Tocom builds high-speed link to Chicago

The Tokyo Commodity Exchange is working to draw in more trading fi rms from North America. The Japanese exchange has partnered with KVH, a telecoms company based in Tokyo, to establish a low latency connection between CME Group’s main data center in Aurora, just outside Chicago, and Tocom’s proximity data center in Tokyo, which is hosted by KVH.

Tocom and KVH estimate that it can take as little as 122 milliseconds for order messages to make the round-trip between Tokyo and Aurora, making this the fastest network connecting these two locations in the market today. Tocom said the new connection will go live on Sept. 15 and is aimed at proprietary trading fi rms and futures commission merchants that have equipment in the CME data center.

Traders from outside Japan now account for 40% of Tocom’s total volume. Most of that trading comes from Hong Kong, Singapore and the U.S. and the exchange has been working to offer faster access for traders in these locations to support cross-market arbitrage.

“I am pleased we can offer this service due to CME Group’s open access model, which allowed us to collaborate with its many service providers to make the Tocom market easily accessible for customers,” said Tadashi Ezaki, president and chief executive offi cer of Tocom.

Markit adds real-time swap trade data to valuation service

Markit has integrated a real-time trade data feed into its portfolio valuation service. The new connection captures customers’ overthe- counter derivatives trades processed through MarkitSERV and eliminates the need for customers to build separate trade feeds for valuations.

The fi rst phase of the integration covers interest rate swaps, swaptions and overnight index swaps. The service will be extended to other asset classes over the next several months. Once customers authorize Markit’s portfolio valuations service to access their trade information via MarkitSERV, the trades will be captured as they are confi rmed and updated throughout their life.

“This initiative, along with our platform’s existing connectivity to clearinghouses and dealers for delivery of cleared and counterparty valuations, will help customers meet their workfl ow and reporting needs,” said Padmesh Thuraisingham, manager director of portfolio valuations.

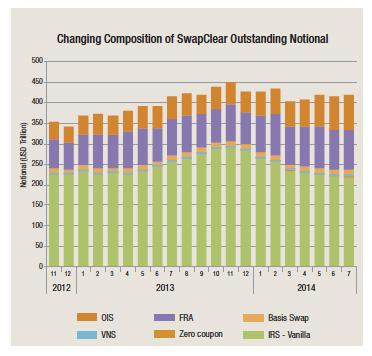

SwapClear enhances buy-side compression service

LCH.Clearnet’s SwapClear enhanced its compression capability in its so-called Solo compression service for buy-side transactions. The expanded service, which SwapClear began offering in August, enables buy-side institutions to reduce the number of individual positions and overall notional value of a portfolio by combining or offsetting trades with compatible features. Specifi cally, the compression service includes blended rate compression in addition to future cashfl ow netting. Blended rate compression enables buy-side institutions to compress any trades with different interest rates but the same remaining cashfl ow dates. Future cashfl ow netting enables compression of trades with different start dates but the same fi xed rates and future cashfl ow dates. CME Group launched a similar blended rate compression service in June with a fee waiver until the end of the year. CME offi cials commented in late July that clients are “actively testing the solution and analyzing the potential effi ciencies,” and noted that their solution was the fi rst to offer “automated and scalable compression” to all participants in the market.

![]()

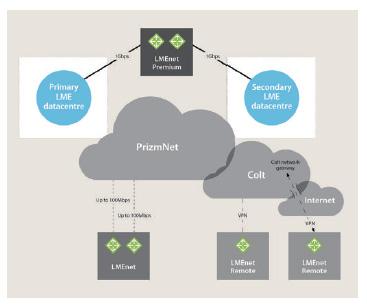

LME taps colt to improve connectivity

London Metal Exchange has entered into an agreement with Colt Technology Services to provide a faster and more resilient way to connect to the exchange’s electronic systems.

The new service, which is scheduled for launch later this year, will use the PrizmNet telecommunications network operated by Colt as the backbone for a dedicated network called LMEnet. The service will provide access to LME’s trading, matching, clearing and market data services. It will replace the existing connectivity options provided by Century Link, formerly known as Savvis.

“By switching to LMEnet, the LME community will benefi t from reduced latency, increased resilience and improved control over how they interact with our electronic systems,” Robin Paine, LME’s chief technology offi cer, said in a statement.

Members will have the option to choose among three tiers of service:

- LMEnet is the standard service for trading, matching, clearing and market data. This service will leverage Colt’s PrizmNet network, which is hosted on the cloud, coupled with Ethernet access circuits from Colt and other carriers. Capacities range from 10 to 100 megabits per second.

- LMEnet Premium is for latency sensitive applications and links clients directly into the LME’s data centers using circuits with a 1 gigabits-per-second capacity.

- LMEnet Remote is for small offi ces and provides a more reliable service than internet VPN for remote market participants. Clients can use either a MPLS connection provided by Colt or their own internet service provider to access PrizmNet.

Citi sdds U.S. Equity Options to CFOX platform

Responding to client demand, Citi has rounded out the range of markets that can be accessed through CFOX, the trading platform it has developed for futures and options.

The bank now offers execution capabilities for U.S. equity options cleared by OCC, adding to its existing capabilities for futures exchanges worldwide and European and Asian options markets. Clients can use CFOX to route orders to 12 different markets in the U.S. via Phaser, Citi’s smart order router for options, which provides access to displayed liquidity along with opportunities for price improvement.

