Reviewing Europe’s algorithmic trading rules

A FIA EPTA webinar

24 February 2021 • 3:00 PM - 4:00 PMAlgorithmic trading has become a central component in modern financial markets. In Europe, MiFID II introduced a comprehensive set of rules around algorithmic and high-frequency trading as well as various aspects of market microstructure. These rules were hotly debated at the time and now form an important cornerstone of the MiFID II rulebook.

Recently, ESMA published a consultation paper evaluating the algorithmic trading regime, ahead of the upcoming MiFID II Review by the European Commission. ESMA also made suggestions for potential changes and new additions to the regime.

In this webinar, experts from the principal trading community will discuss ESMA’s proposals and provide a practitioner's perspective on what has worked well and what should be improved or changed, focusing on:

- Scope of the algorithmic trading regime (HFT definition, DEA, authorisation requirements and third-country implications);

- Market resilience and practical measures to further improve European market structure;

- Impact and regulatory status of exchange speedbumps.

*This is a free webinar open to all.

**This webinar will be held under Chatham House Rules. For more information, please contact Sabina Hussain.

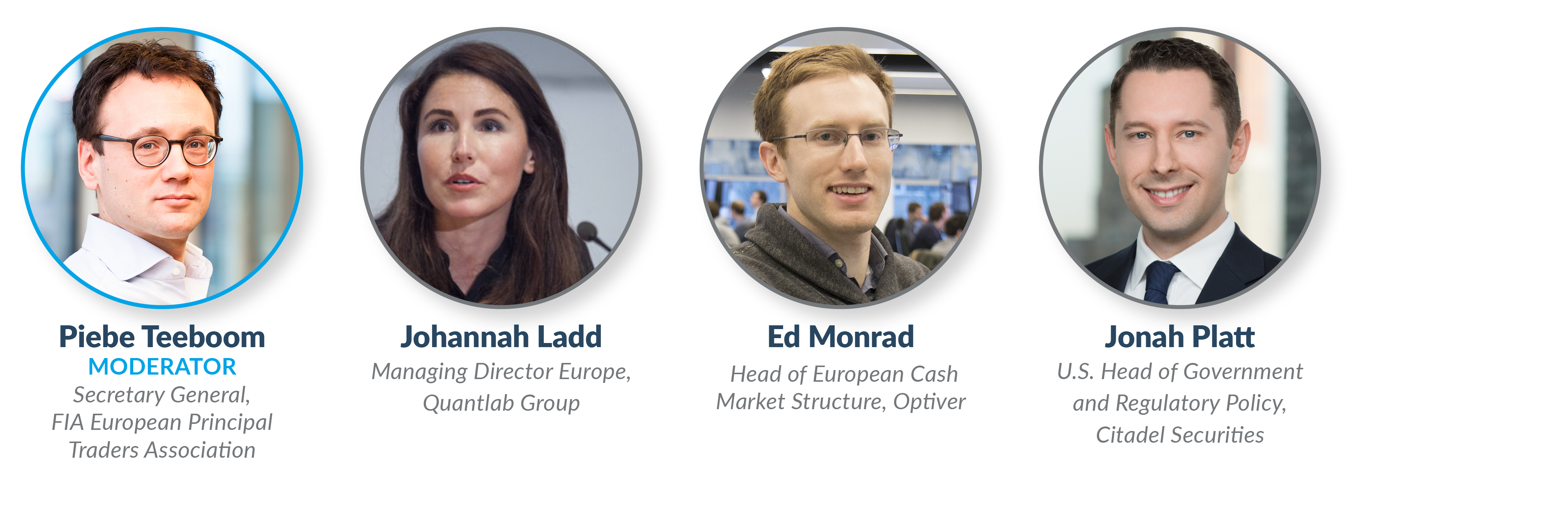

| Moderator: | Piebe Teeboom, Secretary General, FIA European Principal Traders Association (FIA EPTA) |

|

Presenters: |

Johannah Ladd, Managing Director Europe, Quantlab Group Ed Monrad, Head of European Cash Market Structure, Optiver Jonah Platt, U.S. Head of Government and Regulatory Policy, Citadel Securities |

| Date/Time: | Wednesday, 24 February 2021 | 3:00 p.m. – 4:00 p.m. GMT |

This webinar is intended for informational purposes only and is not intended to provide investment, tax, business, legal or professional advice. Neither FIA nor its members endorse, approve, recommend, or certify any information, opinion, product, or service referenced in this webinar. FIA makes no representations, warranties, or guarantees as to the webinar’s content.