up. However, with the downward pressure on gas prices, CCPs lowered the initial margin requirements for gas futures to account for the lower price levels. Some of the largest decreases in margins occurred because the requirements were becoming an unacceptably large percentage of the future price.

Not all CCPs use the same analysis to determine their initial margin rates, although they are all generally aiming to cover the same level of risk. Dutch TTF natural gas futures are available for trading on Nymex, ICE and EEX. Although the margin levels will be relatively similar, the cheapest CCP can vary. For example one CCP may take a more cautious approach to the risks of a position approaching delivery.

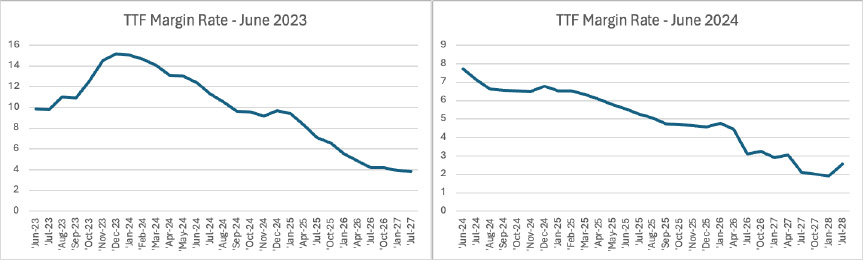

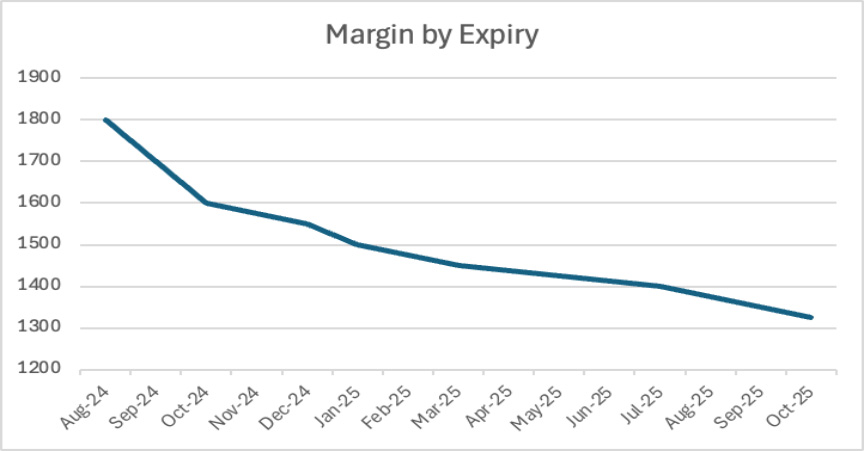

The previous analysis was for a single expiry. It is also possible to see how the requirement for each contract changes depending on the time to expiry:

Although the general trend would be for margin to increase as positions come closer to expiry, in June 2023 there was a margin premium to be paid for trading winter fuel. By summer 2024 the pattern of margin differences based on expiry was more as expected, with margin increasing as contracts moved towards expiry, although still with some increases based on the season.

EEX German Power

The EEX German power future is a cash-settled contract based on the average spot market price for future delivery periods provided by the EPEX day-ahead market. Contracts are available for base or peak load, with maturities covering day, weekend, week, month, quarter and year. It is the most liquid contract for European power, and 2024 has seen a significant increase in trading meaning further available liquidity.

The German power market has a capacity approaching 250 GW. Local regulations and incentives drive the industry towards greener energy in the form of nuclear and renewable power. Overall open interest at EEX sits at around 1 million lots, most of this concentrated in the front 3 months of the base contract.

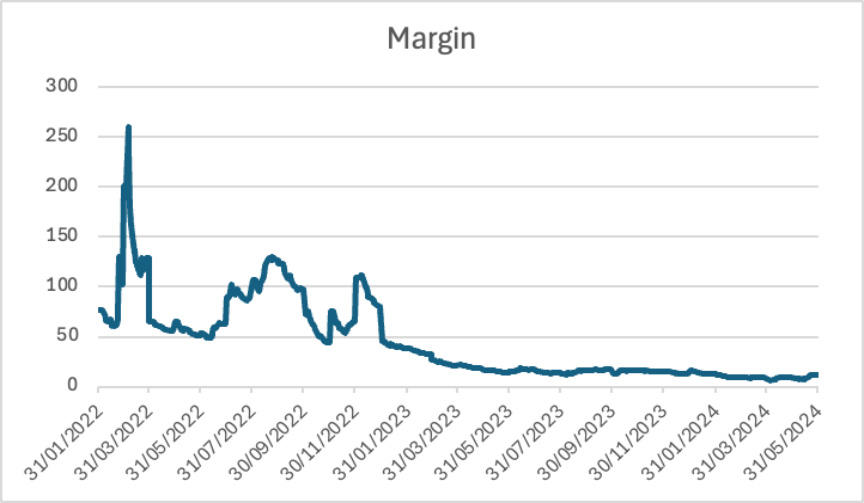

German power saw large increases in prices immediately following the Russian invasion of Ukraine. However, prices fell quickly thereafter. Prices saw further volatility in the second half of 2022 and the beginning of 2023, but have now settled at relatively low levels.

