The benefits of gross margining and strict segregation of customer margin

The derivatives industry has played a key role in allowing market participants to safely and efficiently manage their risks during normal market conditions and stress events for over 100 years. The safe and efficient nature of the centrally cleared derivatives industry has been achieved through using a range of best practices in risk management that promote market stability. This article focuses on two particular risk management techniques related to customer margining: gross margining and segregation. This article focuses on two particular risk management techniques related to customer margining: gross margining and asset segregation.

Customer gross margining

The practice of a central clearinghouse collecting margin for customer accounts on a gross basis ensures that the positions within a customer account are fully collateralized at the CCP while increasing the amount of margin that a CCP has on hand to manage a clearing member default event. Gross margining positively impacts financial stability by increasing the chances of porting.

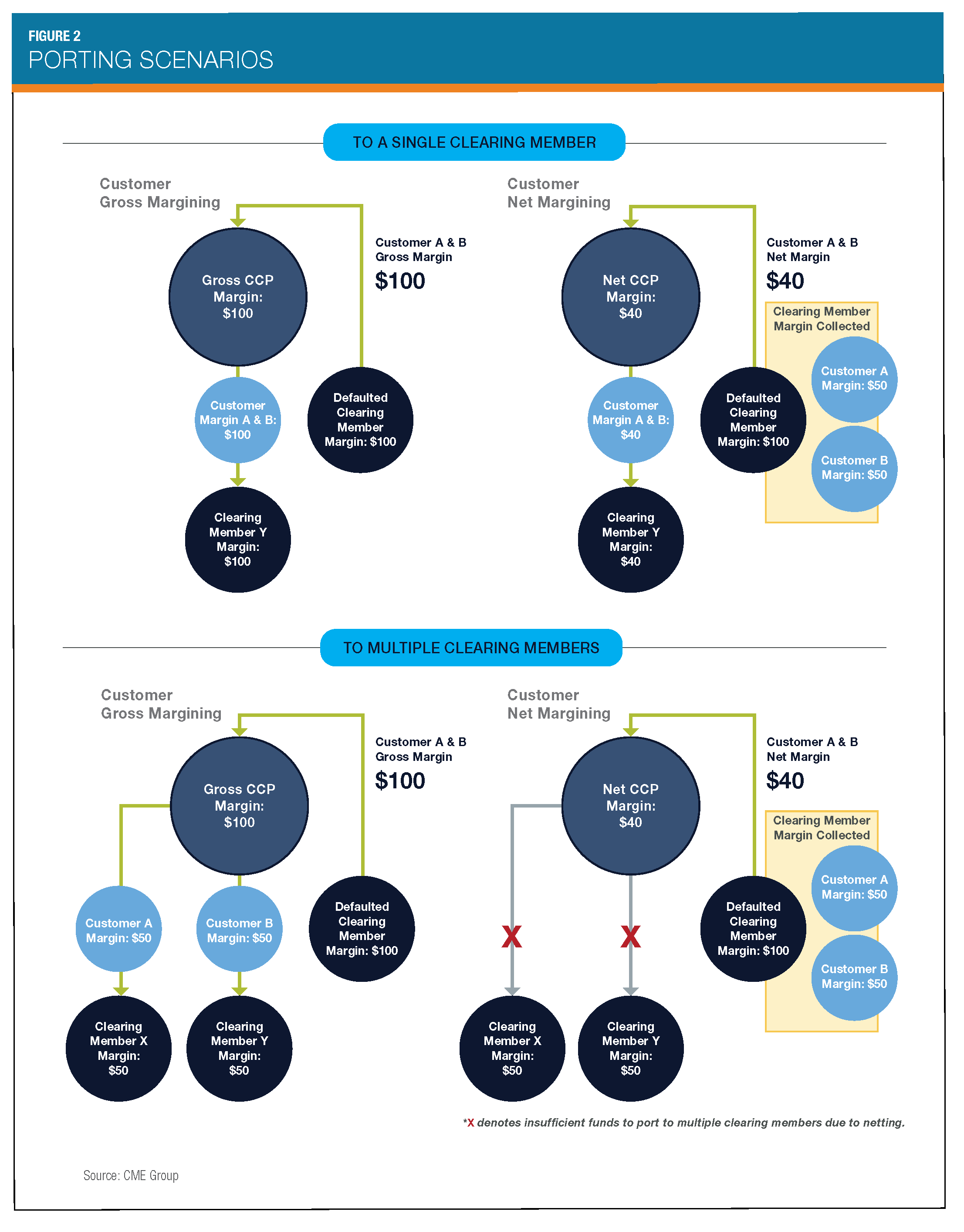

Under a customer gross margin regime each customer is fully margined at the CCP level which provides the CCP with the flexibility to port the customer book of the defaulting clearing member to a single clearing member or break it up and port to multiple clearing members. A CCP’s ability to transfer each customer on a fully margined basis is greatly increased in either scenario due to the increased CCP margin on hand for customers.

In contrast, customer net margin regimes result in a significant portion of customer margin being held at the clearing member, which reduces the ability of a CCP to successfully port the customers of the defaulted clearing member. Customer net margining challenges a CCP’s management of a clearing member default because it will only be able to port customers of the defaulting clearing member with sufficient margin to cover their risks to a single clearing member.

If the clearing member’s customer book is split up in a net margining regime, the risk offsets between customers (which reduced the margin posted to the CCP) are eliminated and thus the risks can no longer be covered with the margin on hand at the CCP. In this scenario three options exist: a margin call against customers by the new clearing member(s) in a stressed market, temporary relief by regulators from requiring those customers to be fully margined or the liquidation of the customer portfolio(s). These options all threaten to increase volatility and risks in already stressed market conditions.

The diagram below illustrates the enhanced porting flexibility offered by a customer gross margining regime: The ability to transfer fully margined customers to multiple different non-defaulting clearing members is likely to be critical in a situation where a clearing member with a large and/or diverse customer book has defaulted. In such a circumstance, the odds of one non-defaulting clearing member accepting the entire customer book reduces significantly so the only option available may be porting to multiple clearing members. Additionally, the flexibility of gross margining may mitigate some of the negative impacts on porting that have been created through the inaccurate formulation of the Basel III Leverage Ratio. Finally, multiple clearing member optionality for porting significantly increases the chances of protecting customers from the risk of liquidation and reduces the risk that liquidations of large customer positions will further destabilize a stressed market.

Absolute austomer/clearing member segregation

The segregation of customer margin and positions from clearing members and their affiliates also provides critical protections in times of market stress. For example, consider the risk that if a clearing member is in financial trouble, the same is true for its affiliates. Where customer positions and margin are strictly segregated from the positions and margin of clearing members and their affiliates, the default or failure of a clearing member should have a more limited impact on its customers. However, if the positions and margin of a clearing member’s affiliates are in the same omnibus account as its customers, the contagion risk of the affiliates’ losses may pollute the customer pool and may result in losses at the end-user level. Effectively, the placing of a clearing member’s affiliate positions and margin in the customer pool negates or at a minimum reduces, the protections associated with customer segregation from the clearing member.

Conclusion

In recognition of CCPs’ performance during the financial crisis, their risk management practices have served as a template for policy-makers seeking to improve the stability of the financial system. This has led to enhanced focus on existing CCP risk management standards in the U.S. and globally by policy-makers. Unfortunately, the dialogue has not sufficiently accounted for the risk management benefits of customer margin collection practices and strict segregation standards. We strongly encourage policymakers to recognize and account for the positive outcomes that these practices engender for customers and overall financial stability.