India has gone from a small player in the equity derivatives market to the world’s largest within just five years. Much of this growth followed the introduction of weekly-expiring contracts in 2019, replacing the traditional month-end expirations.

According to FIA data, more than 36.8 billion equity index options were traded on India’s two main derivatives exchanges, the National Stock Exchange of India and BSE India, in the second quarter of 2024. This represented more than double the volume traded in Q2 2023 and more than two-thirds of all futures and options traded on every exchange around the world.

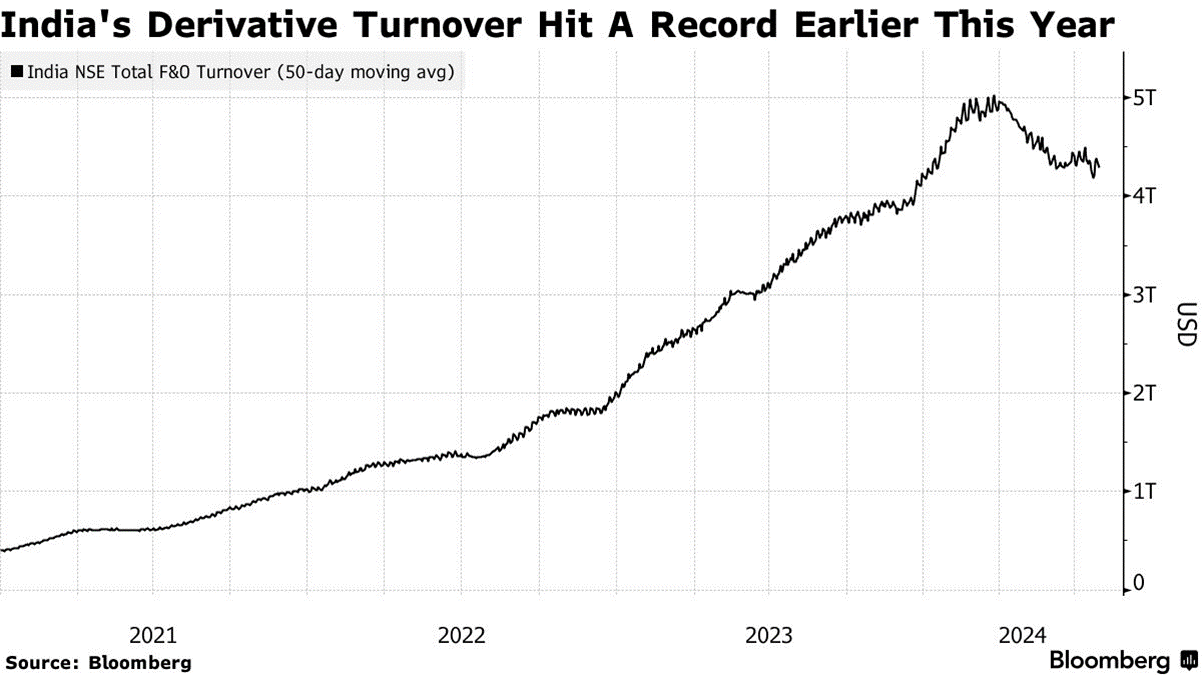

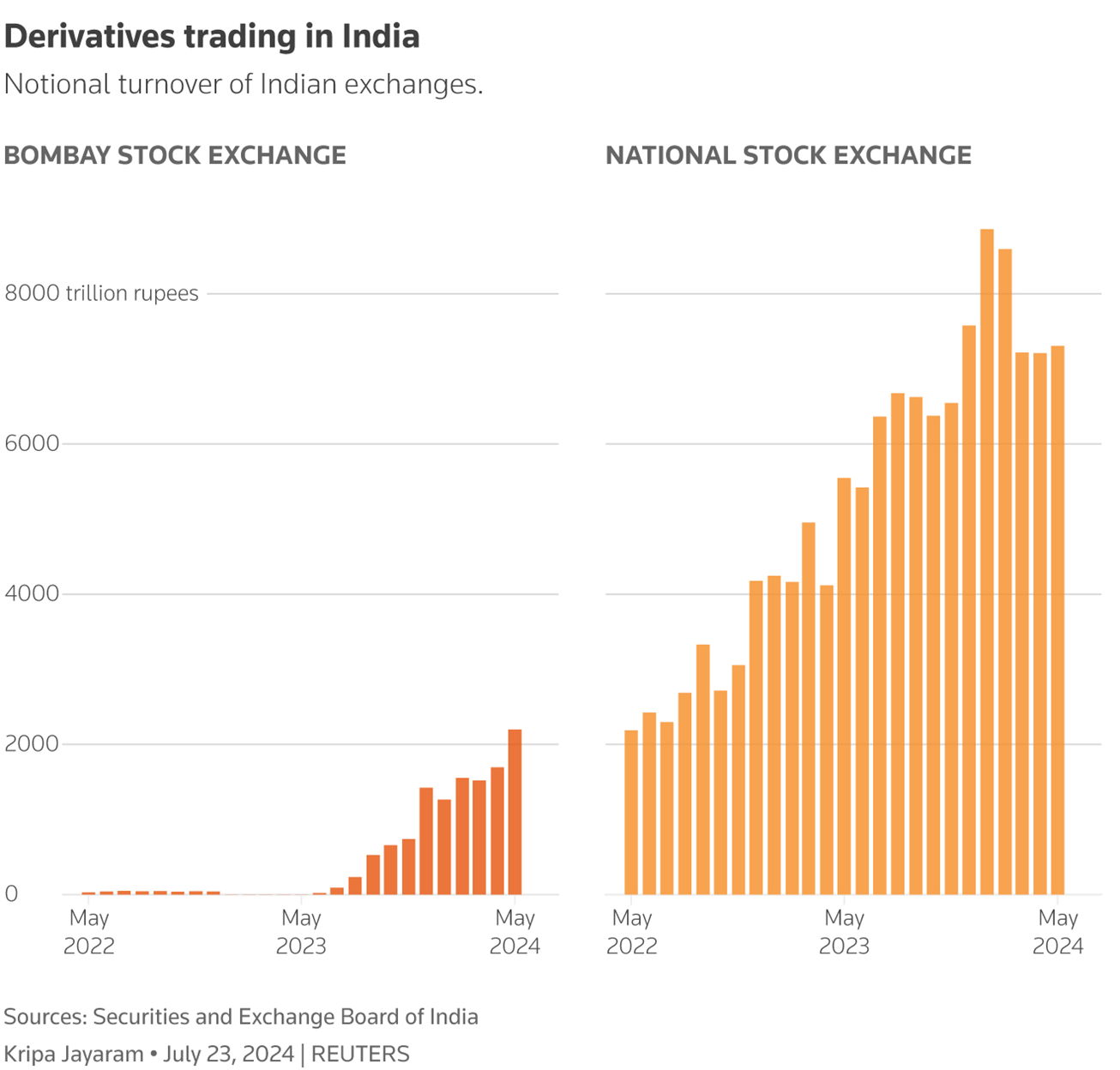

As reported by Bloomberg, the notional turnover in futures and options trading in February reached $6 trillion before easing recently. This was a six-fold surge since the start of 2022. The vast majority of that turnover came from trading on NSE, as demonstrated in the chart below, which has experienced extremely rapid growth in the trading of its equity index options.

Regulators are increasingly concerned about the potential danger to financial stability and the risks arising from this explosive growth.

What is behind the surge in growth?

Much of the demand in Indian equity futures and options comes from retail investors. Their share of derivative trading volumes has risen from 2% in 2018 to 41%, according to the Securities and Exchange Board of India (SEBI), the country’s financial regulator.

The coronavirus pandemic spurred a swell in interest for these products as millions of people worked from home. A booming Indian stock market, the spread of mobile trading apps, the ease of opening an account and the proliferation of how-to-trade content on social media fuelled trading further.

With equity futures and options, retail investors can place speculative bets on moves in share prices without having to put up large amounts of money. They only need to pay for the contract – sometimes costing as little as 10 rupees – and they can take leveraged positions equivalent to as much as five times their invested capital.

