Opening remarks of Walt Lukken, President and CEO of FIA, at the Futures & Options Expo in Chicago on 19 November 2024. As prepared for delivery.

Good morning, and welcome to FIA Expo.

It’s wonderful to be back here in Chicago—the epicenter of our industry—for what promises to be a fascinating two days of discussions.

Truthfully, it’s also nice to escape the bedlam inside the Washington beltway for a few days.

With the elections behind us, I’m longing for less shouting, fewer political text messages and hopefully, more common sense. And some honesty, as well. Because if you can’t come to grips with the truth, you can’t come together to solve problems and heal wounds.

Growth must begin with a reality check. Our industry deserves that too.

This fall has been an amazing time for me, personally.

My college football team—the Indiana Hoosiers—are undefeated for the first time ever under new head coach Curt Cignetti. And my adopted professional football team, the Washington Commanders—are having a surprisingly good season behind “Hail Mary, Full of Grace” quarterback Jayden Daniels. (sorry Caleb!)

These two developments have literally changed my mood for the better. I get up whistling in the morning. I smile more. I now have a skip in my step. It’s changed my demeanor from grouchy to almost tolerable.

Now, there are many reasons for the success of my two football programs. But I believe the top reasons are the coaches—and their willingness to be truth tellers and be honest with their players.

You can’t begin to win until you have laid bare the reality of where you are as an organization. Only then can you start to build up.

For example, Commanders’ head coach Dan Quinn has instituted "Tell the Truth Mondays." During these meetings, he encourages his team to be honest and accountable for what went right – and what went wrong – on Game Day.

Coach Quinn has created a safe space to allow coaches and players to tell the truth and course correct for the betterment of the team. This is creating a culture of growth and winning.

That idea really resonated with me. It got me thinking about our industry and how we might benefit from a frank analysis of how we’re doing.

So, let’s have our own Tell the Truth Day and recognize what we do well and identify where we need to improve.

First off, what are we doing right?

Tell the Truth Fact Number 1: The global growth story of our industry is real.

FIA data shows global trading volume of futures and options continues to increase. We expect to notch another record year in 2024, marking seven straight years of record activity.

And on this theme of honesty, we should point out that much of that growth comes from retail trading, and specifically India. We are also seeing retail growth in US equity options and futures, crypto products and prediction markets.

The retail story is worth keeping an eye on.

