FIA survey shows clearing firm leaders predict higher volatility and rates complex will drive growth

Until recently, the outlook for the derivatives clearing business was cloudy at best. Volatility was low, trading volumes were down, and regulatory burdens were up. Most importantly, the banks that dominate this business had to absorb a massive increase in the cost of providing clearing services due to the implementations of new capital standards.

To get a sense for the major trends facing the industry, FIA conducted a survey of the major clearing firms. We focused on the executives who run the clearing business and asked them for their views on the outlook for the listed derivatives business.Times have changed. The number of new regulations has slowed down and trading volumes have picked up. Ten years after the financial crisis that triggered a global wave of regulatory reforms, the listed derivatives markets appear to be poised for growth. Nevertheless, capital requirements continue to weigh on the business and new challenges have emerged.

Nineteen firms responded. Eight are based in the Americas, seven in Europe, and four in Asia-Pacific. The respondents included 12 clearing firms that are part of banking organizations. These 12 firms provide clearing services in multiple parts of the world, giving them a global perspective on the industry. Seven of the respondents were non-banks that were selected on the basis of their size and importance, as measured by the amount of customer funds held in the U.S. and the number of clearinghouses to which they belong. Most of the respondents in both groups have been in the business for more than 10 years, giving them a long-term view on the trends shaping the industry.

Outlook for the Markets

The respondents generally had a positive outlook for the listed derivatives markets. A majority, 74%, said they were either somewhat optimistic or very optimistic.

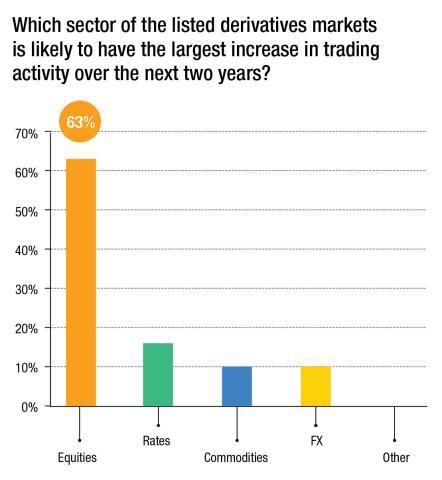

We asked which asset class offers the brightest prospects for growth over the next two years. Nearly two-thirds said they expect the biggest growth to come in the rates sector. Last year the trading of interest rate futures and options picked up dramatically as central banks began raising interest rates. The survey responses suggest that top clearing firm executives are expecting this trend to continue and possibly even accelerate.

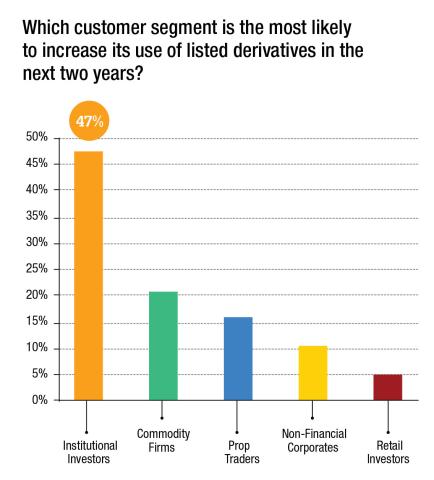

We also asked which customer segment was most likely to increase its use of listed derivatives over the next two years. Three segments were cited the most often: institutional investors, commodity firms and proprietary trading firms. At the opposite end of the spectrum, the retail segment was generally viewed as the least likely to increase its use of derivatives.

There was, however, a noticeable difference in perspective between bank and nonbank clearing firms. Two-thirds of the bank executives picked institutional investors as being the customers most likely to increase their use of listed derivatives. The non-bank executives, on the other hand, split their votes equally among three customer segments: non-financial corporates, commodity firms and prop traders. This divergence in opinion most likely reflects differences in their customer bases and business models.