This price volatility impacted the level of initial margin. For instance, initial margin requirements increased 275% at the beginning of March 2022.

The EEX German Power Base future contract is cleared by European Commodity Clearing (ECC), which is responsible for setting the margin requirements. It uses a modified version of SPAN as its margin methodology for EEX contracts, although it is planning to move to the Eurex Prisma VaR-based methodology in the future. As can be seen, when comparing margin with price there is a very close correlation, although initial margin as a percentage of contract value does vary slightly.

Nodal Ercot Power

The North American power market consists of numerous distinct locations. Cash-settled futures and options are offered on many of these by Nodal Exchange. Its contracts are based on the trading on the Regional Transmission Organization / Independent System Operator (RTO / ISO) Day-Ahead and Real-Time markets.

The Nodal Exchange lists contracts for peak and off-peak power at commercially significant hubs, zones, and nodes in the following electric markets: ISO-NE, NYISO, PJM, MISO, Ercot, SPP and CAISO, as well as Mid-C. For this analysis we looked at the peak Ercot future.

Ercot manages the production and flow of electricity to more than 26 million Texas customers amounting to around 90% of the state's total electricity demand. The company coordinates the electricity output from more than 1,100 generating resources and 52,700 miles of transmission lines in the region. Peak demand can be over 80,000 MW. Power generation methods continue to evolve, with new wind and solar resources being added to the existing natural gas and coal generators.

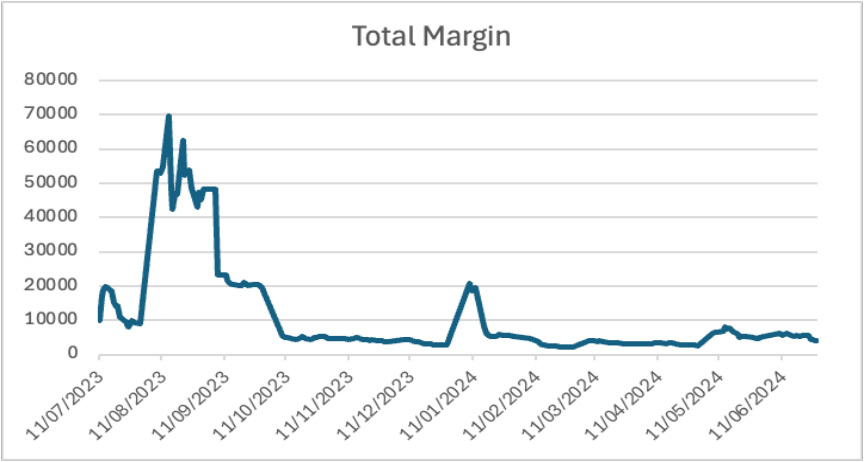

As can be seen, initial margin spiked in August 2023. Texas saw the hottest year ever recorded with average summer temperatures of over 85 degrees. Many places also saw record numbers of days with temperatures over 100 degrees. This inevitably led to increased power consumption to run air conditioning.

Other factors also contribute to price volatility in these markets, in particular the ageing infrastructure and lack of storage to meet peak demand. This is compounded by the increased reliance on renewable energy, such as solar and wind, where supply can be unpredictable in unusual weather conditions. This can be seen in the additional price spikes seen in January 2024.

As with the ECC requirements that apply to the German power futures at EEX, margin and price closely track each other. This is because of the Expected Shortfall-based methodology used by Nodal’s clearinghouse for calculating initial margin.

CME Soybean Oil

Soybean oil is increasingly used in the production of biodiesel. According to the US Department of Agriculture, roughly 40% of US soybean oil production is channelled into fuel production. As a result, the soybean oil futures market is attracting fuel producers that use the futures to hedge their input costs.

CME soybean oil futures are based on physical delivery of 0,000 pounds of the underlying. 15 monthly contracts are listed for Jan, Mar, May, Aug and Sep, while 12 monthly contracts are listed for Jul, Oct and Dec (listed annually following the termination of trading in December). Open interest at CME is currently around 500,000 lots, with 50% of this concentrated in the December contract and with a total value of around $12 billion.