Citi also aims to add its suite of U.S. equity options algorithms to CFOX by the end of the year. The algos will be part of its “CFOX Smart Execution” functionalities, which include execution algorithms, transaction cost analysis and order monitoring tools for futures and options.

Traiana adds new functions for SEF Trading

Traiana has enhanced its CreditLink platform with new functionality designed for buy-side market participants trading on swap execution facilities. The enhanced version includes services to streamline post-trade processing of SEF trades, manage the allocations process for bunched orders and the ability to monitor limits across the entire trade lifecycle.

CreditLink has acted as a pre-trade credit-checking hub for electronic credit default swap and interest rate swap trading since the introduction of mandatory SEF trading in February. CreditLink is now connected to 16 futures commission merchants as well as the major SEFs and clearinghouses, and more than 600 buy-side client organizations have used the service to manage their pre-trade clearing certainty.

Traiana also has added a kill switch capability for users of CreditLink in the foreign exchange markets. The new capability allows users to instantly shut down trading on single dealer FX platforms. Traiana already offers kill switches for multi-dealer FX trading platforms. However, in recent years electronic FX trading has grown on single dealer platforms and now represents a key area of technology risk in global FX markets.

“By enabling prime brokers and their clients to monitor risk in real-time and take swift actions, the market will be further insulated from technology risks and the losses they can rapidly create,” said Jill Sigelbaum, head of FX at Traiana.

ISDA publishes recommendation for FpML Version 5.7

The International Swaps and Derivatives Association on July 9 released recommendations for an enhanced version of Financial Products Markup Language, or FpML version 5.7. This latest version of FpML messaging includes a variety of enhancements including the ability to cover execution of package transactions which, in effect, impacts existing credit limit check messages and clearing messages.

The new version also can serve as an electronic version of the Standardized Credit Support Annex (SCSA) document. “Representing legal documents in an electronic format, of which the SCSA is a fi rst example, opens a further set of opportunities to leverage the marketplace standardization efforts for the purpose of effi ciency and operational risk mitigation” says Pierre Lamy, managing director in the technology division at Goldman Sachs and chairman of the FpML Standards Committee. ISDA is also working on a 5.8 version, expected soon, that will focus further on product standardization in foreign exchange derivatives together with the coverage of commercial loan messages and repo representation.

RMB Futures in Japan and Korea

The Bank of China has entered into agreements with Japan Exchange Group and Korea Exchange to develop Chinese yuandenominated products in Japan and Korea as well as the clearing and settlement of these products.

Under the agreement, Bank of China would provide settlement services in Japan, with the intention of attracting more investment from China in Japan’s market.

Several other exchanges are moving to develop markets for derivatives based on the Chinese currency. Taiwan Futures Exchange is planning to list RMB futures that will be cross-listed on Eurex, an extension of their existing cooperation in stock index futures. In addition, offi cials at Singapore Exchange said they plan to list RMBbased futures later this year.

CME was the fi rst, having launched renminbi-based contracts in 2006. Volume last year in its RMB/U.S. Dollar contract was 18,981. In 2012, Hong Kong Exchanges and Clearing listed RMB currency futures. Volume on the HKEx contract during 2013 was 138,708.

Barchart Releases iPad App for Trading Futures

Barchart, a market data and information provider, in June released a mobile trading application allowing users to execute futures transactions from an iPad. The app is available for free through the Apple App Store as “Barchart Trader” and it features touch interface and key tools such as streaming real-time quotes, interactive charts, market depth, cumulative volume and time and sales information. “We are offering the iPad app directly through Barchart and we are also working with brokerage fi rms to provide them with their own white-labeled versions,” said Eero Pikat, president of Barchart.

Futures traders can use Barchart Trader for executing orders, regardless of which brokerage or FCM they use. Key features of the app include: order entry and management, real-time data streaming, order execution, interactive charts, depth of market with cumulative volume, time and sales information and real-time fi nancial and commodity market news.

ITG Acquires RFQ-hub, Expands Platform Business into OTC Markets

Investment Technology Group in July acquired RFQ-hub, a multi-asset platform for global listed and over-the-counter assets, for roughly $20 million. The acquisition expands ITG’s platform business beyond equities into the OTC markets. Rebranded as ITG RFQ-hub, the newly acquired platform connects buy-side trading desks and portfolio managers with a large network of sell-side market makers, allowing them to place requests for quotes in OTC-negotiated equities, futures, options, swap, commodities, convertible bonds and structured products

“RFQ-hub serves as a blue chip community of derivative dealers and asset managers with the best-in-class trading platform and network that will integrate easily with ITG’s platform business,” said Bob Gasser, chief executive offi cer and president of ITG, in the fi rm’s second quarter 2014 earnings call with analysts.

ITG said the acquisition enhances the multi-asset services it provides institutional investor clients in Europe and elsewhere. “In the post-Dodd Frank world, clients are challenged increasingly by operational complexity across all asset classes and derivative instruments. We believe the team at RFQ-hub has built the best-in-class solution to simplify these work and trade fl ows,” Gasser said in a statement.

RFQ-hub was founded in France in 2008, with headquarters in Paris and representatives in London and Hong Kong.