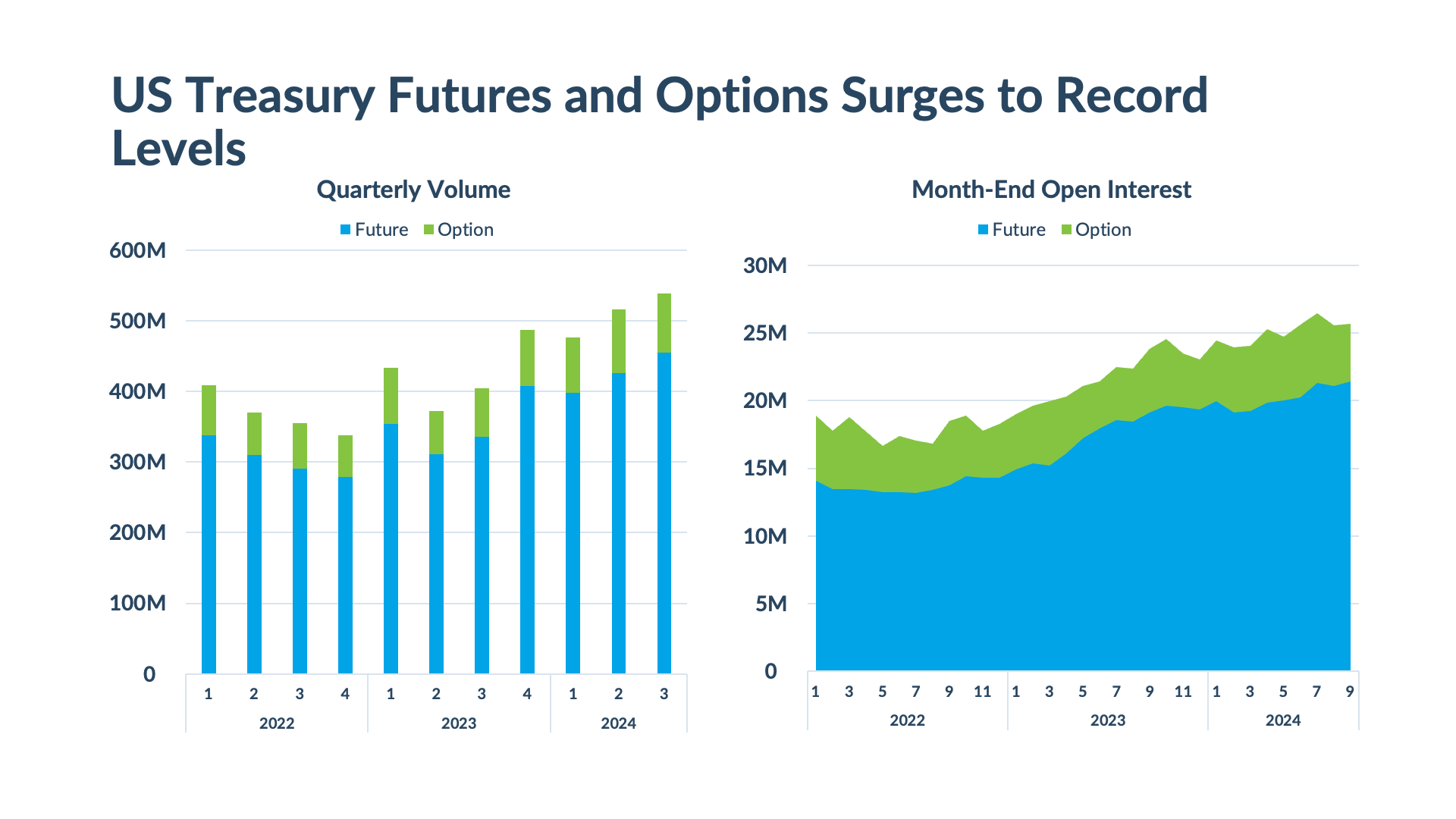

But retail isn't the whole growth story. Here in the US, we see record levels of trading activity in Treasury futures and options, in both volume and open interest.

This growth is fueled by recent inflation and economic volatility in the markets, and the need of market participants to hedge the associated risks.

While volumes typically get the headlines, it’s the open interest chart that’s more interesting to me. Because it shows the long-term hedging and commercial interest in this market, which hit a record high in August.

This is a sign of a healthy market.

Turning to the global energy complex, we have also seen strong growth in futures and options across products from crude oil to natural gas to electricity. This growth extends to alternatives like wind and solar. And it’s not surprising.

With the geo-political conflicts in the Middle East and Ukraine, and the long arc of the energy transition, I expect the energy complex to continue to be a part of our industry’s expansion.

This diverse growth story is worth crowing about on Tell the Truth Day.

Which brings me to Tell the Truth Fact Number Two: This industry’s growth is fueled by innovation, and we must nurture this environment of risk-taking.

Innovation has been part of our DNA since the inception of our markets, and we must never take it for granted.

Just look around this conference. For a decade now, Expo has been home to our Innovators Pavillion, where we feature creative start-ups that bring new ideas and technologies to our markets.

Past innovators have used this platform as a springboard to raise millions in capital and operationalize their businesses. This year is no exception to this risk-taking spirit.

I encourage you to visit the trade show floor to meet the 10 amazing companies showcasing their services that modernize our industry.

But as we look to the future, we must also recognize the pioneers and visionaries who built our markets. These are the people who have democratized the derivatives markets through electronic trading, new products and exchanges, and increased access to global markets.

Look no further than this year’s distinguished class of the FIA Hall of Fame, which we announced last week.

