It has been more than 10 years since the electronic trading revolution in the U.S. Treasury futures market, and the battle between floor and screen is long since over. Electronic trading now accounts for more than 98% of the Treasury futures traded on CME, and the space in the old CBOT building where Treasury futures used to trade is almost completely empty.

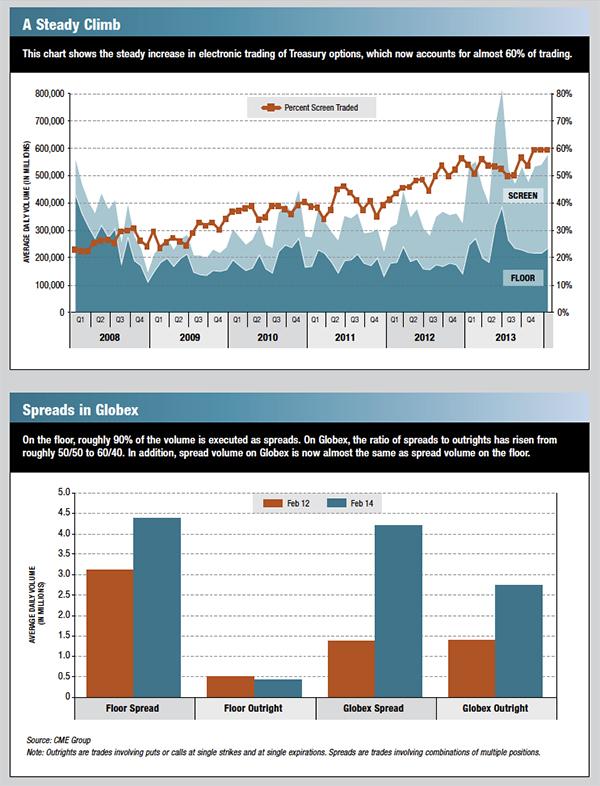

The Treasury options market, on the other hand, has moved much more slowly to adopt screen trading. As the chart below shows (see graph 1), it’s been a long march and we only passed the halfway point last year. In January 2008, roughly 23% of CME’s options on Treasury futures were executed via Globex. In September 2012 the line crossed 50% for the first time, and by last November the electronic trading percentage had risen to almost 60%.

It has been a long time coming, and now that it’s here, students of market structure will have all kinds of questions. Why, for example, does the growth path look like a slow, steady climb rather than the nearly vertical takeoff that took place in the electronic trading of Treasury futures? In the Treasury futures market, it took only three years for the share of electronic trading to jump from 14% in 2000 to 81% in 2003.

One possible answer is that options are more complicated than futures. I remember a story told by one of the early pioneers of options trading in Chicago about how his firm prepared young people to trade in the options pits. The first step, he said with a smile, was to put them in the futures pits where they could learn “to turn the card over.” The humor in this story is that there are really only two things you do with a futures contract – you can buy it, or you can sell it – and in the old days of manual trading you entered buy trades on one side of the card and sell trades on the other.

More complexity

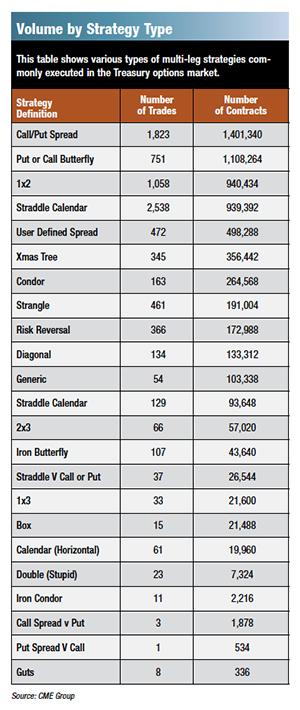

Options, in contrast, look more like three-dimensional chess. First there are calls and puts. Second there are several strike prices. Third there are multiple expirations – quarterly, monthly, and weekly – and all on the same underlying futures contract. As a result, most options trading is done in the form of combinations or spreads that involve the use of two or more of the options available.

This may explain why electronic trading appears to function more like an adjunct to floor trading rather than as a substitute. For the past several years, the increase in the percentage of Treasury options traded via Globex has not been matched by a comparable decrease in floor activity. Instead the two modes of execution have existed side by side.

Another interesting question is why electronic trading is being adopted for Treasury options and not Eurodollar options? In the Eurodollar options market, Globex accounts for 10% or less of the total volume. Here again, the answer is probably one of relative complexity. As complex as they are, Treasury options are models of simplicity when compared with Eurodollar options.

The key is the pattern of trading in the underlying Treasury futures market. On any given day, most of the trading is concentrated in the front month. So for example, in this past April, it was the June 2014 contract that accounted for nearly all Treasury futures trading. In late May, the market’s interest shifted to the September 2014 contract. Given the lack of activity in the more distant contract months, it is hard to trade Treasury options with expirations much longer than three months.

In Eurodollars, on the other hand, one can find activity in the underlying futures that extend out several years on the yield curve. In addition to call spreads, put spreads, and vertical spreads, for example, one can add a rich variety of calendar spreads that involve a complex combination of underlying maturities.

The power of technology

The picture that emerges of the Treasury options market is one that comprises a relatively complex set of interlocking tools. The pit has always been a place where one could trade either outrights or spreads. To this mix, Globex adds a matching engine for outright buys and sells of single options at single strike prices as well as a number of active and well defined spreads. In addition to these, one can also post requests for quotes for customized spreads. The two markets are integrated by market makers who have a presence both on the floor and upstairs and who run consolidated books that allow them to bid, offer, and trade in both settings and to hedge their position risks efficiently.

Will the Treasury options market continue to support both modes of execution, or will we eventually see the floor give way to the screen? It is interesting to note that last year, when the options on the 10-year and the 5-year Treasury futures hit record levels of traded volume, it was the electronic side of the market that accounted for most of the growth. That trend has continued into the first quarter. The number of Treasury options traded on the floor was roughly the same as the first quarter of 2013, but the number traded via Globex jumped by more than 30%.

One way to look at this trend is to see it as a testament to the power of technology. There are several software vendors that are focused on building trading tools for options and they are gradually getting closer to replicating the techniques used on the floor for trading complex combinations of options. They may never exactly match the skills of a seasoned options trader, but it’s clear that people in the market are getting more comfortable with executing various types of spread trades through Globex.

As shown in the attached table, nearly 90% of traded volume on the floor has been done in the form of spreads. On Globex, in contrast, more of the trading has been done in the form of outright buying of puts or calls at single strikes and at single expirations. But the mix has been shifting. Two years ago, the mix of spreads to outrights on Globex was roughly 50/50. Now it is closer to 60/40. Even more telling, Globex now accounts for roughly 50% of the overall trading in spreads.

Galen Burghardt is research director for Coex Partners, a division of ED&F Man Capital Markets.