The rapid development of artificial intelligence is spurring many firms in the global derivatives markets to look for ways to deploy this new technology. In this article, executives from two technology companies point to risk management as an area where AI can have a transformative impact. In their view, AI can improve the ability of clearing brokers and their clients to analyze market data more efficiently and manage risks more effectively. They see AI as "the risk manager's assistant", sifting through thousands of data points to find potential issues. They also cite a specific example of a clearing broker that is deploying AI in risk management and using it to proactively identify risk before it materializes.

Clearing brokers are the backbone of the global exchange-traded derivatives markets. They process trades in futures and options for their clients and collect margin to cover the risk of loss on those positions. Managing market risk effectively is therefore critically important to every clearing broker.

A typical day for a risk manager is filled with constant vigilance. Every client account has its own risk profile, influenced by factors like market exposure, margin requirements, and trading volume. Even the most stable portfolio can be quickly disrupted by interest rate decisions, economic reports, or geopolitical announcements.

Staying on top of all these variables requires real-time data and timely insights to prevent breaches of risk thresholds, ensure that adequate margin is on hand, and avoid significant losses. In the past, this meant spending countless hours manually reviewing data, interpreting market conditions, and anticipating how events might impact different accounts. Delayed or incomplete data could lead to missed opportunities or, worse, unmanaged risks.

AI has the potential to revolutionize this process by allowing risk managers to focus on decision-making rather than data gathering. AI can continuously consume real-time data from market movements, economic news and account positions, and then deliver focused, actionable insights to risk managers before a potential issue escalates.

AI: The Risk Manager’s New Assistant

Imagine starting the day with a full view of all client portfolios, with values updated with the latest prices, and instantly knowing which accounts are closest to breaching their risk limits. With AI, risk managers do not need to manually sift through thousands of data points to find potential issues. Instead, the system does it for them—analyzing risk profiles, identifying vulnerabilities, and highlighting them for immediate attention.

For example, current systems are capable of generating an intraday alert on margin requirements due to market fluctuations. An AI-enabled system can go beyond a simple notification by analyzing historical patterns, account-specific trading behaviors, and broader market conditions in real time. This added layer allows AI to not only flag accounts at immediate risk of margin calls but also to anticipate potential vulnerabilities before they materialize. By providing these enriched, context-driven insights, AI enables the risk manager to proactively address exposures and adjust risk limits.

Let’s say a major market event is on the horizon—an OPEC meeting, a central bank interest rate decision, or a key economic report. AI systems can automatically detect these events, analyze historical data to forecast potential impacts, and highlight which accounts are most exposed.

For example, suppose a risk manager is overseeing several accounts with large positions in the oil market. Within seconds after an OPEC announcement, an AI-enabled system can forecast potential losses based on historical patterns around previous OPEC announcements. That allows the risk manager who receives this forecast to take proactive steps, such as adjusting margins or notifying clients about the increased risk.

This is a crucial shift. Instead of reacting to events after the fact, AI gives risk managers the ability to anticipate and prepare for market disruptions well in advance. Whether it's reallocating resources or tightening risk controls, they can act promptly with the confidence that real-time, data-driven insights back their decisions.

AI in Day-to-Day Operations of a Global Clearer

R.J. O'Brien is an example of a clearing broker that is adopting AI to enhance its risk management toolkit. RJO, the largest independent futures broker in the US, serves more than 80,000 clients globally. The firm offers 24-hour trade execution on every major futures exchange worldwide and held more than $5.6 billion in customer funds as of August 2024.

Brad Giemza, RJO's chief risk officer, says the firm's AI strategy is built on three key pillars: improving data quality, educating staff on AI, and leveraging AI for advanced decision-making.

First, the use of AI for high-value decision making requires high quality data that is organized in a way that allows generative AI technologies to retrieve that information with accuracy and consistency. Giemza says RJO is rapidly improving its data collection, storage and stewardship of information.

Second, RJO has introduced Copilot for Microsoft 365 to familiarize and educate staff on AI and enable them to harness its capabilities effectively in their daily tasks. Copilot is an AI-powered digital assistant that can help with a variety of tasks and activities. Giemza says RJO now has more than 200 colleagues around the world using Copilot.

Finally, RJO is introducing AI for advanced risk management decision-making, allowing risk managers to anticipate and mitigate potential risks more effectively by providing real-time, data-driven insights. For instance, Giemza says the firm has new behavioral alerts that notify risk managers if a trader who normally trades between 8 am – 2 pm starts to trade in the evening.

"By integrating these AI-driven strategies, RJO aims to enhance its operational efficiency, improve decision-making processes, and maintain its competitive edge in the rapidly evolving financial markets," says Giemza.

The Future of Risk Management with AI-Driven Innovation

At Cumulus9, we have built a state-of-the-art system for analyzing the models used by clearinghouses to compute initial margin, variation margin and options premium.

We are now focusing on the development of tools that will redefine how risk managers monitor and mitigate risk. By integrating AI-driven insights into daily workflows, Cumulus9 is set to empower risk managers with faster, more proactive decision-making capabilities.

