With more and more electric cars on the road, futures markets are taking a closer look at battery metals, particularly copper, nickel, cobalt, and lithium.

There are already well-established futures markets for copper and nickel, but cobalt and lithium are new on the scene, with several exchanges listing futures on these two metals in recent years.

Although it is still early days for this new sector of the metals markets, CME has emerged as the leading trading venue, at least outside China. The Guangzhou Futures Exchange, a brand-new exchange on the Chinese mainland not far from Hong Kong, has seen massive trading volume in the lithium futures it launched last July, but prices have been extremely volatile and most of the volume appears to be driven by speculative interest, rather than commercial hedging.

The London Metal Exchange, which has long served as the main venue for price discovery and risk transfer in industrial metals, has listed futures on cobalt and lithium, but so far neither has gained much of a following.

That leaves CME. It launched its first cobalt contract in 2020, added a lithium contract in 2021, and then added a second cobalt contract and a second lithium contract in 2023.

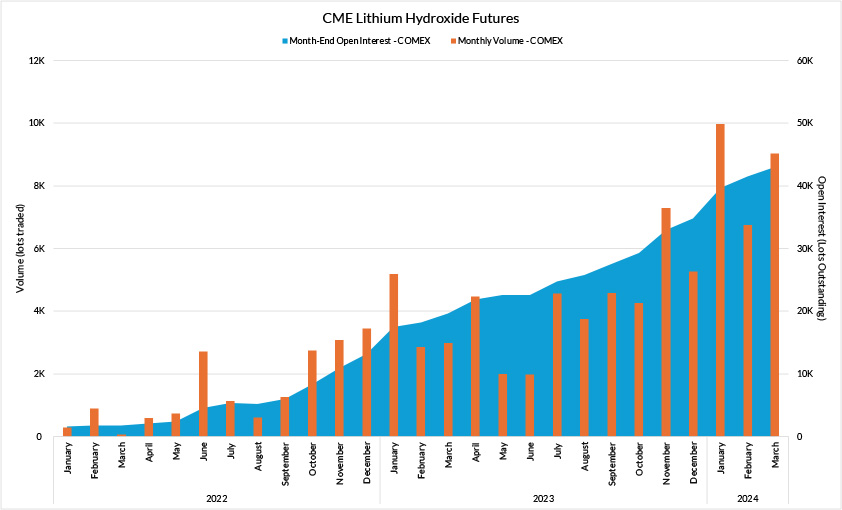

Cobalt was the first to gain traction, but trading interest in lithium hydroxide futures has surged over the last 12 months. Although volumes remain small compared to other industrial metal futures, the battery metals contracts have begun to attract interest from both commercial hedgers and financial institutions, and open interest – which measures the total amount of outstanding positions – has been rising steadily.

CME had been waiting to find the right moment to launch the contracts for some time, according to Jin Hennig, CME's global head of metals. Battery metals were “a market that we had been actually monitoring for almost a decade, but just like anything in the derivatives world, if you don’t have enough of a spot market established, it’s always difficult to have a futures market associated with it,” she explained.

"At the end of the day, you also need to have the market to be ready with you – enough hedging needs and risk management tool needs, enough interest from the buyers as well as the sellers,” Hennig said.

Futures trading accelerates

Despite the fact that cobalt has an active spot market, the contract took six months to start building momentum.

Lithium, on the other hand, took off right away, and has continued to accelerate. Speaking to MarketVoice in May, Hennig said year-to-date volume had already surpassed total volume in 2023. The number of outstanding contracts hit a record high in the first quarter of 24,328, and interest extends out to September 2025.

"The key to that success, I think, has really got to do with the growing awareness of hedging activity in these markets, and demand for more products that cater to the needs of the battery supply chain,” she explained.

Although scientists are experimenting with batteries that don’t use lithium, Hennig believes lithium will continue to be a key ingredient for some time. “Lithium is going to continue to be one of the major ingredients per battery and of the cost structure of the battery,” she said.

One battery scientist agrees. Jeff Dahn, Professor Emeritus of Physics and Professor of Chemistry at Canada's Dalhousie University and a pioneer in lithium-ion battery technology, said lithium is an attractive battery ingredient because its small atomic size allows it to diffuse rapidly, making it possible to create “batteries with high voltage and high energy density that can be recharged many, many times.”

Lithium is relatively plentiful and can be found in a variety of places, particularly China, Argentina, Chile, and Australia. It is typically extracted in two ways, either from brine in salt flats or from lithium rock deposits. Various enterprises, including Tesla and several oil and gas companies, are reportedly looking to join current lithium extractors.

However, while supplies of lithium are increasing, the electric vehicle market is still young and growing in fits and starts, making the price a little choppy.

Hennig said CME’s lithium market attracts a broad range of participants. In addition to industrial users looking to hedge their risks, some traders are beginning to see opportunity in the growing market. For investment banks and institutional investors looking for exposure to lithium prices, CME's futures contract is an efficient and easily accessible alternative to buying shares in lithium mining companies or transacting in the physical market for lithium.

For example, the commodity strategy team at Citi has begun tracking the CME contract and recommending trading strategies based on the outlook for lithium prices as well as the spreads between nearby contract months and more distant months. In April, the team recommended that producers and investors sell the August lithium futures contract to benefit from the downtrend in prices for physical lithium. In May, Citi followed up with a recommendation to sell the December lithium contract to profit from the market’s contango structure as well as further declines in the spot price.

Falling prices, rising demand

Most analysts believe demand for lithium will continue to grow in the near future. One in five new cars sold worldwide in 2024 is expected to be electric, according to the International Energy Administration. The EV share of those 17 million new cars is expected to reach 45% in China in 2024, 25% in Europe, and 11% in the US, and the IEA expects those percentages will continue to grow in the coming years.

Fastmarkets, the commodity data provider, estimates that in the US alone, demand for lithium for electric vehicles will grow at a compound annual growth rate of 29% between now and 2030. A key factor is the rapid growth in the development of battery electrode and cell manufacturing plants in the US. In an April report, Fastmarkets noted that there are more than 40 very large "gigafactories" planned or under construction. If all of those facilities are completed, annual production capacity will more than triple from current levels.

A key factor driving these forecasts is the expectation that the price of EV batteries will continue to decline. Goldman Sachs forecast in November 2023 that battery pack prices will fall below $99 per kw hour by 2025. The $99 figure is significant, in Goldman’s view, as it is roughly the point where the total cost of owning an electric car versus a car with an internal combustion engine will reach parity, even without tax subsidies.

Once it passes that point, Goldman forecasts battery prices will continue to sink 11% per year through 2030, with half of the drop coming from declining prices for raw materials, including lithium. Goldman expects that decline will further accelerate electric car sales.

Goldman expects the per-ton price of lithium carbonate to fall to $13,377 in 2024, and lithium hydroxide to fall to $14,263, continuing their long steep drop from around $70,000 per ton for both varieties two years ago.

Battery makers’ demand for lithium reached 140 kt in 2023, 85% of total lithium demand, and 30% more than 2022, according to the IEA. But supply and demand haven’t always moved in sync. Rising metals cost in 2022 led to a 7% price increase in battery packs over 2021 but then the price slid nearly 14% in 2023.