“To have a living capital market, you need to have capitalists.” - Jacques de Larosière

It took the clear-eyed 95-year-old father of the European Union’s financial regulatory architecture to cut to the chase. This “Yoda-like” statement came during the European Securities and Markets Authority symposium held last week to discuss the future of the European capital markets.

While in Brussels and Paris last week, I heard a common theme coming from European policymakers. The EU is falling behind in productivity and growth compared to other countries, and its policy efforts to build a Capital Markets Union do not seem to be working.

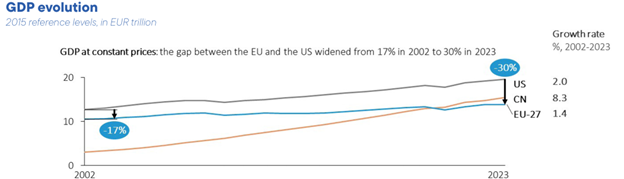

Two seminal reports drive this debate: the Report on the Future of European Competitiveness, penned by the former European central banker and Italian Prime Minister Mario Draghi and the Much More Than A Market Report, authored by another former Italian Prime Minister, Enrico Letta. Both make the strong case that the EU does not effectively put its savings to the most productive use, despite the many strengths of the bloc. The reports reveal that real disposable income has increased twice as much in the US as in the EU since 2000 on a per capita basis. If the EU does not close this productivity gap, and close it soon, its ambitions and standards of living will suffer.

You feel this urgency in Brussels. With EU President Ursula von der Leyen’s new commission in place, everyone talks about the need to develop the Savings and Investment Union. The more difficult question is what needs to change, and there are many views on the right path among policymakers.

One influential architect will be Portuguese Commissioner Maria Luis Albuquerque. President von er Leyen has tasked her with overseeing the financial portfolio of the EU. She spoke during the ESMA symposium, and FIA was privileged to meet with her privately. Her public and private remarks hit the right tone of needing to change the culture and incentives of EU citizens around investing. She also discussed the importance of fixing the process and regulatory structure with an aim towards simplification. She impressed us with her call to arms and vision. The EU will need such leadership.

Dignitaries who spoke at the ESMA event hit on similar themes – what I have termed the EU’s B.I.G. agenda. While the recommendations in these reports are many and cannot be summarized here, I believe the most important fall into three categories.

Be Bold: For the EU to succeed, many believe it must act boldly. We heard the ‘B’ word quite a bit during the conference and in private meetings. This is not a time for marginal change but will require courage and decisive action. Some of the big ideas suggested included consolidating financial supervision under ESMA and replacing parts of the pension schemes of countries with tax-preferred investment accounts. Jacques de Larosière even suggested giving the UK a seat at the ESMA table to improve European capital market rules, in a moment of thinking out-of-the-box. It is anyone’s guess which of these ideas will win the day, but it is clear that policymakers are thinking big.

Incentivize Investment: The Letta report estimates that the EU has €33 trillion in private savings held primarily in deposits rather than investment accounts. To many, this must change and should serve as the starting point. The US went through such a transition in the 1980s, as defined benefit pension schemes of companies and governments became unsustainable. Today, two-thirds of Americans invest in tax-preferred accounts that help fuel innovation and growth. If done correctly, the EU has an opportunity to build an investment culture, especially with the younger “tap and swipe” generation. Developing simple, tax deferred accounts across the EU will incentivize the transition of private savings into investments and energize the development of the asset management and venture capital industries. This will begin the much-needed cultural shift to improve productivity.

Governance Matters: Many EU policymakers have identified the overly bureaucratic regulatory system as a drag on productivity. President von der Leyen has tasked EU Commissioner Valdis Dombrovskis with implementing a simplification agenda across the EU’s economy, with the aim of gaining efficiency in productivity and growth. In fact, Adena Friedman, Nasdaq’s CEO and a speaker at the ESMA event, noted that simplifying and reducing the compliance burdens of financial institutions by $25-50 billion would release $1 trillion in additional lending capacity without materially adding risk to the regulatory system.

FIA has commented on how to improve the competitiveness of the EU, and much of it surrounds improving the process of approving and implementing regulations. Simply identifying duplicative regulations, while helpful, only treats the symptoms and not the disease. The EU must address the process in which it develops and implements rules. We need more industry engagement and thorough cost-benefit analyses. And we need more realistic implementation periods to avoid hasty compliance. Regulators should have more flexibility in tailoring regulations through a more meaningful no-action and guidance authority. And ultimately, the EU should turn to an outcomes- or principles-based system of regulation, similar to the UK and US. We must address governance if good decisions are to follow.

The B.I.G. agenda will not be easy, given the cultural and political hurdles that need to be overcome. But I came away optimistic after meeting with EU leaders who have a clear but sober view of the task at hand. I applaud both EU Commissioner Albuquerque and ESMA Chair Verena Ross for tackling these issues head-on and attempting to build consensus on the work ahead.

FIA and its members stand ready to partner with the EU on ways to improve its competitiveness. A strong and productive EU is not only good for Europeans but good for our industry, the global economy and political stability. Now that’s a win for everyone!