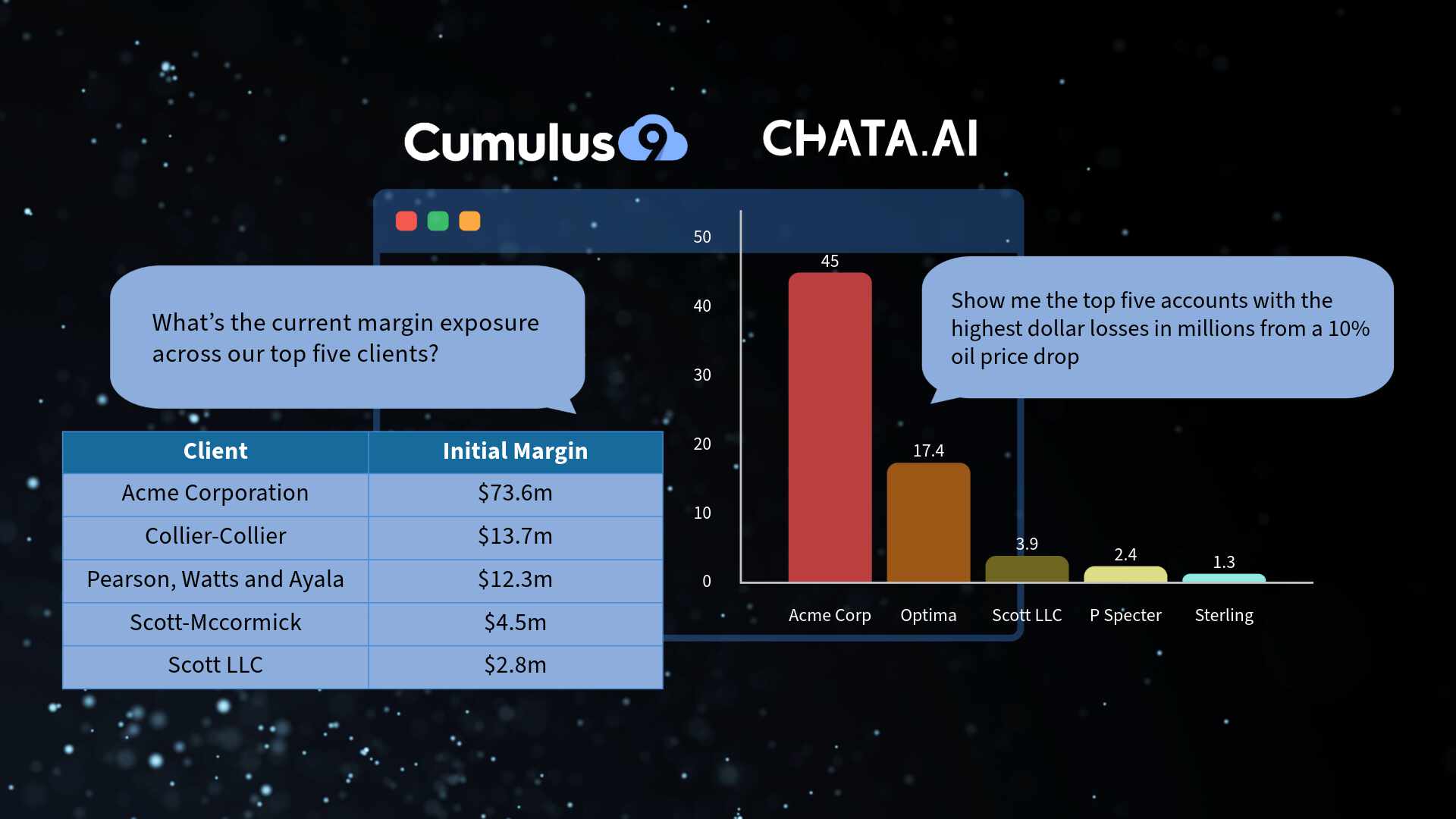

A key part of this transformation is Cumulus9’s collaboration with Chata.ai, a leader in self-service proactive analytics. This partnership will allow risk managers to interact with complex data using simple, natural language queries.

With Chata.ai’s self-service analytics embedded into Cumulus9’s risk management platform, risk managers will no longer need to depend on data analysts to generate custom reports and data requests. Instead, they will be able to ask straightforward questions and receive comprehensive, AI-driven insights in real time. Risk managers are also empowered with the same interface to set up custom data alerts within Cumulus9 for a more proactive experience to risk.

Here’s how it is going to work in practice: A risk manager will be able to ask, “What’s the current margin exposure across our top five clients?” or “Show me which accounts are most vulnerable if the market drops by 10%.” Within moments, Cumulus9’s platform, powered by Chata.ai’s natural language processing, will deliver detailed reports that break down risks in an easy-to-understand format. This instant feedback will enable risk managers to stay ahead of potential issues without needing to dive into complex datasets or wait for end-of-day reports.

This collaboration is designed to make interacting with advanced risk analytics as intuitive as asking a question. Cumulus9’s AI-powered tools, combined with Chata.ai’s self-service interface, will allow risk managers to focus on high-value decision-making.

As AI continues to evolve, this type of seamless integration will be essential for firms looking to stay ahead of market risks and move from reactive to proactive risk management strategies.