The post-trading environment in Brazil's financial markets has evolved dramatically in recent years. What used to be a fragmented landscape, with separate clearinghouses for different types of products, has been replaced by a single consolidated clearinghouse operated by B3, the successor to the Bovespa and BM&F exchanges. This consolidation has resulted in important improvements in both capital allocation and operational efficiency for all participants in the Brazilian markets. The consolidation also provided B3 with an opportunity to implement a novel risk measure named CORE that allows for risk offsets across all of the markets cleared by B3.

Integration of Clearinghouses

Back in 2008, B3 had four existing clearinghouses that cleared (i) equities and corporate bonds; (ii) financial and commodity derivatives; (iii) the spot foreign-exchange interbank market; and (iv) federal government bonds. It is worth noting the considerable liquidity available in all these markets, and in particular the cash equity market, the single stock options and index options and futures markets, and the interest rate and currency futures and options markets. All of these markets have a very strong local presence of banks, brokerage houses and hedge funds as well as a high presence of nonresident investors

It was clear that integrating the clearinghouses would generate significant efficiencies at regulatory, operational, technological, and risk management levels. To this end, B3 started the Post-Trade Integration Project with the main objective of delivering enhanced safety and operational and capital efficiencies to market participants by introducing a new integrated post-trade infrastructure. Integration of the clearinghouses also meant integrating risk management processes, and that led to the introduction of a novel risk measure called CORE (Close-Out Risk Evaluation). CORE was developed to take full advantage of different markets with exposures to similar risk factors cleared through the same CCP. It allows for risk offsets that were not otherwise available in the multi-CCP environment. This makes the Brazilian market a unique environment to trade and clear in terms of capital efficiency

The standardization of rules and procedures, unification of systems and greater automation of processes brought about by the PostTrade Integration Project are aimed at enabling cost savings for market participants and the clearinghouse itself by streamlining the various clearing and back-office processes. A new integrated post-trade infrastructure together with revised and improved processes and rules would also increase the overall safety of the financial system. This was also the key objective of the Post-Trade Integration Project. Increased capital efficiency would derive from having only one settlement window for all the markets served by the four clearinghouses and from a new risk measure - CORE - which was designed to cope with the main problem of an integrated clearinghouse: having enough collateral to withstand the close-out of the portfolio of a defaulting investor who may be exposed to both cash settled instruments and financially settled derivatives.

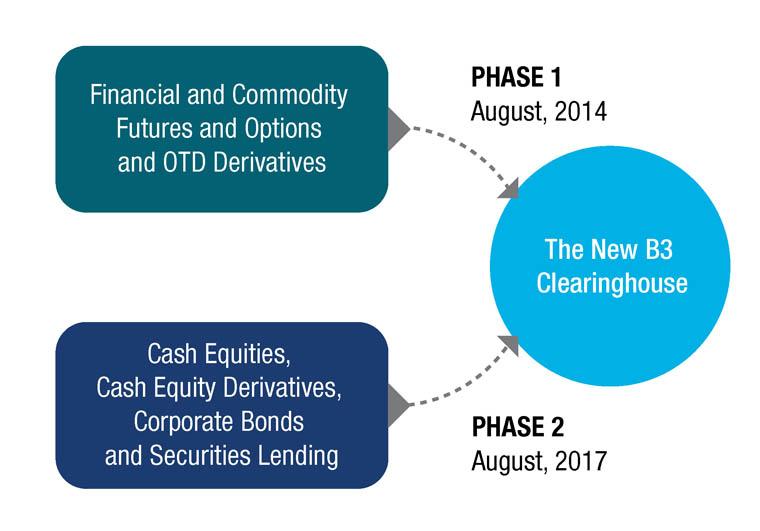

Due to the complexity of the Post-Trade Integration Project and the need to provide a seamless transition from the old clearinghouses to the new one, the project was implemented in two phases. The first phase was rolled out in August 2014 with the migration of the financial and commodity derivatives markets to the new infrastructure. The second phase went live in August 2017 with the migration of the equities and corporate bonds markets.

Close-Out Risk Evaluation (CORE)

One of the greatest benefits of having the CCP for various different markets integrated into a single clearinghouse is the ability of the CCP to allow risk offsets between different instruments exposed to similar risk factors. In order to offer those offsets, the CCP should be able to calculate risk under a risk measure that is robust enough to handle all the different instruments. Some of these instruments are financially settled, while others, such as cash equities, are settled with delivery of cash instruments, i.e., shares. The main problem faced by the CCP is to close out a defaulting investor’s position, sell vits collateral and avoid any shortfall of liquidity while performing these tasks.

