German exchange operator buys stake in San Francisco-based data wrangler

Being a customer just wasn't enough. In September Deutsche Börse made a minority investment in Trifacta, a data processing firm founded in 2012. The German exchange operator was already a customer of Trifacta's software tools and was so impressed that it decided to buy a stake in the fast-growing company through DB1 Ventures, its venture capital arm.

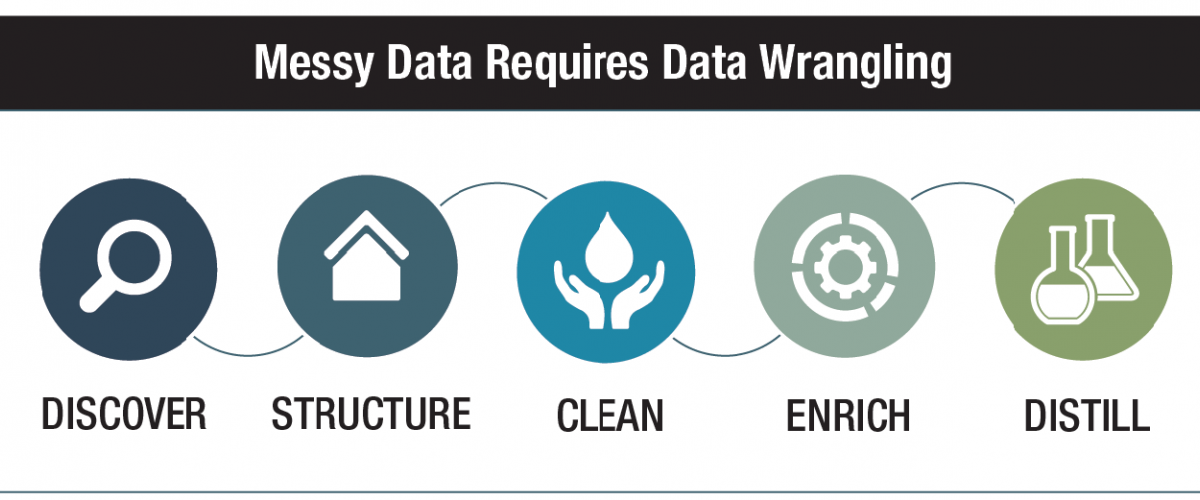

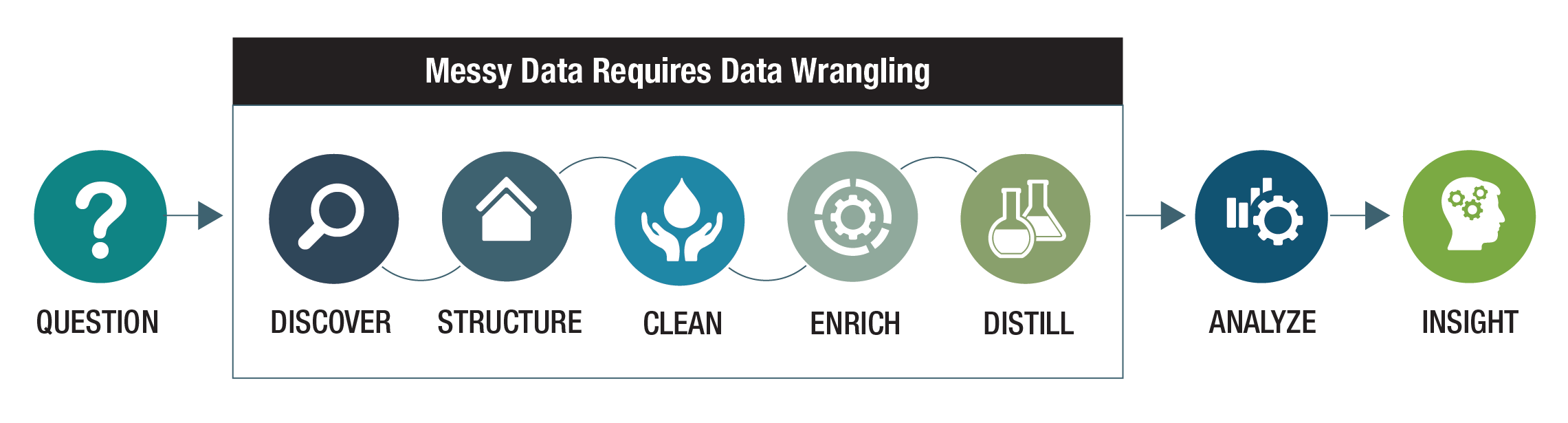

Trifacta, which describes itself as “the global leader in data wrangling,” has developed analytics tools that can corral large volumes of raw data into useful analytics. Current clients include Google, which uses it for its enterprise cloud data preparation service. The company's software, which leverages the technology of machine learning, is designed to allow users to clean, enrich, structure and validate their data. Rather than running the data preparation process through an IT team, the software is designed for use by any professional on their desktop to reduce the hassle of data preparation, accelerate the analysis process, and expand the variety and complexity of the data that can be brought into the analysis.

The San Francisco-based company has raised more than $76 million in funding since launch. Other investors in Trifacta include two venture capital firms—Accel Partners and Greylock Partners—and Infosys Ltd., the Indian outsourcing company. Deutsche Börse made the investment after using Trifacta's software internally and recognizing the potential for improving its ability to analyze data and create new data-driven products and services.

In mid-2016, Deutsche Börse set up a research department within its market data and services division to explore trends in the digitalization of data. This department, called the "Content Lab," has been working with Trifacta to harness internal data sets for its team of data scientists.

"We operate across the whole trading and clearing value chain and deal with large amounts of extremely varied data," Konrad Sippel, head of Content Lab, said in August when the exchange announced that it had begun using Trifacta's software. "By using Trifacta, the Content Lab team can develop and implement data driven solutions across the group and implement long-term, strategic projects in areas like risk management, investment decision making and trading analytics."

Deutsche Börse is not new to the fintech rodeo. Previous investments by Deutsche Börse’s venture capital arm include Trumid, a New York-based electronic credit-trading platform, Figo, a Hamburg-based provider of banking API technologies, and Digital Asset Holdings, a New York startup focused on building capital markets applications with distributed ledger technology.