Growth Drivers

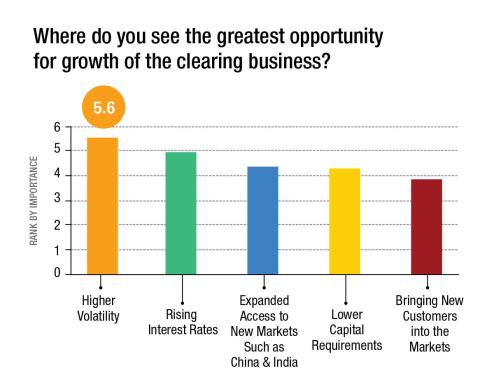

We asked the executives to dive deeper into the reasons for their positive outlook by identifying the factors that they expect to drive increased clearing. The two most frequently cited factors were higher volatility and higher interest rates. Volatility in many asset classes has been unusually low until recently, and a sustained increase almost certainly would drive more business activity. As for interest rates, rising rates typically triggers a wave of trading as hedgers and speculators adjust their positions. Trading of interest rate futures and options accounts for 16% of the total volume on derivatives exchanges worldwide and a much higher percentage on the major exchanges in the U.S. and Europe, so growth in this sector would have a powerful effect on the clearing business.

Bank executives cited two other factors that they expect will drive increased clearing: a reduction in capital requirements, which would reduce their costs, and expanded access to new markets such as China and India. The first is more of a hope than a prediction; banking regulators have promised to study the impact of the Basel III capital requirements on the cost of clearing but there is no consensus yet on what changes will be made. As for the expanded access, this mainly reflects recent moves in China, where the authorities have encouraged international participation in the trading of futures on crude oil and iron ore.

Nonbank executives agreed that expanded access to new markets has potential, but they did not put a high rating on lower capital requirements. Instead they said they saw more opportunity for growth by bringing new customers to the listed derivatives markets.

Another important difference between these two types of clearing firms was in their views on the introduction of new contracts. Respondents from the bank clearers generally saw this as the least important driver for increased clearing, whereas the nonbank clearers were more optimistic, with several giving this a fairly high rating. That may reflect the ability of nonbanks to enter new markets more quickly, as shown with the introduction of cryptocurrency futures in the U.S. late last year.

Challenges Ahead

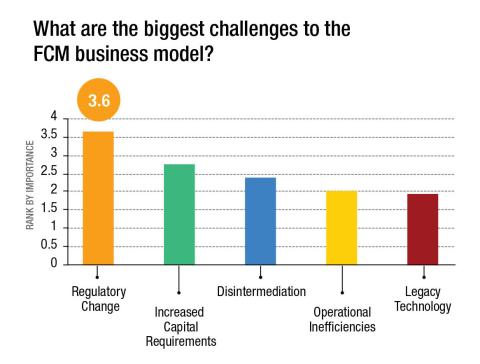

Two issues stand out as the biggest challenges facing the clearing business: capital requirements and regulatory change. That will come as no surprise for people who have been following the recent history of the industry, but all the same, it is striking to see how strong the consensus was. Twelve of the clearing firm leaders put regulatory change as the top one or two challenges facing the industry, while eleven put capital as the top one or two challenges.

This reflects the impact of the Basel III capital requirements have had on the banks that provide clearing services. The way that these standards treat derivatives, and in particular the treatment of the collateral that customers post to meet margin requirements, has changed the economics of the business and caused several banks to reduce their clearing services or get out of the business altogether.

As for regulatory change, the implementation of Dodd-Frank in the U.S. and EMIR and MiFID II in Europe have changed the rules of the game in ways large and small. The sheer number of changes to the rulebook has forced clearing firms to make huge investments in their compliance processes. The regulatory changes also have affected the trading venues that the clearing firms do business with, even to the point where some exchanges have moved contracts to a different continent to avoid new regulations.

Another important challenge is in the area of risk management. The survey found that a large number of firms view real-time risk management as one of the top operational challenges facing clearing firms. This reflects the fact that today's trading environment is operating at sub-millisecond speeds and clearing firms need the ability to monitor their client's positions in close to real-time. Waiting until the end of the day, the way the business used to work, is simply too risky.

