On 20 August, Hong Kong Exchanges and Clearing received regulatory approval to launch futures on the MSCI China A50 Connect index. The new contract, which begin trading in October, will strengthen the exchange's position as the gateway to China's onshore equity market, one of the largest and fastest growing in the world.

Many observers have interpreted the alliance between HKEX and MSCI as a loss for the Singapore Exchange. For years, SGX's FTSE China A50 futures have been the go-to contract for international investors looking for efficient access to onshore Chinese equities. But HKEX is much more closely intertwined with China's stock markets and its new contract is widely expected to capture some of the trading that now goes to Singapore.

The competition is more complicated than that, however. There is a third horse in this race—Shanghai's China Financial Futures Exchange. CFFEX lists three equity index futures based on stocks traded in the onshore markets and all three have robust trading volume. Although international access to CFFEX is limited, the Chinese government has made several moves in recent years to open its futures markets, and it may decide to make one or more of the CFFEX equity index futures accessible directly from overseas.

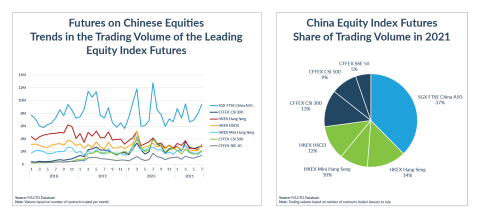

Currently SGX has the lead in terms of the number of contracts traded. As of the end of July, the year-to-date volume in its FTSE China A50 futures was 56.4 million contracts, the second-highest total for a futures contract in the Asia-Pacific region behind the mini Nikkei 225 futures traded on the Osaka Exchange.

HKEX does not yet have a contract that offers direct exposure to the onshore market, but it does have more than a dozen equity index futures based on stocks listed on the Hong Kong stock exchange. The two most important are the Hang Seng index, the benchmark for the local stock market, and the Hang Seng China Enterprises Index, which is based on shares issued by Chinese companies that are listed on HKEX. That class of shares are known as the H shares, and the futures are often called the H-Shares contracts. Year-to-date volume for these two contracts was 20.4 million and 17.8 million, respectively. HKEX also offers a mini version of the Hang Seng futures, which had volume of 14.6 million year-to-date.

CFFEX offers futures based on three indices: the CSI 300, which tracks the 300 stocks in the onshore markets with the highest market capitalization; the CSI 500, which tracks mid-sized and small stocks; and the SSE 50, which tracks the 50 largest and most liquid stocks listed on the Shanghai Stock Exchange.

The CSI 300 futures are the oldest and most heavily traded, with 19.2 million contracts traded year to date. The CSI 500 had higher trading volume in 2020, but so far this year volume has lagged behind, with 13.6 million contracts traded since January. The SSE 50 had volume of 7.9 million so far this year.

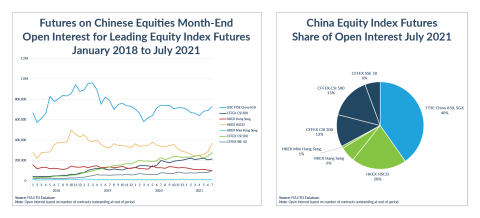

SGX also has the lead in terms of open interest, which measures the number of contracts outstanding at one moment in time. At the end of July, open interest in its FTSE China A50 futures was 728,000 contracts, more than any other equity index futures in the Asia-Pacific region, and nearly twice as much as any other China-related futures contract.

CFFEX was not far behind, however. Total open interest across its three equity index futures came to almost 595,000 contracts. That is relatively high for the Chinese futures markets and suggests that these three contracts have strong participation from local institutions and foreign investors that have regulatory approval for onshore trading.

HKEX had 486,000 in open interest across its top three equity index futures, with three-quarters of that coming from the H-shares contract. The popularity of the H-shares contract relative to the Hang Seng futures indicates the demand for exposure to onshore Chinese equities.

The competition among these three market centers goes beyond these futures contracts. HKEX has a sizeable market for options on the Hang Seng and HSCEI indices, with 14.1 million contracts traded so far this year. CFFEX began offering options on the CSI 300 in December 2019. This year trading has taken off, with volume of 17.5 million since January, more than double the comparable period in 2020. Given the interconnections between options and futures, strong trading activity in both sets of contracts is likely to lead to greater liquidity overall.

SGX recently introduced options on the FTSE China H50 index, which is based on the H-shares market, but volume is relatively low so far, and it does not offer options on the FTSE China A50 index. That puts the exchange at a disadvantage to its competitors in Hong Kong and Shanghai. On the other hand, it offers futures based on several other Asia-Pacific stock markets, notably India, Japan and Taiwan. For some international investors, the efficiencies of the pan-Asian approach may be enough for them to continue using SGX to manage their exposures to China.