CME reinvigorates NDF clearing service in battle with LCH's ForexClear

CME Group is making another run at the OTC FX market. The Chicago-based market operator recently unveiled an agreement with seven leading liquidity providers to begin using its clearing service for non-deliverable forwards and redoubled its efforts to promote the capital efficiencies that clearing can provide for FX traders. But with LCH currently dominating NDF clearing, is there really enough demand for the CME solution?

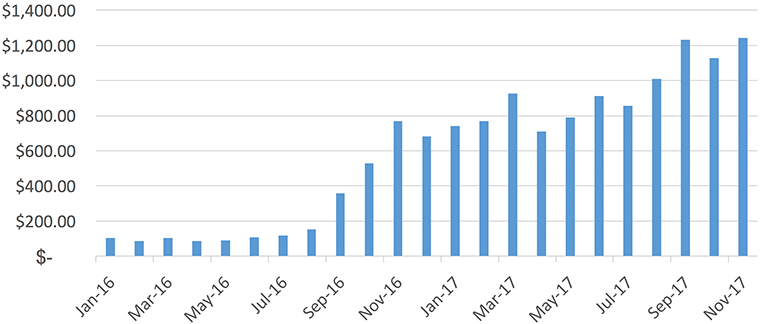

Over the last two years, NDF clearing has exploded as margin requirements for uncleared derivatives have come into effect around the world. Banks seeking to avoid those margin requirements have mainly turned to LCH's ForexClear service, which provides clearing for NDFs in 12 emerging market currencies as well as several G-10 currencies. The service has 30 clearing members and has signed up an additional 3,000 client accounts this year alone. In the third quarter, the London-based clearinghouse processed NDFs worth $1.5 trillion in notional value, up more than 400% from the third quarter of 2016.

NDF Clearing Surges

Monthly Notional Value Cleared at LCH (Billions USD)

Note: Monthly clearing volumes include a small amount of NDFs in major currencies such as EUR, GBP, JPY and CHF. These NDFs make up less than 0.1% of total NDF clearing volume.

Source: LCH

Virtually all interdealer activity resides on the LCH platform, explained John O'Hara, Americas head of prime brokerage and clearing at Société Générale Corporate and Investment Banking. But he said there is demand for a CME solution as well. One reason is the potential synergy with CME's well-established foreign exchange futures market, which boasts more than $91 billion in average daily volume and more than $260 billion in open interest. “People gravitate toward what is most familiar to them, and for those actively clearing futures on CME, OTC FX clearing is a natural progression,” O'Hara explained.

CME has offered NDF clearing for several years but with minimal success. As of early December, across the 12 emerging market NDFs that CME clears, the only one with any activity was the Colombian peso NDF. The open interest in all of the others was exactly zero.

CME sees an opportunity for a second chance, however. So far most of the NDF clearing has been for interbank trades, but fund managers and other buyside institutions are poised to take up clearing as margin requirements for uncleared derivatives come into effect. CME is hoping that it can capture a share of this business by offering a clearing solution that combines OTC FX products with listed futures and options. Portfolio margining of OTC FX NDFs and listed FX futures is not available yet, but CME is working on getting regulatory approval and is hoping to bring that live in 2018.

Getting Market Makers on Board

The deeper challenge is pricing. Market sources said because ForexClear has been so widely adopted, liquidity in NDFs that are cleared at LCH are quoted with a tighter bid-ask spread than NDFs cleared at CME. CME is hoping to address that issue with its November announcement that seven leading NDF liquidity providers intend to start clearing with the service by the end of the first quarter of 2018. The seven liquidity providers are BBVA, Citi, Itau Unibanco, NatWest Markets, Santander, Standard Chartered and XTX Markets.

It is no accident that three of the liquidity providers—BBVA, Itau Unibanco, and Santander—are specialists in Latin American markets. Many of the most heavily traded NDFs are based on Latin currencies such as the Brazilian real and the Colombian peso. The other big center for NDFs is in Asia. That is one of the strengths of Standard Chartered, one of the top liquidity providers in Asian forex markets.

XTX is the only one of the seven that is not a bank, but the London-based electronic trading firm has emerged over the last three years as a major liquidity providers in the FX market. In last year's Euromoney survey, which calculates market share across the top forex market-makers, XTX took third place in electronic spot trading in last year's Euromoney survey of market share across the top FX market makers, and first place in this year's FX Week awards for best liquidity provider.

All Under One Roof

CME also argues that its solution has a structural advantage. At LCH, the ForexClear service has its own default fund that is separate from its clearing services for other asset classes such as interest rate swaps. At CME, NDFs are under the same umbrella as a range of related products, including listed FX futures and options as well as interest rate swaps. That opens the door for margin offsets that LCH cannot offer. For example, CME estimates that the margin offsets between NDFs and non-deliverable interest rate swaps denominated in currencies such as the Brazilian real and the Korean won could go as high as 51%. The single default fund structure also offers capital savings for clearing firms. Rather than having to commit their capital to multiple default funds, the clearing firms only need to make one commitment that covers all the asset classes that they clear.