The CORE risk measure was developed from scratch to tackle this challenge, which involves calculating in one single measure three types of risks: market, liquidity and cash flow. The CORE risk measure can assess how a defaulting participant’s positions and collateral are closed out in the event of default by taking into account the following risks:

- Market risk: arising from exposure to price movements during the portfolio close-out;

- Liquidity risk: arising from liquidating positions and collateral that are subject to bid-ask spreads and limit order book depths;

- Cash flow mismatch risk: during the process of closing out a portfolio, the CCP needs to have access to enough liquidity (cash) to withstand the most negative accumulated cash flow arising from the close-out process, which can be substantially higher than the permanent loss (market risk).

Compared to the risk calculation methodologies employed before the introduction of CORE, the confidence level in the margin calculation remains the same - 99.96% - and is designed to deal with a crisis every 10 years. But the increased precision of the new risk measure and its ability to hold the same risk calculation positions from different markets and all collateral accepted by the CCP means that, without increasing the CCP risk exposure, the new integrated clearinghouse will have released close to BRL 40 billion in excess collateral after the completion of the Post-Trade Integration Project phase 2.

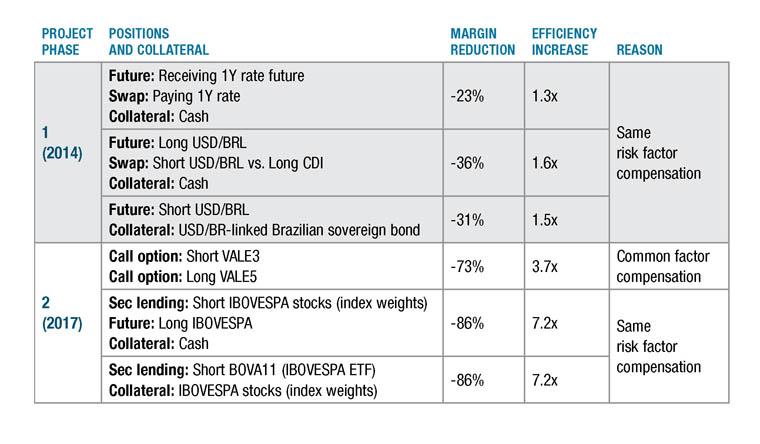

The table below offers some examples of capital efficiencies that were enabled when CORE was introduced during phase 1 of the Post-Trade Integration Project and the efficiencies that will be delivered after completion of phase 2.

The “portfolio close-out strategy” in CORE follows two conditions: (i) first, positions must be closed out in an orderly manner to avoid triggering serious market volatility and (ii) second, any hedging relationship in the portfolio must be preserved to avoid increasing its exposure to unnecessary risk.

Put simply, the calculation of the CORE risk measure can be understood as consisting of three steps:

- Definition of the portfolio close-out strategy. As one of the most important parameters in CORE, the close-out strategy is defined as per the condition (i) above. The close-out of illiquid positions is spread out in time according to the market liquidity of the instrument and the size of the position to ensure an orderly liquidation with minimal price impact.

- Definition of stress scenarios for price trajectories. CORE uses 10,000 scenarios to introduce market risk to the portfolios to be closed out. Each scenario is composed of one 10-day price trajectory for each risk factor to which the investor’s portfolio is exposed. Those 10,000 scenarios are comprised of historical simulations for a period longer than ten years (whereby price variations observed in the past are used to project the future); statistical simulations (whereby the best econometric models available are used to project a range of different price trajectories); and prospective (what-if) stress scenarios.

- Evaluation of the close-out strategy and choice of the worst-case scenario. In this last step, the positive and negative cash flows resulting from the application of price trajectories in step 2 to the close-out strategies defined in the first step are calculated for all positions and collateral within the portfolio. Next, the worst accumulated cash flow out of all the 10,000 cash flows accounted for is chosen and this number is the amount of excess collateral available, or the margin to be required in case of a negative number.

CORE is a highly precise risk measure, reflecting market, liquidity and cash flow mismatch risks in the positions held by more than 50,000 participants in B3's markets. It is also capable of calculating in quasi-real time the risk of a complete portfolio of assets, contracts and collateral by multilateral netting where appropriate, and taking into account diversification benefits and hedges. CORE’s combination of robustness, precision and investor capital allocation efficiency places B3 at the forefront of global risk management.

To learn more, visit: clearing.com.br/en