Senior executives for two of the largest market operators in the US options industry sounded a note of caution on the boom in the trading of options with zero days to expiration, saying that brokers and exchanges should carefully consider the costs and benefits before extending this trend into single stock options.

Speaking at the annual Options Industry Conference last week, Shelley Brown, an executive vice president at MIAX Options, and Sean Feeney, head of US options at Nasdaq, welcomed the recent growth in the US options market. More than 11 billion options were traded on US options exchanges in 2023, compared to just four billion ten years ago.

One factor driving that growth, especially over the last several years, has been the introduction of additional expirations for certain index and ETF options. This has encouraged a shift in trading volume towards shorter duration contracts such as "0DTE" options, meaning options that expire on the same day that they are traded.

For example, more than 40% of the volume in SPX options, the most heavily traded index option in the US, were traded with zero days to expiration in 2023, compared to just 11% five years ago. And the trend shows no sign of stopping – in the first quarter of 2024, that ratio rose to 48%.

Paul Jiganti, an expert on the options industry who moderated the discussion at the OIC conference, asked the exchange leaders to comment on how they would respond if this trend flowed into the trading of options on stocks such as Amazon and Tesla, which are already two of the most heavily traded contracts in the industry.

"It appears that people are voting with their order flow," commented Jiganti, who works at IMC, one of the top market makers for options. "They want shorter and shorter expirations. Will that leak into Amazon and Tesla?"

Such a move would have "pluses and minuses", said Brown, a 40-year industry veteran who joined MIAX in 2011. The additional expirations could lead to additional volume, as seen in the index and ETF options, but it would also expose retail investors to risks that they are not familiar with, he said.

For example, when a company announces earnings after the market closes, it can have a dramatic effect on the value of the options on its stock. What will happen, he asked, if exercise happens for options with strike prices that were $20 out of the money during the day but then move into the money after an earnings announcement. "We have to be smart about how we do this," he warned.

