Both ICE and CME, the two most important exchanges in energy markets, have introduced a new set of crude oil futures contracts to reflect a specific pricing point whose importance has increased in the last several years.

The production of oil in the North Sea has decreased so much that S&P Platts adjusted the Brent benchmark to include oil from West Texas. Since May 2023, when that change took effect, WTI Midland has been the most dominant grade of crude in the Brent basket. According to S&P Platts, WTI Midland has set the price for dated Brent more than half the time.

Equally important, US exports of oil, and WTI Midland in particular, have steadily risen. Since 2015, when the US lifted its ban on oil exports, the outflows have risen from one million barrels per day in 2017 to more than four million barrels per day in 2023, making the US one of the top three oil exporters in the world.

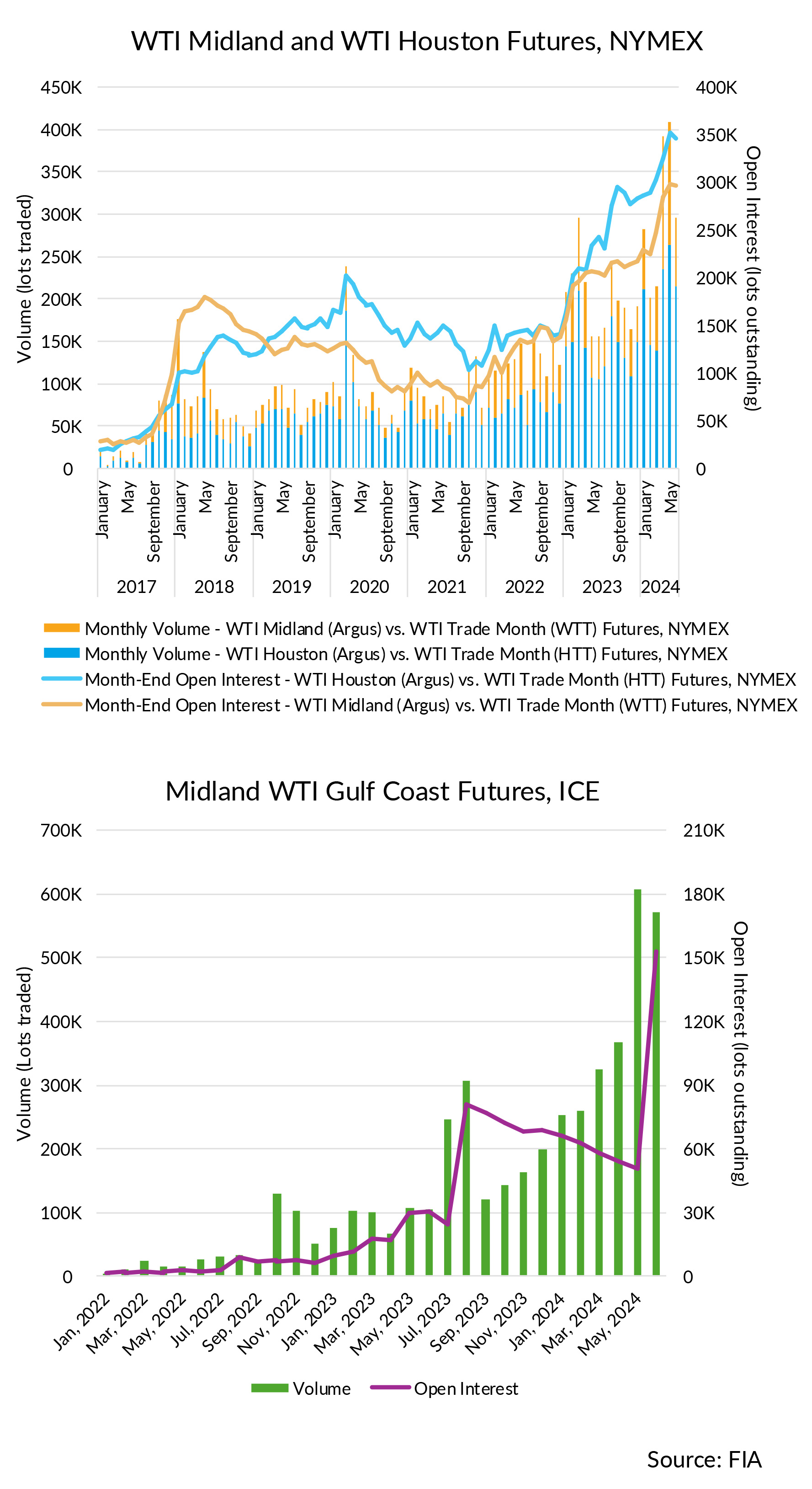

As a result, there has been a significant shift in how people price the crude oil destined for export and a growing need for a way to manage the price risk on those cargoes. In response, CME and ICE have introduced new futures contracts based on the price for these flows of oil. As shown in the charts, the volume and open interest in these newer contracts have risen quite substantially in the last 18 months.

Midland Grades - Hedging Outflows of US Crude

CME offers two contracts – one based on WTI Midland, and one based on WTI Houston. Both trade as a differential to the original WTI contract that is based on delivery to Cushing, an important storage and pipeline location in Oklahoma.

The WTI Midland contract is based on a specific grade of crude oil produced in the Permian basin and deliverable into the Brent benchmark, and tracks prices at Midland, a pricing hub near the center of production. The WTI Houston contract is based on the same grade of crude oil. However, it tracks prices at export terminals in Houston. Both contracts rely on price assessments by Argus, an independent provider of price benchmarks for commodity markets.

CME's WTI Houston contract hit a record level of trading activity in the first half of 2024, with more than 1.2 million contracts changing hands, up 40% from the first half of 2023. Open interest also has risen rapidly, reaching 347,000 contracts at the end of June, up 43% from the same point of time in 2023.

Its WTI Midland contract also has experienced rapid growth. First half volume reached 586,000 contracts, up 44% from a year ago, and open interest reached almost 300,000 contracts at the end of June, also up 44% from the same point of time a year ago.

ICE has taken a different approach. Its futures contract is based on physical delivery of Midland WTI crude at two export terminals in Houston. The contract has caught traders’ attention, with 2.38 million contracts changing hands in the first half of the year, more than four times the volume in the first half of 2023. Open interest reached 150,000 contracts at the end of June, five times the level in June 2023. In effect, ICE's contract now has more trading volume than the two CME contracts combined but less than a quarter of the combined open interest.

While still early days for all three contracts, the market clearly has embraced these Midland grade crude oil futures as important new pricing and risk management tools for US exports of oil.