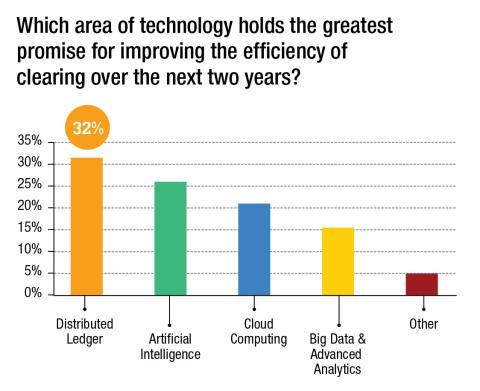

Turning to technology, we listed some of the new technologies emerging in financial services and asked which of these is likely to have the biggest impact on the efficiency of clearing. On this question there were no clear winners; 32% of the respondents said distributed ledgers, 26% said artificial intelligence, 21% said cloud computing, and 16% said big data and advanced analytics.

Priorities for Clearinghouses and Regulators

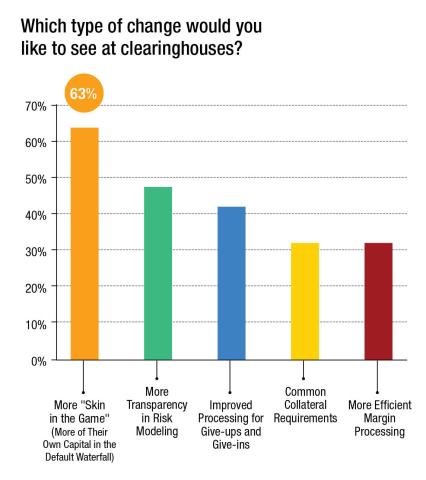

For our final round of questions, we asked the clearing executives to tell us what changes they would like to see at the clearinghouses that sit at the center of the listed derivatives markets. At the top of their list was more “skin in the game,” i.e., a larger contribution to the resources that cover any losses in case of a default. The bulk of those resources come from members, and 63% said they would like the clearinghouses put more of their own capital into the waterfall.

The second most frequently cited request was more transparency into risk modelling. This reflects a need for better understanding of the process by which the clearinghouses set their margin requirements. Clearing firms have to collect that margin from their clients, and having more transparency into the risk modeling puts the firms into a better position to anticipate those requirements.

The third most frequently cited request was improved processing for give-ups and give-ins. In the listed derivatives markets, it is common practice for clients to use one broker for execution and another for clearing. In that type of situation, trades have to be “given up” from one firm to another. This process does not always work smoothly, however, and clearinghouses are well positioned to support operational improvements.

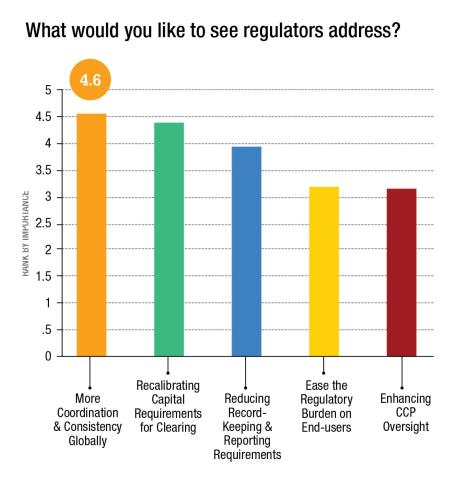

We also asked the clearing firm executives for their opinions on what changes they would like to see in the regulatory environment. At the top of the list was more coordination and consistency globally. This reflects one of the biggest problems facing the industry today—the differences in the rules from one jurisdiction to the next. These differences create huge headaches for firms that are trying to operate on a global level.

The bank executives among our respondents also put recalibrating capital requirements very high on their wish lists. Four respondents singled out the leverage ratio and its treatment of client collateral as a particularly onerous part of the capital requirements. As one person commented, regulators should recognize that client collateral is a pass-through and should not make it the driver for capital requirements.

The nonbank executives showed less concern about capital requirements, and instead put more emphasis on easing the regulatory burden on end-users and enhancing clearing oversight. For the nonbank firms, these two changes were just as important as achieving global regulatory coordination and consistency.