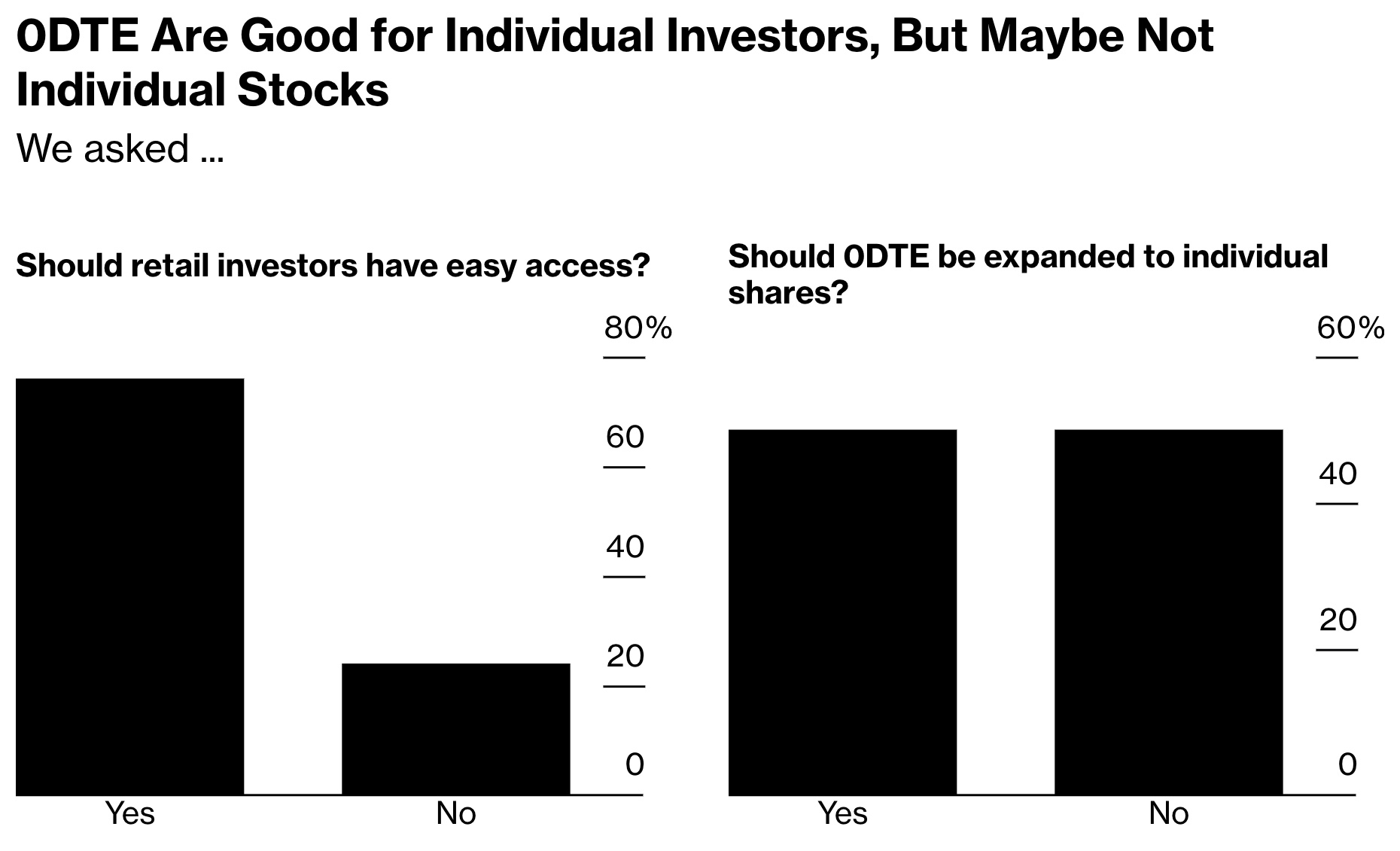

A recent poll by Bloomberg showed that opinions are split on the 0DTE trend. The MLIV survey, which captures sentiment among Bloomberg readers, asked at the end of April if 0DTE should be expanded to individual stocks. Half of the 300 respondents said yes; half said no.

Source: Bloomberg MLIV Pulse survey April 29-May 3

Nasdaq's Feeney commented that the options industry is seeing a general preference for options with shorter durations, especially among what he called the "new demographic" among retail traders. He agreed with Brown that extending the 0DTE trend to single stock options would create risks, but he said the exchange community has to consider that these risks "may be acceptable" to these market participants.

"We need to work with the businesses that absorb these risks, which at this point in time are retail firms, and figure out ways to mitigate the risks in order to provide the product that people want to trade, and then be able to list the products responsibly and suitably," said Feeney.

Meanwhile the industry is creating more opportunities for zero day trading in ETF options by expanding the range of contracts that have additional expirations. Feeney said Nasdaq is planning to seek regulatory approval to list Monday expirations for five ETFs that currently have Wednesday and Friday expirations – GLD, SLV, TLT, USO, and UNG. Four of those ETFs track commodity prices; the fifth – TLT – tracks Treasury bond prices.

Better Handle on Intraday Risk

A different dimension of the 0DTE issue is the risk that arises for brokers and market makers when a sudden market move leads to large losses. The central clearing system operated by the OCC, the clearinghouse that processes trades for all 17 US options exchanges, is designed to protect the markets from the risk of a default. But its systems were built at a time when end-of-day processing was the norm, and that approach is far from optimal for positions that only last for a few hours.

Speaking alongside the exchange leaders, Andrej Bolkovic, the OCC's chief executive officer, said the clearinghouse is implementing a new platform that will allow it to manage intraday risk more effectively. "We also have to adjust … as the market evolves," he said.

The new platform, called Ovation, will allow the clearinghouse to use current prices when it measures risk exposures, rather than the prior day's closing prices. That will help the OCC capture the risk exposures that arise with same day expiries, according to OCC executives leading the implementation.

OCC is now in the process of testing the new platform and plans to launch it into production next year. In addition to the more sophisticated approach to measuring intraday risk, the new platform will provide more flexible options for firms to access data and more transparency into transaction information and history. The new features include a "what-if margining simulation" tool that will allow clearing members to submit a portfolio of positions and see how the margin requirements on those positions would change in various types of market scenarios.