Statistics at a glance

- Retail investors now account for 41% of India’s overall derivative trading volumes, compared with just 2% in 2018.

- India had 154 million trading accounts as of April 2024, a more than four times jump from the 36 million trading accounts in April 2019.

- India's monthly notional value of derivatives traded reached a worldwide high of 9,504 trillion rupees in May, data from Reuters shows.

Why are regulators worried?

The surge in trading volume has come despite repeated warnings from Indian authorities that retail traders are taking a big risk in trying to bet against larger, better funded and more experienced financial market players.

In the US, for example, a recent court case revealed that Jane Street earned around $1 billion from an Indian options strategy. Optiver, Citadel Securities and Jump Trading have all been expanding in India, alongside hedge funds and other players.

SEBI’s own studies suggest that 90% of active retail traders lose money trading derivative contracts. The finance ministry’s economic survey published on 22 July also warned that derivatives trading loses money for investors for the most part, and that the rise in retail engagement is largely motivated by “humans’ gambling instincts.”

Regulators are concerned about financial stability risks that could emerge and have warned that the “frenzy” may hinder efforts to channel household savings for productive uses.

How do regulators plan to curb retail trading?

In July, SEBI proposed a series of steps to curb retail activity in the index derivatives segment, including raising the minimum contract size of index derivatives, limiting weekly options to a single benchmark of an exchange, collecting options premium upfront and reducing the number of strike prices.

FIA responded to the proposal with a letter, expressing support for the underlying intent of these measures and urging caution to consider any potential unintended consequences of the proposed measures.

SEBI’s proposals at a glance:

Increase contract size:

- SEBI has proposed raising the contract size for index derivatives to a range of 1.5 million rupees to 2 million rupees ($18,000 to $24,000) initially, and then to 2 million rupees to 3 million rupees. Currently, the minimum size is 500,000 rupees to 1 million rupees, which was set more than five years ago. This would make derivatives less accessible to smaller investors.

Weekly index products:

- SEBI has proposed limiting weekly expiry for one benchmark index per exchange, as opposed to the existing practice of weekly expiries across multiple indices.

Increase margin near contract expiry:

- Margins on expiry day and the day before expiry should increase according to the proposals. At the start of the day before expiry, Extreme Loss Margin (ELM) should increase by 3%, and at the start of the expiry day, ELM should increase further by 5%.

Intraday monitoring of position limits:

- Position limits for index derivative contracts should be monitored by clearing corporations and stock exchanges on an intraday basis. Currently, position limits are monitored at the end of the day, which leaves open the possibility of undetected intraday positions beyond permissible limits.

Upfront collection of options premium:

- SEBI proposes to mandate the collection of options premium upfront, including from the options buyer. Currently, upfront margins are only collected for futures positions and for short positions in options.

Removal of calendar spread benefit on expiry day:

- Given the skew in volumes witnessed on the expiry day vis-à-vis other non-expiry days and the inherent basis and liquidity risk present, SEBI proposes to remove the calendar spread margin benefit for contracts expiring on the same day.

Rationalisation of options strikes:

- SEBI proposes to limit the number of options strikes that can be introduced at the time of contract launch to 50 to avoid scattered trading activity across multiple strikes, which can cause sudden price movements in those contracts. It will also require strike intervals to be uniform near the prevailing index price (4% around the prevailing price) and the interval to increase as the strikes move away from the prevailing price (around 4% to 8%).

SEBI’s consultation follows the Indian government’s decision in July to make changes to taxes on gains from equity investments and stock derivatives in an effort to steer household savings away from speculative trading. The government raised the levy on stocks held for less than 12 months to 20%, the first hike since 2008, and to 12.5% from 10% for those held for more than a year.

What could be the impact of the proposals?

Should SEBI’s proposals be enacted, both NSE and BSE may experience reduced trading volumes, potentially affecting their profitability. Beyond the exchanges, the new proposals would likely impact brokers.

Market participants and other stakeholders have until 20 August to submit their responses to SEBI’s proposals. FIA’s response recommends that the proposals are implemented gradually by introducing a number of measures at a time and rolling each one out in stages, as well as a raft of other suggestions for consideration.