"Our NDF clearing solution leverages the same guaranty fund as the entire CME Group-listed futures and options complex, enabling material capital savings for our NDF clearing members and lower fees for customers clearing via an FCM," Sean Tully, CME's senior managing director of financials and OTC products, said in November when the agreement with the seven liquidity providers was announced.

Buyside Interest on the Rise

One of the key drivers behind the rise in demand for NDF clearing is the implementation of uncleared margin rules, which are still in the early stages of being phased in. Paddy Boyle, global head of ForexClear, explained that bilateral initial margin was initially required from all participants with at least $3 trillion of notional outstanding. That limit has now fallen to $2.25 trillion and will continue to fall to lower and lower thresholds. By September 2020, nearly all market participants will be subject to the rules.

“When we reach the final threshold in 2020, NDFs that are bilaterally traded and uncleared will become significantly more expensive and will provide all types of institutions with obvious greater incentive to clear,” Boyle said. Although most buyside firms are not yet subject to the margin requirements, Boyle said there is a “small but active group” of buyside firms voluntarily clearing NDFs at LCH now. “We expect buy-side clearing to grow substantially over the next few years, particularly as most buy-side firms will be caught as the thresholds continue to fall in 2019 and 2020,” he added.

“We expect buy-side clearing to grow substantially over the next few years, particularly as most buy-side firms will be caught as the thresholds continue to fall in 2019 and 2020.”

- Paddy Boyle, LCH

Basu Choudhury, head of business intelligence at NEX Traiana, also predicted that the buy side will soon have to start clearing more. Choudhury, who worked at ForexClear before joining Traiana in August 2016, explained that the first two waves of margin rules created an upturn in demand from tier one and tier two banks for NDF clearing. "Come January 2018, buy-side firms globally will also start to be impacted, so what CME are looking to do on the NDF side makes sense,” he said.

There is an added attraction for mutual funds in the U.S., according to SocGen's O'Hara. “Since these fund structures have leverage and cash retention requirements measured on a gross notional basis when trading deliverable forwards, they have been seeking ways to ensure that there is no chance of delivery so their exposure can be assessed purely on a mark-to-market basis,” he explained. Since the CCPs have a mechanism wherein they can disallow delivery, they should be able to provide this relief, he said.

Convergence Play

Bringing liquidity providers on board is only one part of a renewed focus on the OTC FX market at CME. The company also is preparing to roll out a new service in the first quarter that will give OTC market participants better access to the liquidity in CME's FX futures. Starting on Feb. 18, CME's Globex electronic trading platform will support a central limit order book for trades that track the basis between spot FX and FX futures. This service, called FX Link, will enable the trading of an OTC spot FX contract and an FX futures contract via a single spread trade.

CME is partnering with Citi, one of the largest liquidity providers in the FX market, to act as central prime broker for the spot FX transactions resulting from the spread. The benefit of this arrangement, according to CME, is that it will allow participants to tap into their existing OTC FX interbank credit relationships and the established OTC FX prime brokerage network.

"By strengthening the integration between futures and the OTC FX marketplace, CME FX Link will enhance access to our deeply liquid FX futures market," Paul Houston, CME's global head of FX products, said in September when the initiative was announced. "OTC FX market participants will benefit from the capital and regulatory advantages of listed futures as well as optimizing credit lines through facing a central counterparty."

“There will continue to be a convergence of sorts as OTC becomes more futures-like and futures assume some characteristics of OTC.”

- John O'Hara, Société Générale

In addition, both CME and ForexClear are preparing to launch OTC FX options clearing. CME said it is working with major FX options dealers to deliver a cash-settled clearing solution later this year, with the expectation of volumes beginning in early 2018. In contrast, ForexClear’s solution will offer physical settlement of OTC FX options in partnership with CLS, the widely used settlement service. ForexClear is currently seeking regulatory approval and plans to start by offering clearing in eight major currency pairs.

SocGen’s O’Hara explained that the options market has historically been characterized by physical settlement and many firms’ operational infrastructures have been built with this in mind. CME’s view, however, is that physical-settlement had become the standard simply as a consequence of how the market evolved and that cash settled would be the norm if it were starting today.

Ultimately the FX market is big enough to support both clearinghouses, according to Choudhury. “In IRS clearing we saw the buyside use CME initially while big dealers used LCH and it will be interesting to see if the same occurs with FX clearing,” he said. “CME do offer risk offsets between FX futures and OTC FX. For the buyside this may be attractive due to arbitrage opportunities, but dealers may prefer the LCH model due to larger netting pool.”

O’Hara commented that all of these moves are part of a larger trend that is blurring the lines between different sectors of the FX marketplace. “There will continue to be a convergence of sorts as OTC becomes more futures-like and futures assume some characteristics of OTC,” he said.