We will celebrate these six leaders at the 50th Boca conference next March. And they are worthy of our appreciation today, for the vision and achievement they have brought and continue to bring to our markets.

This innovative spirit must be nurtured through policies that promote competition and risk-taking. We need smart regulation that is fit for purpose, and we need policies that incentivize new entrants to come into our space.

This leads me to Tell the Truth Fact Number 3: Competition is heating up, but more is needed.

When I started in this industry nearly 30 years ago, there were more than 100 FCMs. Today, there are 50. Back then, there were 20 exchanges registered with the CFTC. Today there are 16. And among those 16, only four have meaningful volume.

On Tell the Truth Tuesday, we must admit that our markets would benefit from more competition.

Competition sharpens our animal spirits. It encourages innovation and lower costs. And choice is good for consumers.

That said, we are starting to see some signs that competition is heating up.

One area is interest rate futures. New exchanges have embarked on a campaign to compete in the US interest rate futures market. So far, volumes have remained low, but this competition has spurred the animal spirits in the fixed income marketplace for the first time in over a decade.

This competition in the treasury markets is further driven by the SEC’s treasury and repo clearing mandate, which currently takes effect in 2025 and 2026. We now have three clearinghouses that will compete in treasury clearing as these markets move towards a “futures-style” client clearing model.

Whoever can build the clearing model that best optimizes the collateral and bank capital for market participants may be the big winner. This competition is good for the marketplace, and it's fascinating to watch.

Another area ripe with competition is event markets. These markets date back to my time at the CFTC, when the Iowa Political Markets first started an exchange to predict election results.

Recent court rulings have clarified the legal uncertainty around these markets, allowing several prediction markets to move forward with scale before this past election. And boy did they.

While listening to my Commanders football game on the radio before the election, I heard no less than three commercials for Robinhood promoting their event contracts on the Presidential election. Others must have been listening too … as Robinhood surpassed 200 million contracts traded in the week leading up to the election.

It's astounding that this activity exceeds the number of people who actually voted in the Presidential election – and that these markets were more accurate than traditional polls.

I’m still digesting what these markets mean for the traditional regulatory environment, but the wisdom of crowds appears to have worked in this instance.

On Tell the Truth Tuesday, it’s exciting to see that competition in our industry is heating up, and we welcome this trend.

But in life, too much of a good thing can sometimes lead to unintended consequences. And that’s why the laws that govern our markets require fair competition and responsible innovation.

Unfettered competition and innovation could jeopardize the integrity of the markets and put customers at risk.

Which brings me to the final Tell the Truth fact of the day: The laws and regulations of our industry must keep pace with our evolving market structure.

Traditionally, the regulation of the futures markets has been by functional activity.

Public exchanges that bring together buyers and sellers are regulated to protect the fairness of the marketplace. Clearinghouses, with their obligations to protect the financial integrity of the system, have strict financial protections and safeguards to avoid contagion risk. And clearing members, who serve as agents for their clients, are charged to protect these customers and their funds.

Increasingly, however, we are seeing more exchanges embedding all of these functions within one legal structure.

But as the Good Book says, “No one can serve two masters.”

FIA has strong concerns that consolidating these functions could undo the independent checks and balances of our markets and, ultimately, put customers at risk. We strongly encourage the current CFTC and the incoming Administration to propose strong rules that govern the inherent conflicts from these arrangements.

So, I’ll leave you with these final thoughts on Tell the Truth Tuesday.

As we approach Thanksgiving, I’m reminded that our industry is a big, messy and sometimes loud family. Maybe like many of yours.

We work hard and we play hard. We have a lot of diverse views, and we don’t have all the answers. At the same time, we’re trying to bring the right people together to have an honest, frank discussion to reach the best conclusions for our industry.

Together, and only together, will we continue our industry’s impressive track record of resiliency and innovation.

And that’s what this week is about. So, as we kick off Expo, I hope you will learn new things, meet interesting people and engage with your colleagues with an honest and open mindset.

If we can do that, the sky is the limit for our markets.