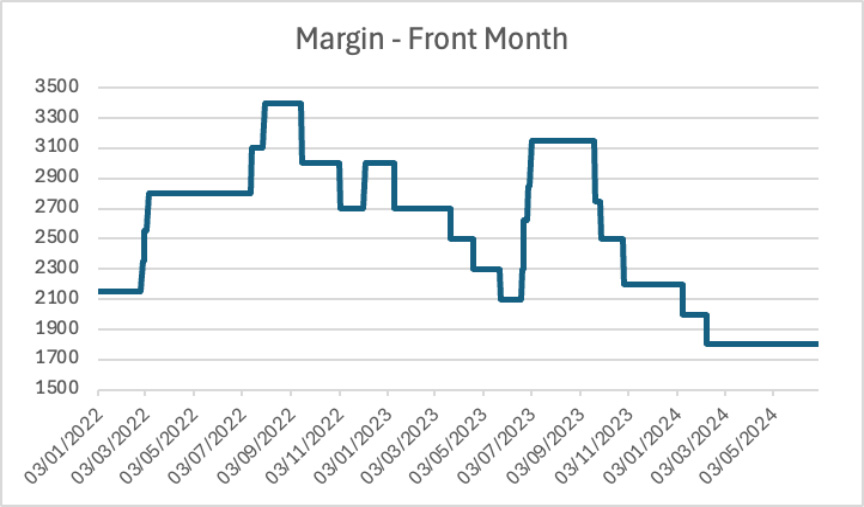

The chart below shows how variable the initial margin has been over the past couple of years:

Although traded alongside many energy products, soybean oil is an agricultural product, and therefore the original SPAN margin algorithm still applies, unlike the energy products that CME has moved to SPAN 2, its VaR-based algorithm. This can be seen in the step changes in margin requirements.

The maximum initial margin, seen in summer 2022, is almost double the level of requirements that are currently being charged, with margins seeing continuous fluctuation in between.

From the chart above it can be seen that some of the reduction in margin is because prices are currently lower than those seen in 2022. However, price is not the only factor affecting margin levels. For the increases in requirements seen in summer 2022 it was the combination of large falls in prices and increases in volatility that fed into the increases in initial margin.

Margin as a percentage of value has also fluctuated over the same period, moving from around 5% as a minimum to nearly 10% as a maximum. However, it has not reached the same extremes as energy contracts where at times margin has been greater than value.

It is also interesting to see how margin varies depending on expiry. As the chart above shows, there is a relatively steady increase in margin requirements as a contract moves towards expiry, with front month initial margin being around 40% higher than later expiries.

Conclusion

As can be seen from the examples above - all contracts that in their own way are key to the energy markets - it is not easy to predict how prices will affect initial margin.

The last few years have seen some predictable, but some less expected impacts on margin and treasury. The additional volatility has highlighted quirks in the way that the margin algorithms react to different market conditions. In particular we have seen that:

- Large price moves don’t always impact margins, and large margin changes aren’t always caused by price moves

- Despite being designed to cover the same level of risk, there can be large differences in margin requirements based on different methodologies

- In general, front months are subject to higher levels of initial margin, but this isn’t always the case, particularly for seasonal contracts.

Commodities often see much larger changes in margin than other products. They are prone to larger price changes and higher volatility; this is especially true for power and gas contracts. Margin requirements also tend to be a higher percentage of value than that seen for other products. And this means that commodity firms can be exposed to high financing costs in order to meet margin calls.

Global regulators have observed these trends and have called for greater transparency into margin models. As one recent official report [1]concluded, greater transparency into the models used to calculate margin for these products would greatly improve the ability of firms to predict future liquidity needs.

Currently, the level of transparency provided is varied. Whilst some CCPs publish details of their methodologies, others provide only high-level information. The tools provided by the CCPs to replicate margin also tend to be limited in the functionality that they provide, with most acting solely as a current day what-if calculator.

Understanding why and when margin changes are likely to occur is key to avoiding liquidity issues, but this is only possible with in-depth knowledge of the multiple initial margin algorithms involved. A continued effort to increase transparency and the implementation of more advanced tools are key to achieving this.

[1] Transparency and responsiveness of initial margin in centrally cleared markets: review and policy proposals (bis.org)

Joanne Burnham is risk and margin subject matter expert at OpenGamma, covering quantitative solutions for central counterparty risk management for cleared derivatives. She has more than 25 years of experience in CCP risk and margin methodologies.